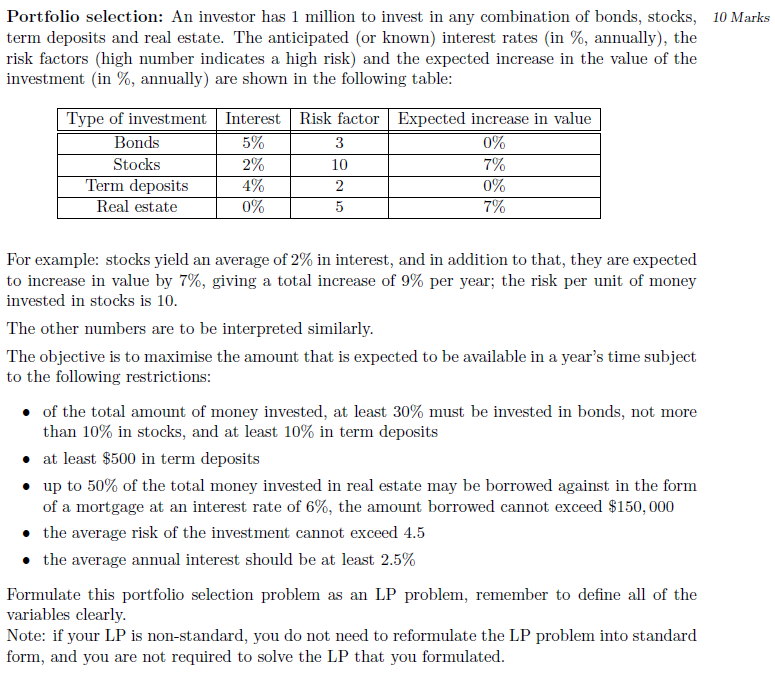

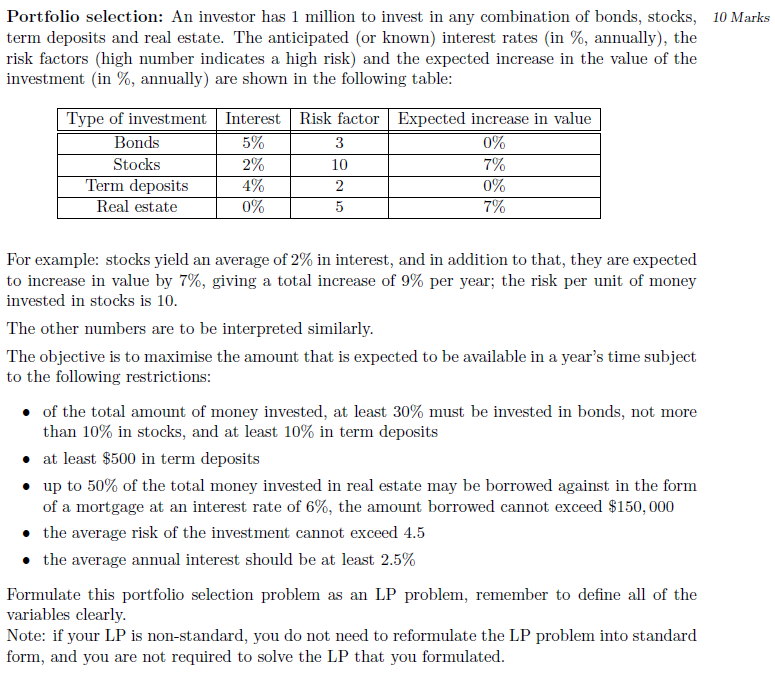

Portfolio selection: An investor has 1 million to invest in any combination of bonds, stocks, 10 Marks term deposits and real estate. The anticipated (or known) interest rates (in %, annually), the risk factors (high number indicates a high risk) and the expected increase in the value of the investment (in %, annually) are shown in the following table: Type of investment Interest Risk factor Expected increase in value Bonds 5% 3 0% Stocks 2% 7% Term deposits 4% 2 0% Real estate 0% 5 7% 10 For example: stocks yield an average of 2% in interest, and in addition to that, they are expected to increase in value by 7%, giving a total increase of 9% per year; the risk per unit of money invested in stocks is 10. The other numbers are to be interpreted similarly. The objective is to maximise the amount that is expected to be available in a year's time subject to the following restrictions: of the total amount of money invested, at least 30% must be invested in bonds, not more than 10% in stocks, and at least 10% in term deposits at least $500 in term deposits up to 50% of the total money invested in real estate may be borrowed against in the form of a mortgage at an interest rate of 6%, the amount borrowed cannot exceed $150,000 the average risk of the investment cannot exceed 4.5 the average annual interest should be at least 2.5% Formulate this portfolio selection problem as an LP problem, remember to define all of the variables clearly. Note: if your LP is non-standard, you do not need to reformulate the LP problem into standard form, and you are not required to solve the LP that you formulated. Portfolio selection: An investor has 1 million to invest in any combination of bonds, stocks, 10 Marks term deposits and real estate. The anticipated (or known) interest rates (in %, annually), the risk factors (high number indicates a high risk) and the expected increase in the value of the investment (in %, annually) are shown in the following table: Type of investment Interest Risk factor Expected increase in value Bonds 5% 3 0% Stocks 2% 7% Term deposits 4% 2 0% Real estate 0% 5 7% 10 For example: stocks yield an average of 2% in interest, and in addition to that, they are expected to increase in value by 7%, giving a total increase of 9% per year; the risk per unit of money invested in stocks is 10. The other numbers are to be interpreted similarly. The objective is to maximise the amount that is expected to be available in a year's time subject to the following restrictions: of the total amount of money invested, at least 30% must be invested in bonds, not more than 10% in stocks, and at least 10% in term deposits at least $500 in term deposits up to 50% of the total money invested in real estate may be borrowed against in the form of a mortgage at an interest rate of 6%, the amount borrowed cannot exceed $150,000 the average risk of the investment cannot exceed 4.5 the average annual interest should be at least 2.5% Formulate this portfolio selection problem as an LP problem, remember to define all of the variables clearly. Note: if your LP is non-standard, you do not need to reformulate the LP problem into standard form, and you are not required to solve the LP that you formulated