Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portfolio Performance Evaluation Exercise You invested $ 1 0 , 0 0 0 a year ago in a balanced fund with target weights of 7

Portfolio Performance Evaluation Exercise

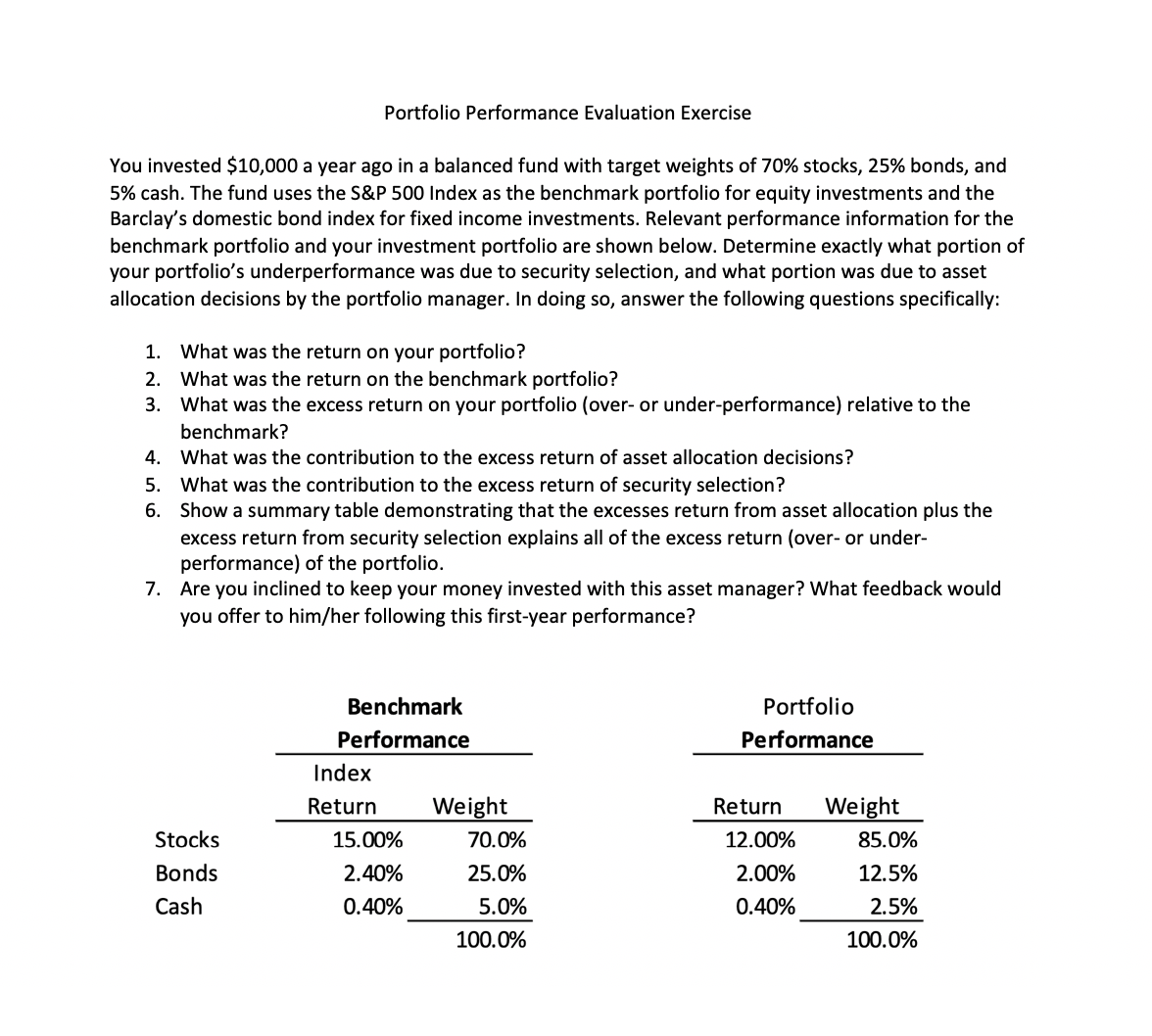

You invested $ a year ago in a balanced fund with target weights of stocks, bonds, and

cash. The fund uses the S&P Index as the benchmark portfolio for equity investments and the

Barclay's domestic bond index for fixed income investments. Relevant performance information for the

benchmark portfolio and your investment portfolio are shown below. Determine exactly what portion of

your portfolio's underperformance was due to security selection, and what portion was due to asset

allocation decisions by the portfolio manager. In doing so answer the following questions specifically:

What was the return on your portfolio?

What was the return on the benchmark portfolio?

What was the excess return on your portfolio over or underperformance relative to the

benchmark?

What was the contribution to the excess return of asset allocation decisions?

What was the contribution to the excess return of security selection?

Show a summary table demonstrating that the excesses return from asset allocation plus the

excess return from security selection explains all of the excess return over or under

performance of the portfolio.

Are you inclined to keep your money invested with this asset manager? What feedback would

you offer to himher following this firstyear performance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started