Answered step by step

Verified Expert Solution

Question

1 Approved Answer

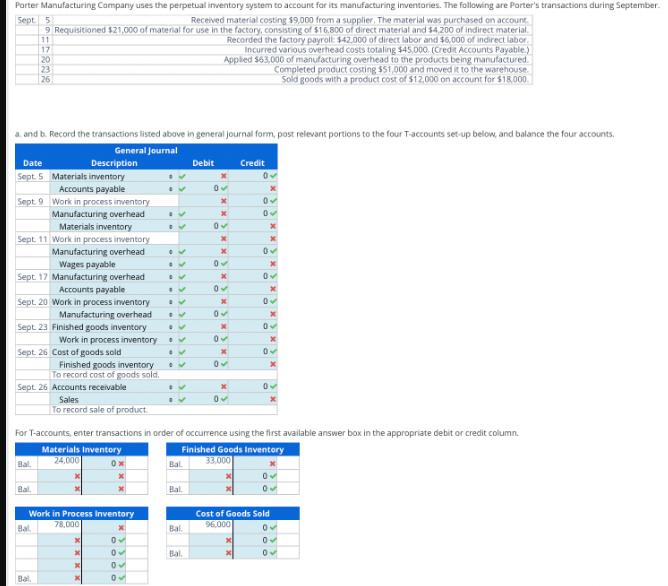

Porter Manufacturing Company uses the perpetual inventory system to account for its manufacturing inventories. The following are Porter's transactions during September. Received material costing

Porter Manufacturing Company uses the perpetual inventory system to account for its manufacturing inventories. The following are Porter's transactions during September. Received material costing $9,000 from a supplier. The material was purchased on account. Sept. 5 9 Requisitioned $21,000 of material for use in the factory, consisting of $16.800 of direct material and $4,200 of indirect material. 31 Recorded the factory payroll: $42.000 of direct labor and $6,000 of indirect labor. Incurred various overhead costs totaling $45,000. (Credit Accounts Payable.) Applied $63,000 of manufacturing overhead to the products being manufactured. Completed product costing $51,000 and moved it to the warehouse. Sold goods with a product cost of $12,000 on account for $18,000 a and b. Record the transactions listed above in general journal form, post relevant portions to the four T-accounts set-up below, and balance the four accounts. General Journal Date Sept. 5 Sept. 9 17 20 23 26 Materials inventory Sept. 11 Work in process inventory Manufacturing overhead Wages payable Sept. 17 Manufacturing overhead Accounts payable Sept. 20 Work in process inventory Manufacturing overhead Sept. 23 Finished goods inventory Work in process inventory Sept. 26 Cost of goods sold Finished goods inventory To record cost of goods sold. Bal Description Materials inventory Accounts payable Work in process inventory Manufacturing overhead Sept. 26 Accounts receivable Sales Bal Bal Bal To record sale of product Work in Process Inventory Materials Inventory 24,000 X x IV 05 0 05 05 14 IV IV IV IV IV IV EV Bal Bal. Bal. Debit Bal 0 * 0 x x 05 x 0 x 0 x For T-accounts, enter transactions in order of occurrence using the first available answer box in the appropriate debit or credit column. Finished Goods Inventory 33,000 0 * 0 x 04 Credit OV x Ov x Ov x OV x 0 0 0 Cost of Goods Sold 96,000 x x 0 15 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 General Journal September 5 Debit Materials Inventory 9000 Credit Accounts Payable 9000 September ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started