Portfolio Optimization Question

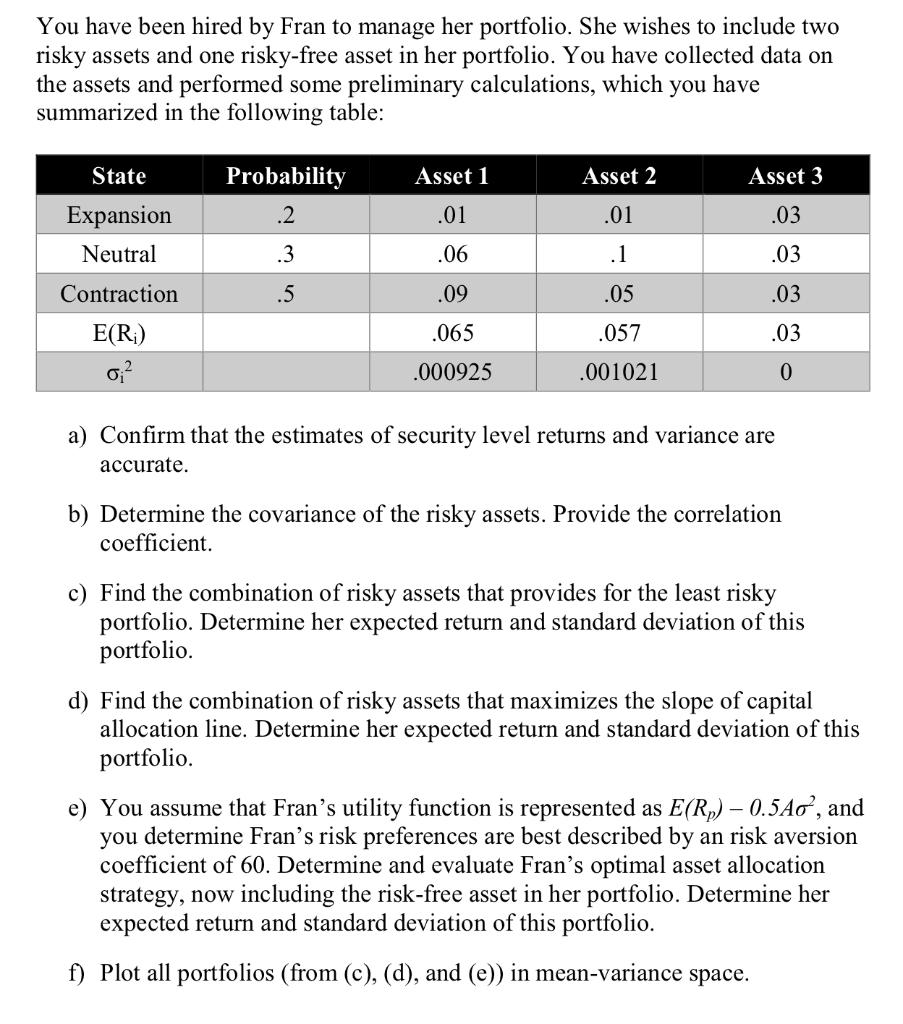

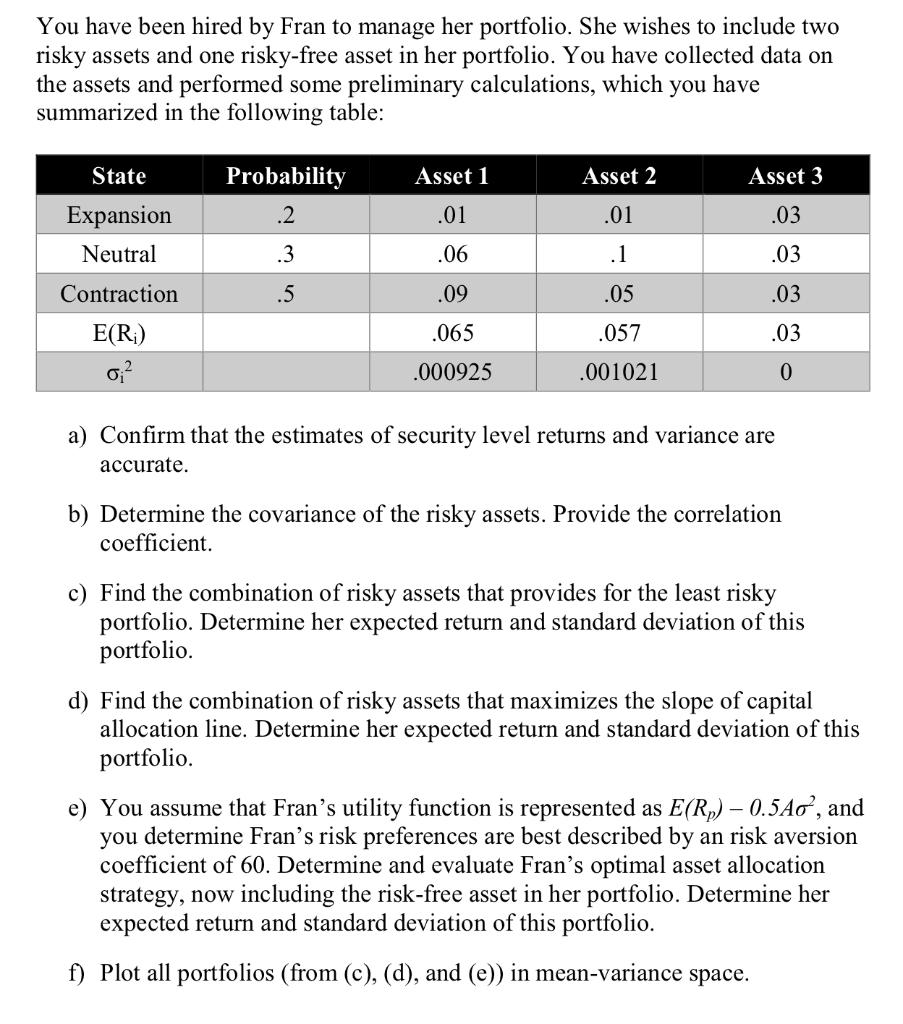

You have been hired by Fran to manage her portfolio. She wishes to include two risky assets and one risky-free asset in her portfolio. You have collected data on the assets and performed some preliminary calculations, which you have summarized in the following table: State Asset 1 Asset 2 Asset 3 Probability .2 .01 .01 .03 Expansion Neutral .3 .06 .1 .03 .5 .09 .05 .03 Contraction E(R) 0;? .065 .057 .03 .000925 .001021 0 a) Confirm that the estimates of security level returns and variance are accurate. b) Determine the covariance of the risky assets. Provide the correlation coefficient. c) Find the combination of risky assets that provides for the least risky portfolio. Determine her expected return and standard deviation of this portfolio. d) Find the combination of risky assets that maximizes the slope of capital allocation line. Determine her expected return and standard deviation of this portfolio. e) You assume that Frans utility function is represented as E(Rp) 0.5Ao", and you determine Fran's risk preferences are best described by an risk aversion coefficient of 60. Determine and evaluate Fran's optimal asset allocation strategy, now including the risk-free asset in her portfolio. Determine her expected return and standard deviation of this portfolio. f) Plot all portfolios (from (c), (d), and (e)) in mean-variance space. You have been hired by Fran to manage her portfolio. She wishes to include two risky assets and one risky-free asset in her portfolio. You have collected data on the assets and performed some preliminary calculations, which you have summarized in the following table: State Asset 1 Asset 2 Asset 3 Probability .2 .01 .01 .03 Expansion Neutral .3 .06 .1 .03 .5 .09 .05 .03 Contraction E(R) 0;? .065 .057 .03 .000925 .001021 0 a) Confirm that the estimates of security level returns and variance are accurate. b) Determine the covariance of the risky assets. Provide the correlation coefficient. c) Find the combination of risky assets that provides for the least risky portfolio. Determine her expected return and standard deviation of this portfolio. d) Find the combination of risky assets that maximizes the slope of capital allocation line. Determine her expected return and standard deviation of this portfolio. e) You assume that Frans utility function is represented as E(Rp) 0.5Ao", and you determine Fran's risk preferences are best described by an risk aversion coefficient of 60. Determine and evaluate Fran's optimal asset allocation strategy, now including the risk-free asset in her portfolio. Determine her expected return and standard deviation of this portfolio. f) Plot all portfolios (from (c), (d), and (e)) in mean-variance space