Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Portia Ltd is a specialist manufacturer of components for luxury yachts. A contract has been offered to Portia by Nerrisa Supermarine plc for the

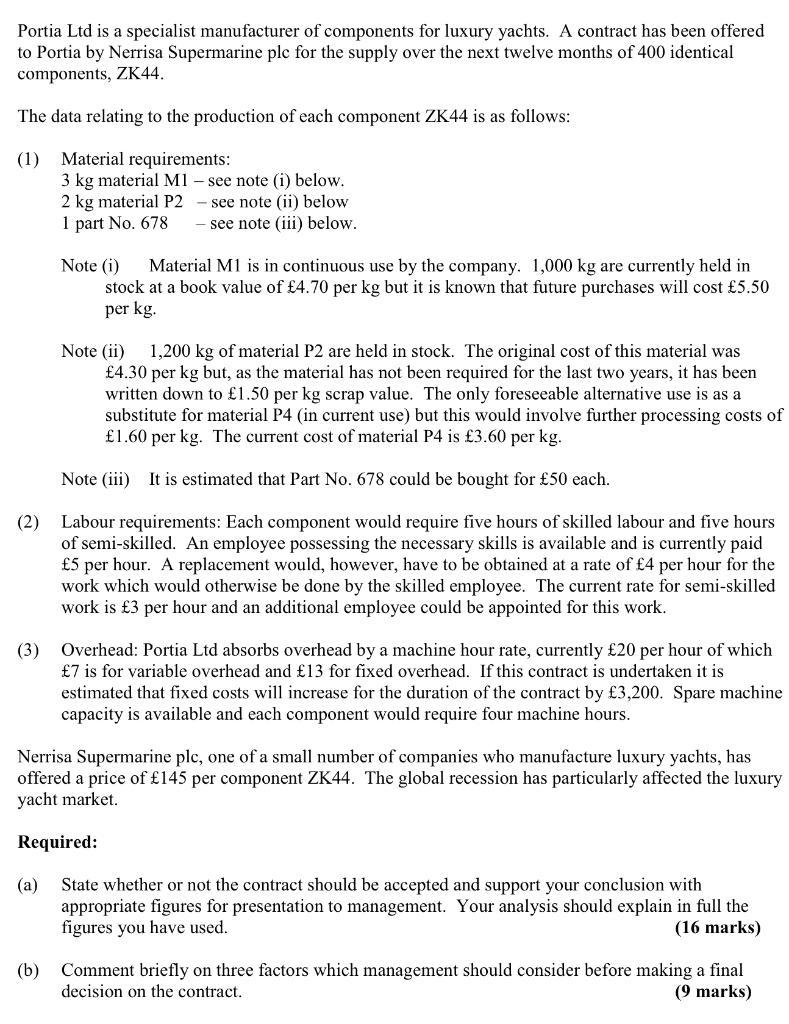

Portia Ltd is a specialist manufacturer of components for luxury yachts. A contract has been offered to Portia by Nerrisa Supermarine plc for the supply over the next twelve months of 400 identical components, ZK44. The data relating to the production of each component ZK44 is as follows: (1) Material requirements: (2) (3) (a) 3 kg material M1 - see note (i) below. 2 kg material P2 - see note (ii) below 1 part No. 678 - see note (iii) below. (b) Note (i) Material M1 is in continuous use by the company. 1,000 kg are currently held in stock at a book value of 4.70 per kg but it is known that future purchases will cost 5.50 per kg. Note (ii) 1,200 kg of material P2 are held in stock. The original cost of this material was 4.30 per kg but, as the material has not been required for the last two years, it has been written down to 1.50 per kg scrap value. The only foreseeable alternative use is as a substitute for material P4 (in current use) but this would involve further processing costs of 1.60 per kg. The current cost of material P4 is 3.60 per kg. Note (iii) It is estimated that Part No. 678 could be bought for 50 each. Labour requirements: Each component would require five hours of skilled labour and five hours of semi-skilled. An employee possessing the necessary skills is available and is currently paid 5 per hour. A replacement would, however, have to be obtained at a rate of 4 per hour for the work which would otherwise be done by the skilled employee. The current rate for semi-skilled work is 3 per hour and an additional employee could be appointed for this work. Overhead: Portia Ltd absorbs overhead by a machine hour rate, currently 20 per hour of which 7 is for variable overhead and 13 for fixed overhead. If this contract is undertaken it is Nerrisa Supermarine plc, one of a small number of companies who manufacture luxury yachts, has offered a price of 145 per component ZK44. The global recession has particularly affected the luxury yacht market. Required: State whether or not the contract should be accepted and support your conclusion with appropriate figures for presentation to management. Your analysis should explain in full the figures you have used. (16 marks) estimated that fixed costs will increase for the duration of the contract by 3,200. Spare machine capacity is available and each component would require four machine hours. Comment briefly on three factors which management should consider before making a final decision on the contract. (9 marks)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a The contract should not be accepted The breakeven point for this contract is 400 components 145 pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started