Answered step by step

Verified Expert Solution

Question

1 Approved Answer

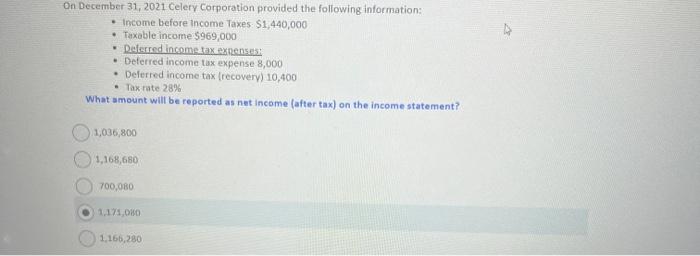

On December 31, 2021 Celery Corporation provided the following information: Income before Income Taxes $1,440,000 Taxable income $969,000 Deferred income tax expenses: Deferred income

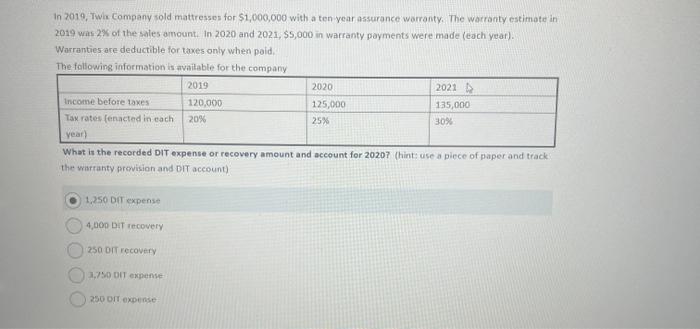

On December 31, 2021 Celery Corporation provided the following information: Income before Income Taxes $1,440,000 Taxable income $969,000 Deferred income tax expenses: Deferred income tax expense 8,000 Deferred income tax (recovery) 10,400 Tax rate 28% What amount will be reported as net income (after tax) on the income statement? 1,036,800 1,168,680 700,080 1,171,080 1,166,280 In 2019, Twix Company sold mattresses for $1,000,000 with a ten-year assurance warranty. The warranty estimate in 2019 was 2% of the sales amount. In 2020 and 2021, $5,000 in warranty payments were made (each year). Warranties are deductible for taxes only when paid. The following information is available for the company 2019 1,250 DIT expense 4,000 DIT recovery 250 DIT recovery Income before taxes Tax rates (enacted in each year) What is the recorded DIT expense or recovery amount and account for 20207 (hint: use a piece of paper and track) the warranty provision and DIT account) 3,750 DIT expense 250 DIT expense 2020 120,000 20% 2021 135,000 30% 125,000 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below For the first image you have provided the following pieces of information Income before Income Taxes 1440000 Taxable Income 969000 Deferred ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started