Answered step by step

Verified Expert Solution

Question

1 Approved Answer

portfolio management questions: Q4. If you own a foreign security, are you more concerned with micro or macro political risk? answer for all the questions

portfolio management questions:

Q4. If you own a foreign security, are you more concerned with micro or macro political risk?

answer for all the questions

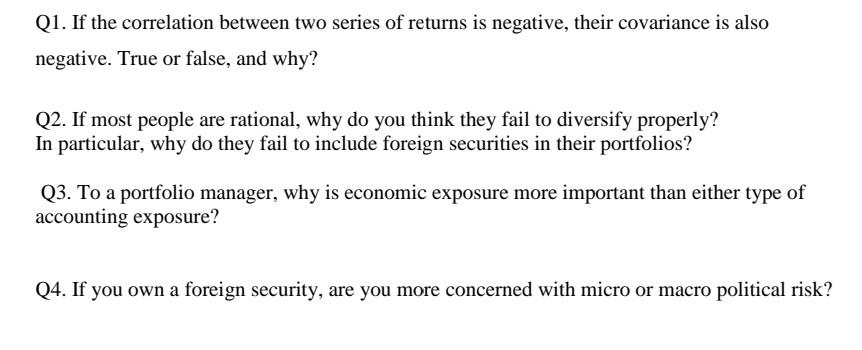

Q1. If the correlation between two series of returns is negative, their covariance is also negative. True or false, and why? Q2. If most people are rational, why do you think they fail to diversify properly? In particular, why do they fail to include foreign securities in their portfolios? Q3. To a portfolio manager, why is economic exposure more important than either type of accounting exposure? Q4. If you own a foreign security, are you more concerned with micro or macro political riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started