Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portfolio theory FCFF model... Please show all manual Workings. Netflieks Financial Data Current dividends per share R2.75 Current FCFE per share ? Current FCFF per

Portfolio theory FCFF model... Please show all manual Workings.

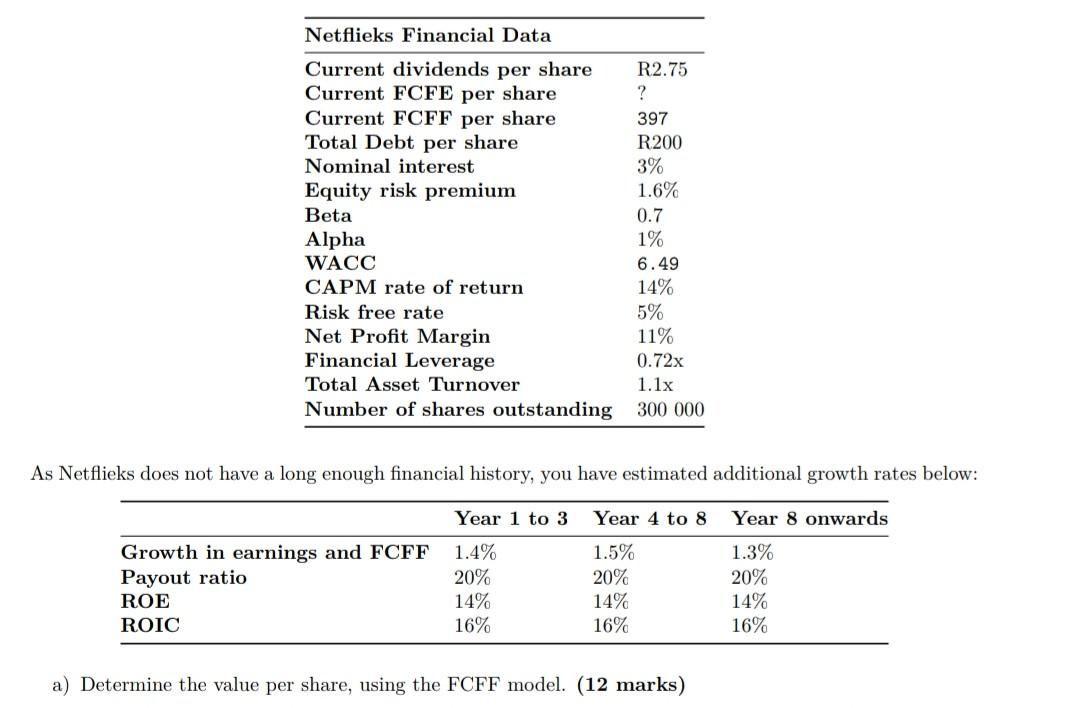

Netflieks Financial Data Current dividends per share R2.75 Current FCFE per share ? Current FCFF per share 397 Total Debt per share R200 Nominal interest 3% Equity risk premium 1.6% Beta 0.7 Alpha 1% WACC 6.49 CAPM rate of return 14% Risk free rate Net Profit Margin 11% Financial Leverage 0.72x Total Asset Turnover 1.1x Number of shares outstanding 300 000 5% As Netflieks does not have a long enough financial history, you have estimated additional growth rates below: Year 1 to 3 Year 4 to 8 Year 8 onwards Growth in earnings and FCFF Payout ratio ROE ROIC 1.4% 20% 14% 16% 1.5% 20% 14% 16% 1.3% 20% 14% 16% a) Determine the value per share, using the FCFF model. (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started