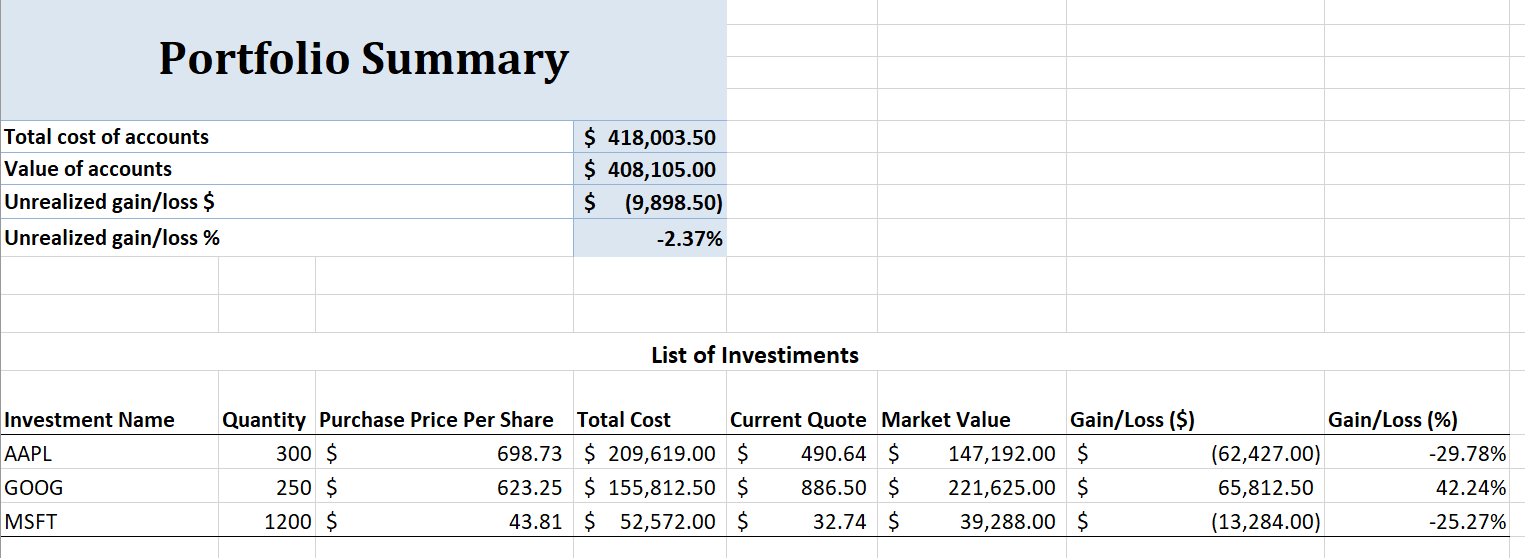

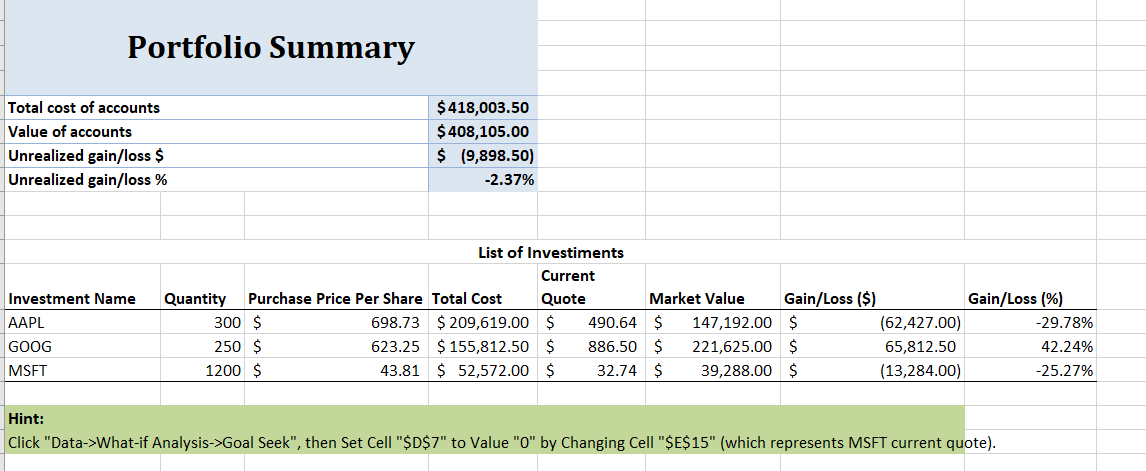

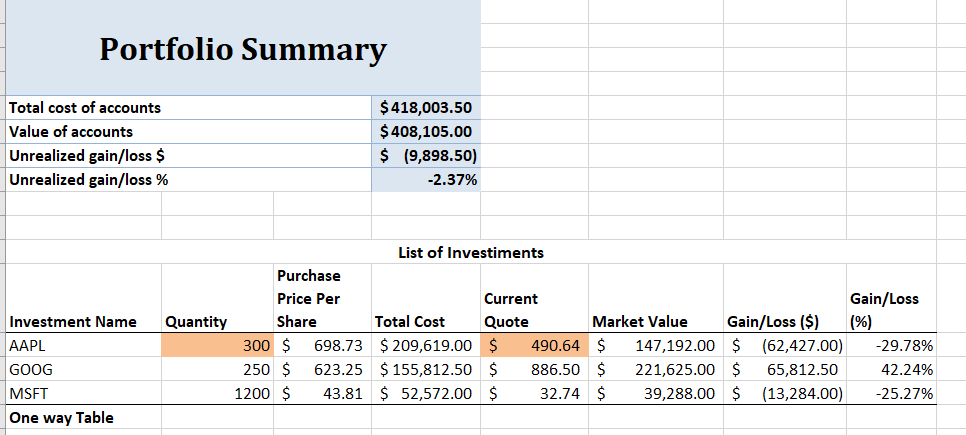

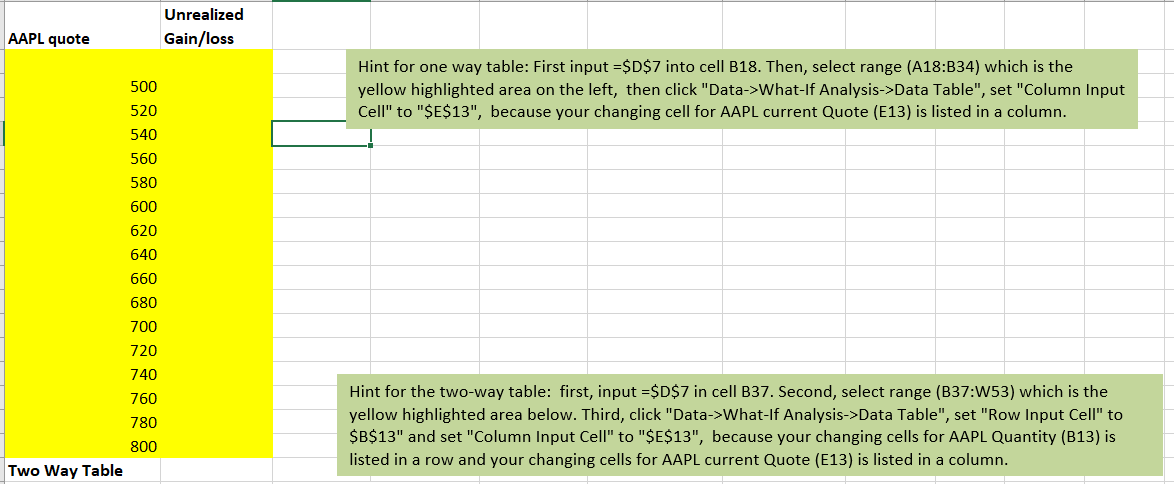

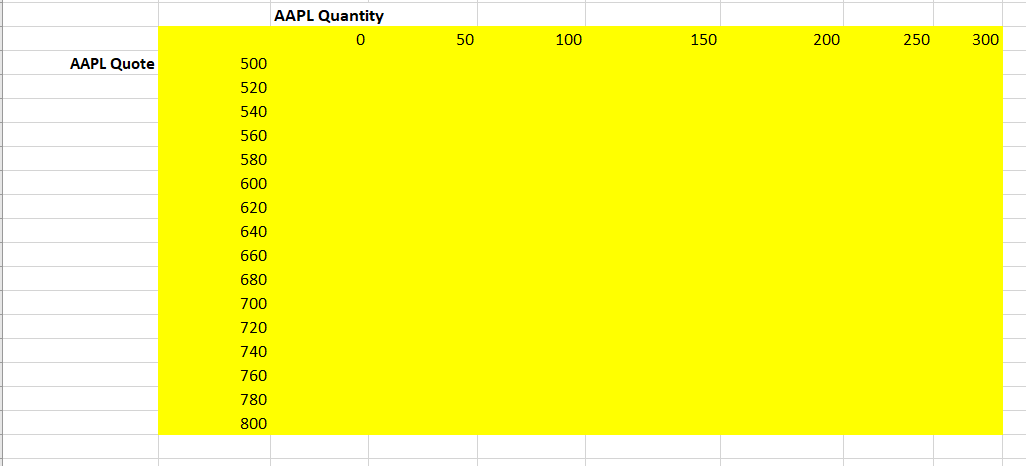

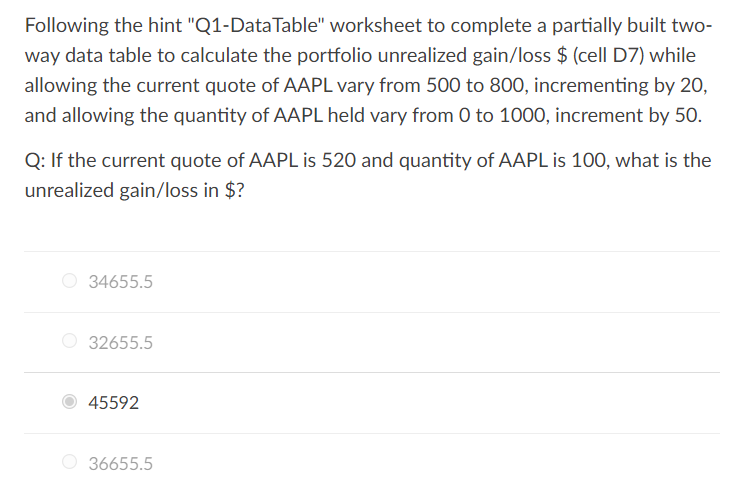

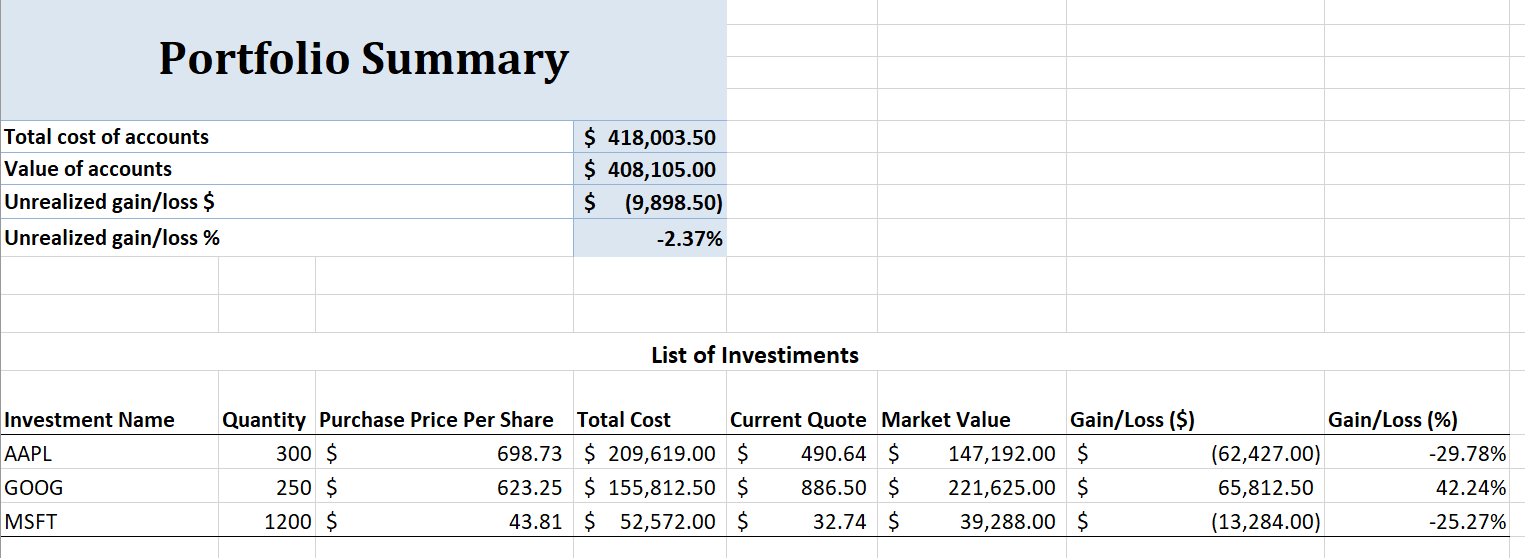

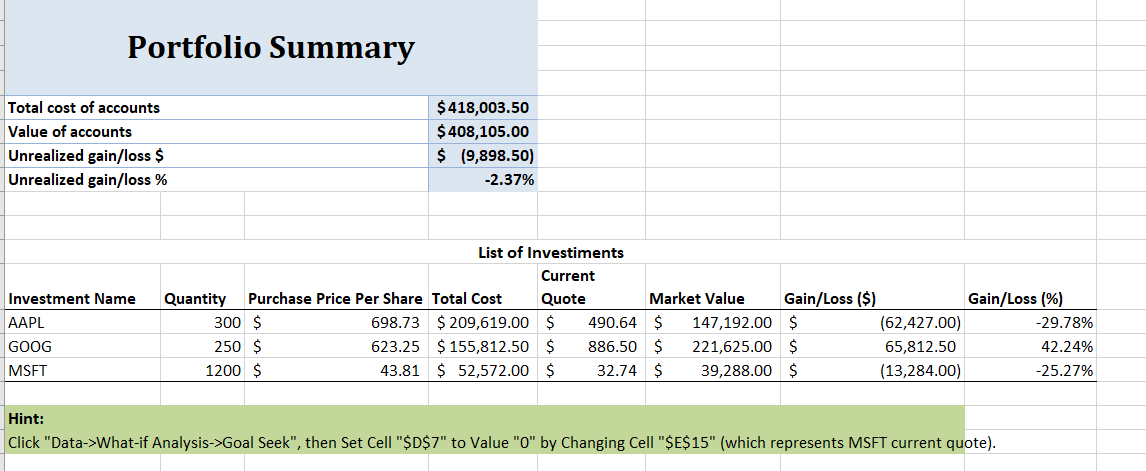

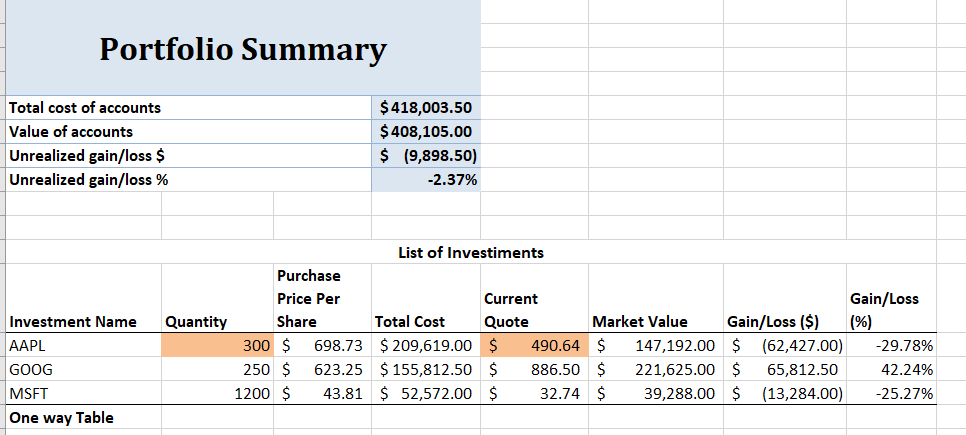

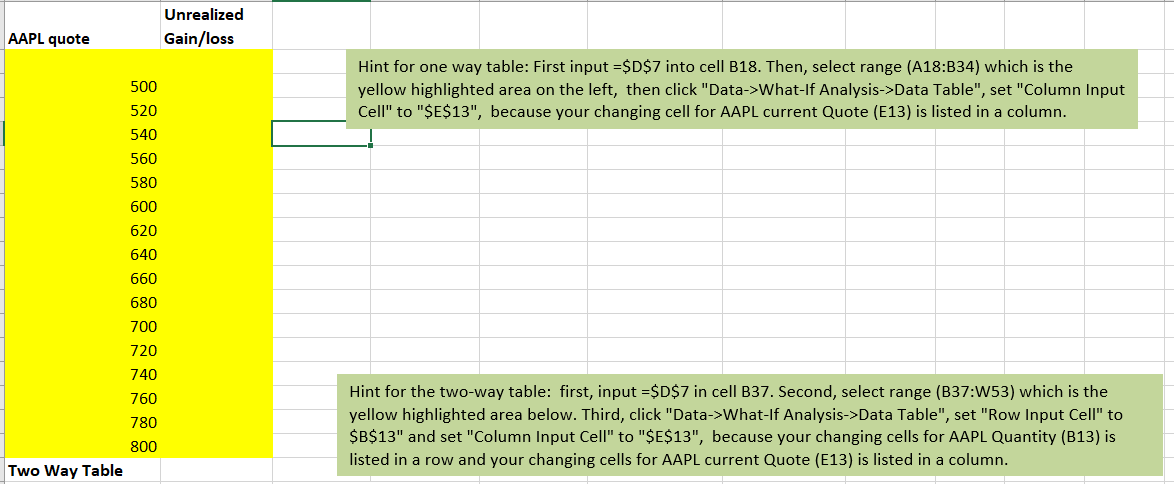

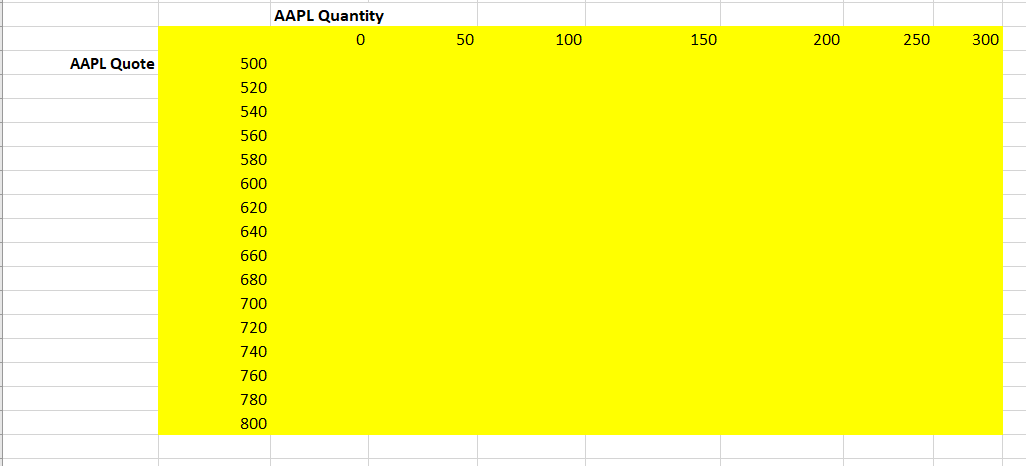

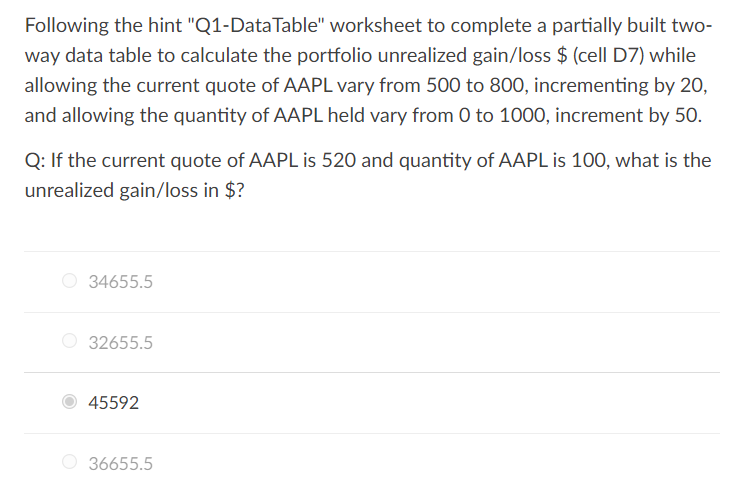

Portfolio Summary Total cost of accounts Value of accounts Unrealized gain/loss $ Unrealized gain/loss % $ 418,003.50 $ 408,105.00 $ 19,898.50) -2.37% List of Investiments Investment Name AAPL Quantity Purchase Price Per Share Total Cost Current Quote Market Value Gain/Loss ($) 300 $ 698.73 $ 209,619.00 $ 490.64 $ 147,192.00 $ 250 $ 623.25 $ 155,812.50 $ 886.50 $ 221,625.00 $ 1200 $ 43.81 $ 52,572.00 $ 32.74 $ 39,288.00 $ Gain/Loss (%) (62,427.00) -29.78% 65,812.50 42.24% (13,284.00) -25.27% GOOG MSFT Portfolio Summary Total cost of accounts Value of accounts Unrealized gain/loss $ Unrealized gain/loss % $ 418,003.50 $ 408,105.00 $ (9,898.50) -2.37% Investment Name AAPL GOOG MSFT List of Investiments Current Quantity Purchase Price Per Share Total Cost Quote Market Value Gain/Loss ($) 300 $ 698.73 $ 209,619.00 $ 490.64 $ 147,192.00 $ (62,427.00) 250 $ 623.25 $ 155,812.50 $ 886.50 $ 221,625.00 $ 65,812.50 1200 $ 43.81 $ 52,572.00 $ 32.74 $ 39,288.00 $ (13,284.00) Gain/Loss (%) -29.78% 42.24% -25.27% Hint: Click "Data->What-if Analysis->Goal Seek", then Set Cell "$D$7" to Value "O" by Changing Cell "$E$15" (which represents MSFT current quote). Portfolio Summary Total cost of accounts Value of accounts Unrealized gain/loss $ Unrealized gain/loss % $ 418,003.50 $ 408,105.00 $ 19,898.50) -2.37% Investment Name AAPL GOOG MSFT One way Table List of Investiments Purchase Price Per Current Gain/Loss Quantity Share Total Cost Quote Market Value Gain/Loss ($) (%) 300 $ 698.73 $ 209,619.00 490.64 $ 147,192.00 $ (62,427.00) -29.78% 250 $ 623.25 $ 155,812.50 $ 886.50 $ 221,625.00 $ 65,812.50 42.24% 1200 $ 43.81 $ 52,572.00 $ 32.74 $ 39,288.00 $ (13,284.00) -25.27% Unrealized Gain/loss AAPL quote Hint for one way table: First input =$D$7 into cell B18. Then, select range (A18:B34) which is the yellow highlighted area on the left, then click "Data->What-If Analysis->Data Table", set "Column Input Cell" to "$E$13", because your changing cell for AAPL current Quote (E13) is listed in a column. 500 520 540 560 580 600 620 640 660 680 700 720 740 760 780 800 Two Way Table Hint for the two-way table: first, input =$D$7 in cell B37. Second, select range (B37:W53) which is the yellow highlighted area below. Third, click "Data->What-lf Analysis->Data Table", set "Row Input Cell" to $B$13" and set "Column Input Cell" to "$E$13", because your changing cells for AAPL Quantity (B13) is listed in a row and your changing cells for AAPL current Quote (E13) is listed in a column. 50 100 150 200 250 300 AAPL Quote AAPL Quantity 0 500 520 540 560 580 600 620 640 660 680 700 720 740 760 780 800 Following the hint "Q1-Data Table" worksheet to complete a partially built two- way data table to calculate the portfolio unrealized gain/loss $ (cell D7) while allowing the current quote of AAPL vary from 500 to 800, incrementing by 20, and allowing the quantity of AAPL held vary from 0 to 1000, increment by 50. Q: If the current quote of AAPL is 520 and quantity of AAPL is 100, what is the unrealized gain/loss in $? 34655.5 32655.5 45592 36655.5 Portfolio Summary Total cost of accounts Value of accounts Unrealized gain/loss $ Unrealized gain/loss % $ 418,003.50 $ 408,105.00 $ 19,898.50) -2.37% List of Investiments Investment Name AAPL Quantity Purchase Price Per Share Total Cost Current Quote Market Value Gain/Loss ($) 300 $ 698.73 $ 209,619.00 $ 490.64 $ 147,192.00 $ 250 $ 623.25 $ 155,812.50 $ 886.50 $ 221,625.00 $ 1200 $ 43.81 $ 52,572.00 $ 32.74 $ 39,288.00 $ Gain/Loss (%) (62,427.00) -29.78% 65,812.50 42.24% (13,284.00) -25.27% GOOG MSFT Portfolio Summary Total cost of accounts Value of accounts Unrealized gain/loss $ Unrealized gain/loss % $ 418,003.50 $ 408,105.00 $ (9,898.50) -2.37% Investment Name AAPL GOOG MSFT List of Investiments Current Quantity Purchase Price Per Share Total Cost Quote Market Value Gain/Loss ($) 300 $ 698.73 $ 209,619.00 $ 490.64 $ 147,192.00 $ (62,427.00) 250 $ 623.25 $ 155,812.50 $ 886.50 $ 221,625.00 $ 65,812.50 1200 $ 43.81 $ 52,572.00 $ 32.74 $ 39,288.00 $ (13,284.00) Gain/Loss (%) -29.78% 42.24% -25.27% Hint: Click "Data->What-if Analysis->Goal Seek", then Set Cell "$D$7" to Value "O" by Changing Cell "$E$15" (which represents MSFT current quote). Portfolio Summary Total cost of accounts Value of accounts Unrealized gain/loss $ Unrealized gain/loss % $ 418,003.50 $ 408,105.00 $ 19,898.50) -2.37% Investment Name AAPL GOOG MSFT One way Table List of Investiments Purchase Price Per Current Gain/Loss Quantity Share Total Cost Quote Market Value Gain/Loss ($) (%) 300 $ 698.73 $ 209,619.00 490.64 $ 147,192.00 $ (62,427.00) -29.78% 250 $ 623.25 $ 155,812.50 $ 886.50 $ 221,625.00 $ 65,812.50 42.24% 1200 $ 43.81 $ 52,572.00 $ 32.74 $ 39,288.00 $ (13,284.00) -25.27% Unrealized Gain/loss AAPL quote Hint for one way table: First input =$D$7 into cell B18. Then, select range (A18:B34) which is the yellow highlighted area on the left, then click "Data->What-If Analysis->Data Table", set "Column Input Cell" to "$E$13", because your changing cell for AAPL current Quote (E13) is listed in a column. 500 520 540 560 580 600 620 640 660 680 700 720 740 760 780 800 Two Way Table Hint for the two-way table: first, input =$D$7 in cell B37. Second, select range (B37:W53) which is the yellow highlighted area below. Third, click "Data->What-lf Analysis->Data Table", set "Row Input Cell" to $B$13" and set "Column Input Cell" to "$E$13", because your changing cells for AAPL Quantity (B13) is listed in a row and your changing cells for AAPL current Quote (E13) is listed in a column. 50 100 150 200 250 300 AAPL Quote AAPL Quantity 0 500 520 540 560 580 600 620 640 660 680 700 720 740 760 780 800 Following the hint "Q1-Data Table" worksheet to complete a partially built two- way data table to calculate the portfolio unrealized gain/loss $ (cell D7) while allowing the current quote of AAPL vary from 500 to 800, incrementing by 20, and allowing the quantity of AAPL held vary from 0 to 1000, increment by 50. Q: If the current quote of AAPL is 520 and quantity of AAPL is 100, what is the unrealized gain/loss in $? 34655.5 32655.5 45592 36655.5