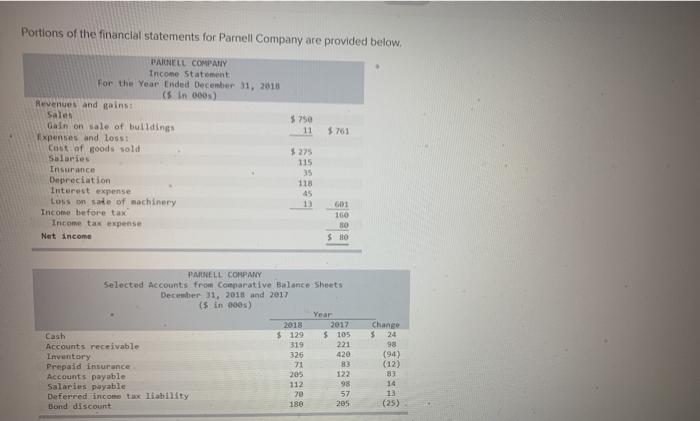

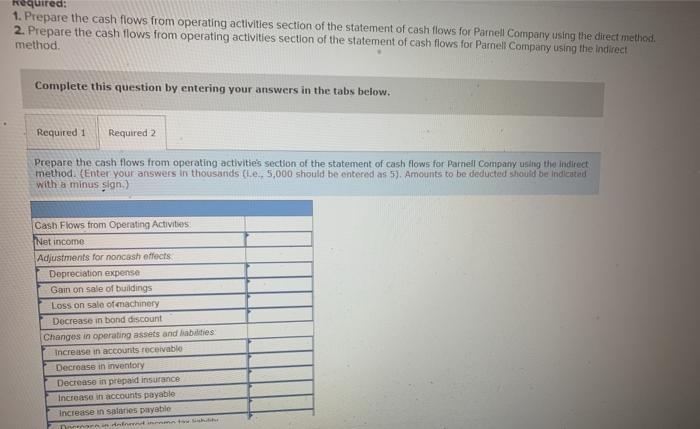

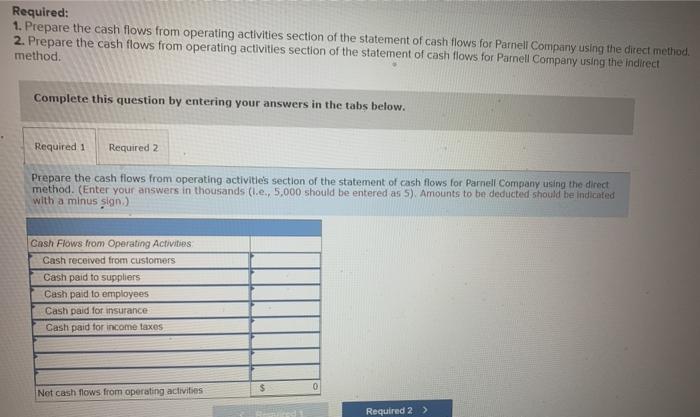

Portions of the financial statements for Parnell Company are provided below. $750 11 $761 PAINELL COMPANY Income Statement For the Year Ended December 31, 2018 (5 in 000) Revenues and gainst Sales Gain on sale of buildings Expenses and loss! Cost of goods sold Salaries Insurance Depreciation Interest expense Loss on sale of machinery Income before tax Income tax expense Net income $275 115 35 118 45 160 HO $ 80 PAINELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2017 and 2017 ($ in 060) Year 2018 2017 Cash $ 129 $ 105 Accounts receivable 319 221 Inventory 326 420 Prepaid insurance 71 83 Accounts payable 122 Salaries payable 112 98 Deferred income tax liability 70 57 Bond discount 180 205 Change $ 24 98 (94) (12) 87 14 13 (25) 205 Required: 1. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method 2. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the Indirect method Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the indirect method. (Enter your answers in thousands (.e., 5,000 should be entered as 5). Amounts to be deducted should be indicated with a minus sign.) Cash Flows from Operating Activities Net income Adjustments for noncash effects Depreciation expense Gain on sale of buildings Loss on sale of machinery Decrease in bond discount Changes in operating assets and abilities Increase in accounts receivable Decrease in inventory Decrease in prepaid insurance Increase in accounts payable Increase in sales payable Dan Him Required: 1. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. 2. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the indirect method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. (Enter your answers in thousands (1.e., 5,000 should be entered as 5). Amounts to be deducted should be indicated with a minus sign.) Cash Flows from Operating Activities Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for insurance Cash paid for income taxes $ 0 Net cash flows from operating activities Required 2 >