Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Porter Corporation, a U.S. company, has a foreign subsidiary reporting the following in its local currency units (LCU) for 2021: Cost of goods sold LCU

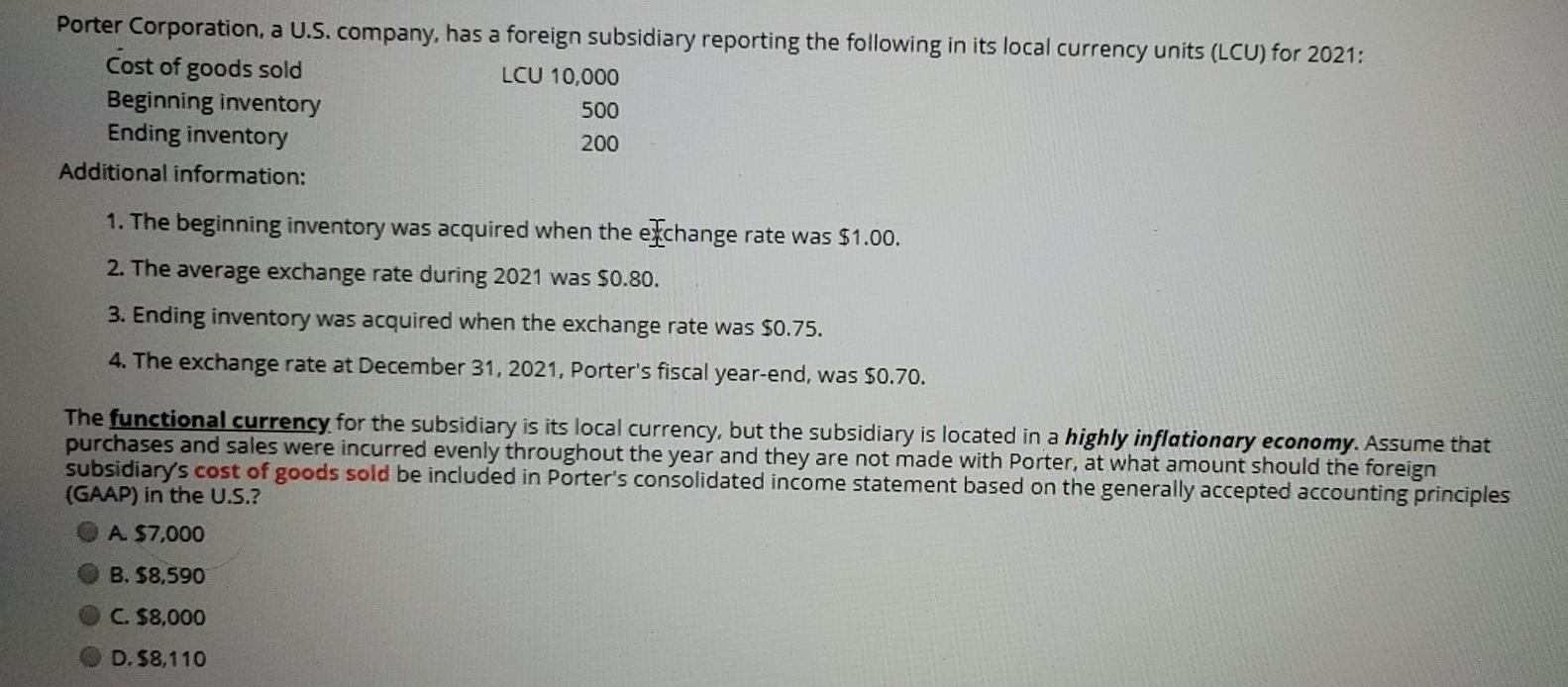

Porter Corporation, a U.S. company, has a foreign subsidiary reporting the following in its local currency units (LCU) for 2021: Cost of goods sold LCU 10,000 Beginning inventory 500 Ending inventory 200 Additional information: 1. The beginning inventory was acquired when the exchange rate was $1.00. 2. The average exchange rate during 2021 was $0.80. 3. Ending inventory was acquired when the exchange rate was $0.75. 4. The exchange rate at December 31, 2021, Porter's fiscal year-end, was $0.70. The functional currency for the subsidiary is its local currency, but the subsidiary is located in a highly inflationary economy. Assume that purchases and sales were incurred evenly throughout the year and they are not made with Porter, at what amount should the foreign subsidiary's cost of goods sold be included in Porter's consolidated income statement based on the generally accepted accounting principles (GAAP) in the U.S.? OA $7,000 B. $8,590 C. $8,000 D. $8,110

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started