Answered step by step

Verified Expert Solution

Question

1 Approved Answer

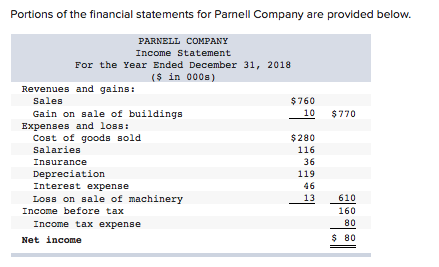

Portions of the financial statements for Parnell Company are provided below. PARNELL COMPANY Income Statement For the Year Ended December 31, 2018 ($ in 000s)

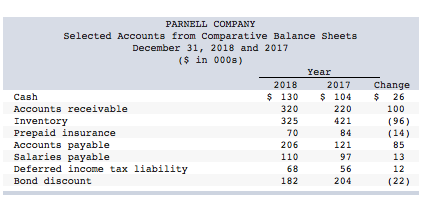

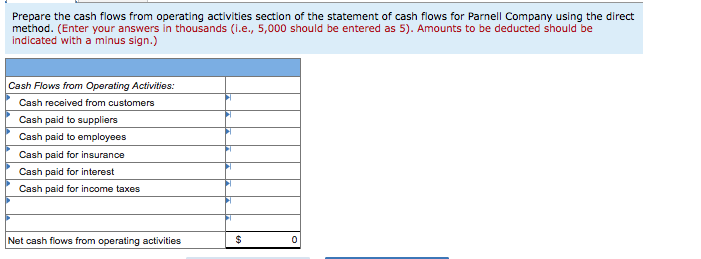

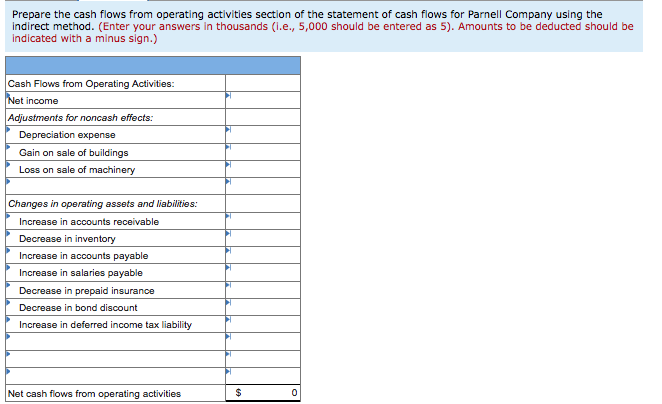

Portions of the financial statements for Parnell Company are provided below. PARNELL COMPANY Income Statement For the Year Ended December 31, 2018 ($ in 000s) Revenues and gains Sales $760 10 $770 Gain on sale of buildings Expenses and loss Cost of goods sold $280 Salaries 116 36 Insurance Depreciation 119 46 Interest expense 13 610 Loss on sale of machinery Income before tax 160 80 Income tax expense 80 Net income PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2018 and 2017 ($ in 000s) Year 2018 2017 change 26 Cash 130 104 Accounts receivable 320 220 100 325 421 (96) (14) Inventory Prepaid insurance Accounts payable Salaries payable Deferred income tax liability 70 84 206 121 85 110 97 13 68 56 12 Bond discount 182 204 (22) Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. (Enter your answers in thousands (i.e., 5,000 should be entered as 5). Amounts to be deducted should be indicated with a minus sign.) Cash Flows from Operating Activities: Cas received from customers Cash paid to suppliers Cash paid to employees Cash paid for insurance Cash paid for interest Cash paid for income taxes Net cash flows from operating activities $ 0 Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the indirect method. (Enter your answers in thousands (.e., 5,000 should be entered as 5). Amounts to be deducted should be indicated with a minus sign.) Cash Flows from Operating Activities: INet income Adjustments for noncash effects: Depreciation expense Gain on sale of buildings Loss on sale of machinery Changes in operating assets and liabilities: Increase in accounts receivable Decrease in inventory Increase in accounts payable Increase in salaries payable Decrease in prepaid insurance Decrease in bond discount Increase in deferred income tax liability $ 0 Net cash flows from operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started