Answered step by step

Verified Expert Solution

Question

1 Approved Answer

possible options 1) lower/higher 2)junior/senior 3)are/are not 4)municipal/agency 5)are freely callable/are noncallable/carry a deferred call 6)better/worse 7)lower/higher 8)repayment/call premium/call fee/recall fee Understanding How Bonds Work

possible options

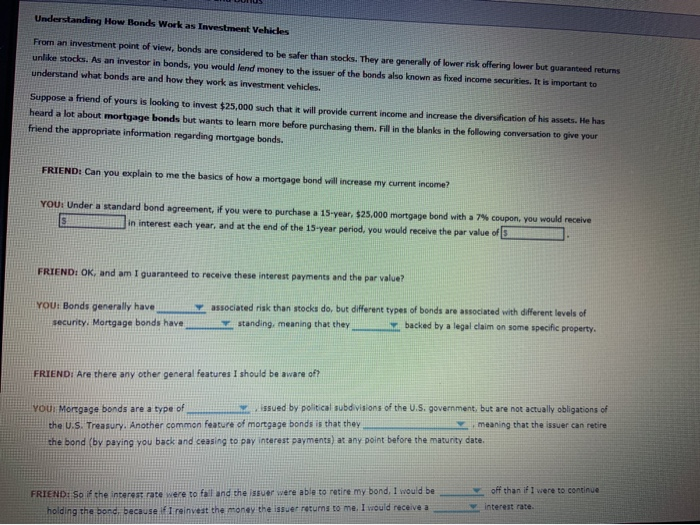

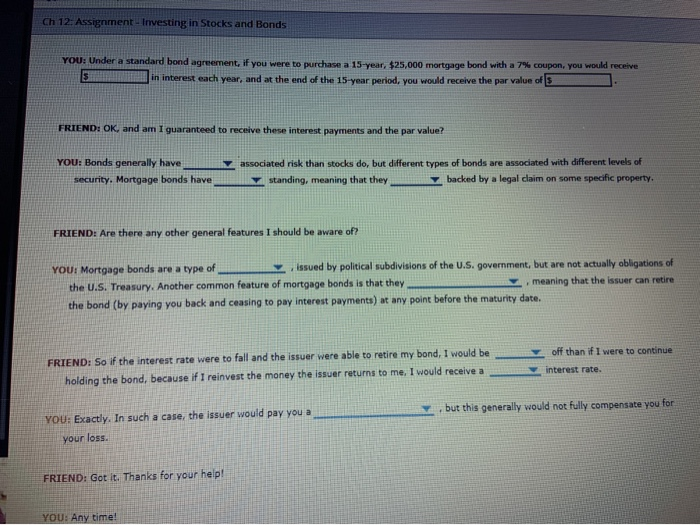

Understanding How Bonds Work as Investment Vehices From an investment point of view, bonds are considered to be safer than stocks. They are generally of lower risk offering lover but guaranteed returns unlike stocks. As an investor in bonds, you would lend money to the issuer of the bonds also known as foxed income securities. It is important to understand what bonds are and how they work as investment vehides Suppose a friend of yours is looking to invest $25,000 such that it will provide current income and increase the diversification of his assets. He has heard a lot about mortgage bonds but wants to learn more before purchasing them. Fill in the blanks in the following conversation to give your friend the appropriate information regarding mortgage bonds. FRIEND: Can you explain to me the basics of how a mortgage bond will increase my current income? YOU: Under a standard bond agreement, if you were to purchase a 15-year, $25,000 mortgage bond with a 7% coupon, you would receive in interest each year, and at the end of the 15-year period, you would receive the par value of FRIEND: OK, and am I guaranteed to receive these interest payments and the par value? v associated risk than stocks do, but different types of bonds are associated with different levels of backed by a legal claim on some specific property. YOU: Bonds generally have standing, meaning that they security. Mortgage bonds have FRIEND: Are there any other general features I should be aware of? issued by political subdivisions of the U.S. government, but are not actually obligations of YOU Mortgage bonds are a type of the U.S. Treasury. Another common feature of mortgage bonds is that they meaning that the issuer can retire the bond (by paying you back and ceasing to pay interest payments) at any point before the maturity date. off than if I were to continue FRIEND: So if the interest rate were to fall and the issuer were able to retire my bond. I would be Y interest rate. holding the bond. because if I reinvest the money the issuer returms to me. I would receive a Ch 12: Assignment Investing in Stocks and Bonds YOU: Under a standard bond agreement, if you were to purchase a 15-year, $25,000 mortgage bond with a 7% coupon, you would receive in interest each year, and at the end of the 15-year period, you would receive the par value of s FRIEND: OK, and am I guaranteed to receive these interest payments and the par value? associated risk than stocks do, but different types of bonds are associated with different levels of backed by a legal claim on some specific property. YOU: Bonds generally have security. Mortgage bonds have standing, meaning that they FRIEND: Are there any other general features I should aware of? , issued by political subdivisions of the U.S. government, but are not actually obligations of meaning that the issuer can retire YOU: Mortgage bonds are a type of the U.S. Treasury. Another common feature of mortgage bonds is that they the bond (by paying you back and ceasing to pay interest payments) at any point before the maturity date. off than if I were to continue FRIEND: So if the interest rate were to fall and the issuer were able to retire my bond, I would be interest rate. holding the bond, because if I reinvest the money the issuer returns to me, I would receive a but this generally would not fully compensate you for YOU: Exactly. In such a case, the issuer would pay you a your loss. FRIEND: Got it. Thanks for your help! YOU: Any time 1) lower/higher

2)junior/senior

3)are/are not

4)municipal/agency

5)are freely callable/are noncallable/carry a deferred call

6)better/worse

7)lower/higher

8)repayment/call premium/call fee/recall fee

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started