Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On a weekend in late October 2015, Albert sat over his breakfast, and imitated of his personal investment portfolio over the past seven years.

![Background Material (Pick the right equation based on your need) Mean = E(R) E(R) = S(r) R, = wR1 + R2 + ... + w,R E[R] = Wil](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/02/602cf6e4db268_1613559522769.jpg)

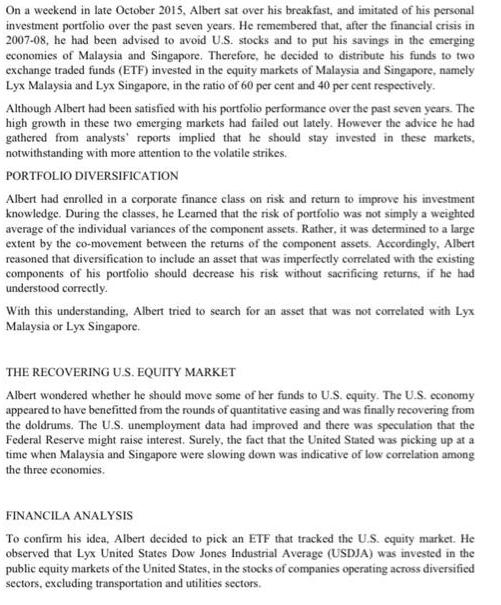

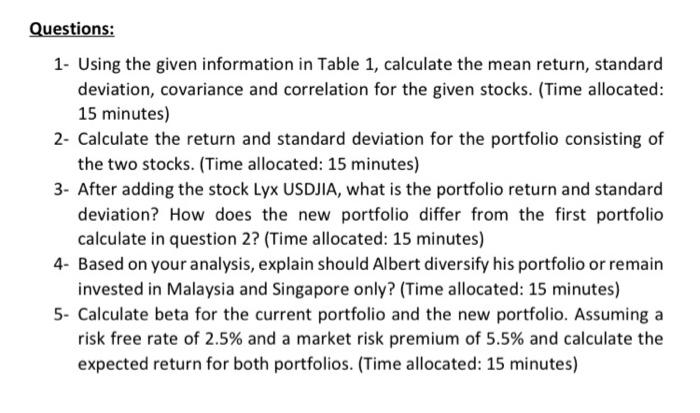

On a weekend in late October 2015, Albert sat over his breakfast, and imitated of his personal investment portfolio over the past seven years. He remembered that, after the financial crisis in 2007-08, he had been advised to avoid U.S. stocks and to put his savings in the emerging economies of Malaysia and Singapore. Therefore, he decided to distribute his funds to two exchange traded funds (ETF) invested in the equity markets of Malaysia and Singapore, namely Lyx Malaysia and Lyx Singapore, in the ratio of 60 per cent and 40 per cent respectively. Although Albert had been satisfied with his portfolio performance over the past seven years. The high growth in these two emerging markets had failed out lately. However the advice he had gathered from analysts' reports implied that he should stay invested in these markets, notwithstanding with more attention to the volatile strikes. PORTFOLIO DIVERSIFICATION Albert had enrolled in a corporate finance class on risk and return to improve his investment knowledge. During the classes, he Leamed that the risk of portfolio was not simply a weighted average of the individual variances of the component assets. Rather, it was determined to a large extent by the co-movement between the returns of the component assets. Accordingly, Albert reasoned that diversification to include an asset that was imperfectly correlated with the existing components of his portfolio should decrease his risk without sacrificing returns, if he had understood correctly. With this understanding, Albert tried to search for an asset that was not correlated with Lyx Malaysia or Lyx Singapore. THE RECOVERING U.S. EQUITY MARKET Albert wondered whether he should move some of her funds to U.S. equity. The U.S. economy appeared to have benefitted from the rounds of quantitative casing and was finally recovering from the doldrums. The U.S. unemployment data had improved and there was speculation that the Federal Reserve might raise interest. Surely, the fact that the United Stated was picking up at a time when Malaysia and Singapore were slowing down was indicative of low correlation among the three economies. FINANCILA ANALYSIS To confirm his idea, Albert decided to pick an ETF that tracked the U.S. equity market. He observed that Lyx United States Dow Jones Industrial Average (USDJA) was invested in the public equity markets of the United States, in the stocks of companies operating across diversified sectors, excluding transportation and utilities sectors. He proceeded to gather past return data on Lyx Malaysia, Lyx Singapore and Lyx USDJIA (see Table 1). All three ETF that were listed on the Singapore Exchange. As a proxy for the market portfolio, Albert downloaded corresponding return data for Lyx World (see Table 1). Lyx World was an ETF that invested in the public equity markets of developed countries across the globe. It invested in the stocks of large cap and mid-cap companies, and provided results that closely corresponded to the performance of the MSCI World Index. Albert's idea was to compare the mean returns and deviations of his existing portfolio with an alternative portfolio that would invest 40 per cent in Malaysia, 30 per cent Singapore and 30 per cent in United States (see Table 2). He hoped that the analysis would help him decide whether to diversify his portfolio or remain invested in Malaysia and Singapore only. In addition, he intended to compute the betas of Lyx Malaysia, Lyx Singapore, and Lyx USDJIA using their covariance with the market proxy, which would help her figure out their required returns, assuming a risk-free rate of 2.5 per cent and a market risk premium of 5.5 per cent. From there, she would be able to describe the systematic risk of her existing portfolio and the new portfolio, and their corresponding required returns. 2009 2010 2011 2012 2013 2014 2015 Lyx Malaysia 2.00 4.25 -29.40 13.23 8.86 2.31 -2.96 Assets Table 1: ANNUAL RETURNS (%) Lyx Malaysia Lyx Singapore Lyx USDJIA Lyx Singapore Lyx USDJIA 5.86 5.56 22.40 6.11 -27.07 7.94 18.29 0.06 -6.84 33.87 -9.28 17.09 14.20 -4.71 Table 2: PORTFOLIO WEIGHTS (%) Exising Portfolio Weights 60 40 Lyx would 7.69 5.79 -3.28 20.75 New Portfolio Weights 40 30 30 14.14 15.06 -4.28 Questions: 1- Using the given information in Table 1, calculate the mean return, standard deviation, covariance and correlation for the given stocks. (Time allocated: 15 minutes) 2- Calculate the return and standard deviation for the portfolio consisting of the two stocks. (Time allocated: 15 minutes) 3- After adding the stock Lyx USDJIA, what is the portfolio return and standard deviation? How does the new portfolio differ from the first portfolio calculate in question 2? (Time allocated: 15 minutes) 4- Based on your analysis, explain should Albert diversify his portfolio or remain invested in Malaysia and Singapore only? (Time allocated: 15 minutes) 5- Calculate beta for the current portfolio and the new portfolio. Assuming a risk free rate of 2.5% and a market risk premium of 5.5% and calculate the expected return for both portfolios. (Time allocated: 15 minutes) Background Material (Pick the right equation based on your need) Mean = E[R] E(R) = {(r.) R = wR + wR + E[R] = 0= *Pab= = wifi+w/2 + ...Wnfln (r.-E(r.)) n-1 Var Rp] = wo+wot+2wawsCOV [Ra, Rs] = wo + wio? + 2wawsoa@bPab COV R.R dags +wnRn COV Ra, Rb] = Pabab E[R] = Rpremium = E[Rm] - T E[R]=r; +3 x (E[Rm]-rs) Cov(R, Rm) B = Var(Rm) = wifi + *** +wntn

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The Means SD Variance covariance and correlation are shown below The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started