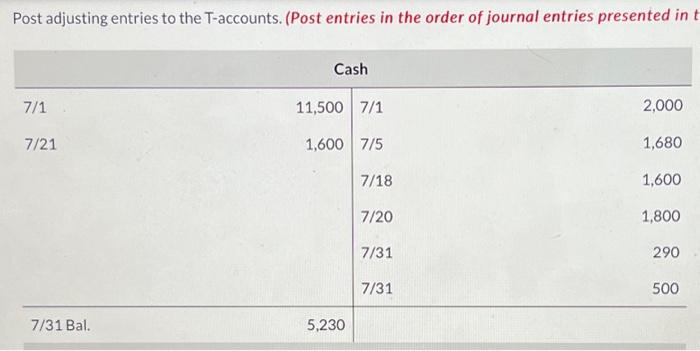

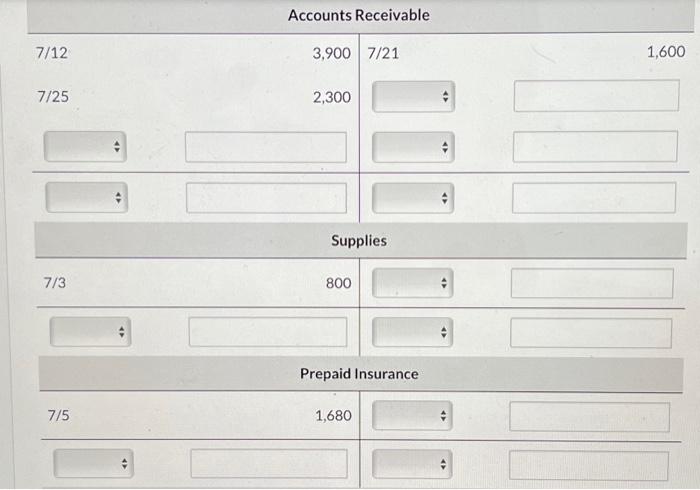

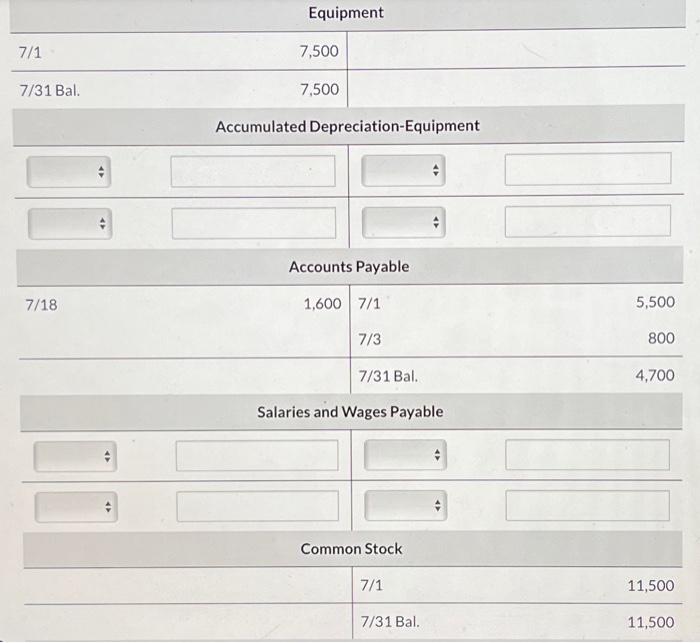

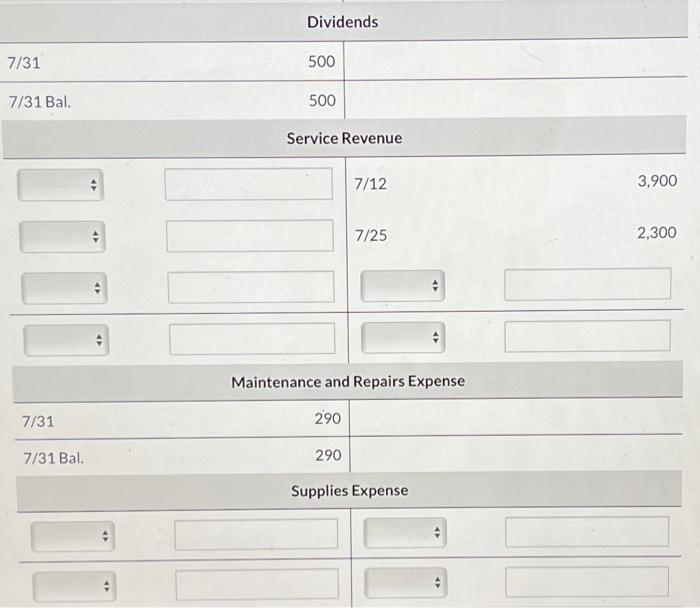

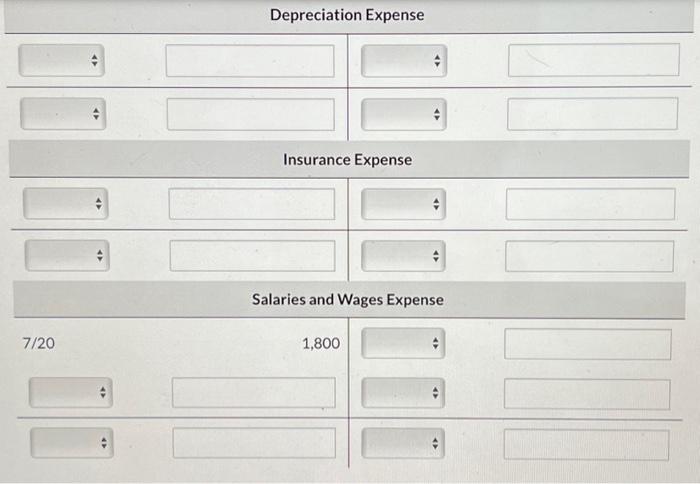

post adjustment entries to the T-accounts

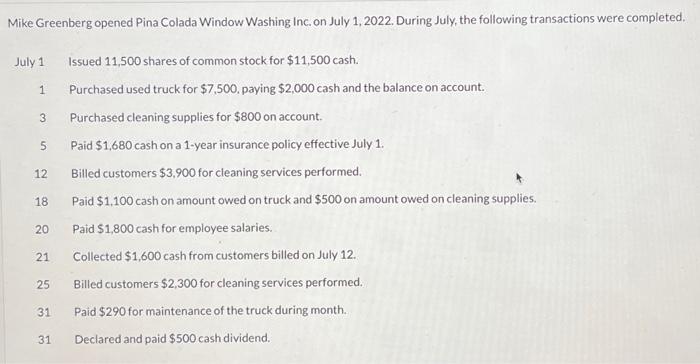

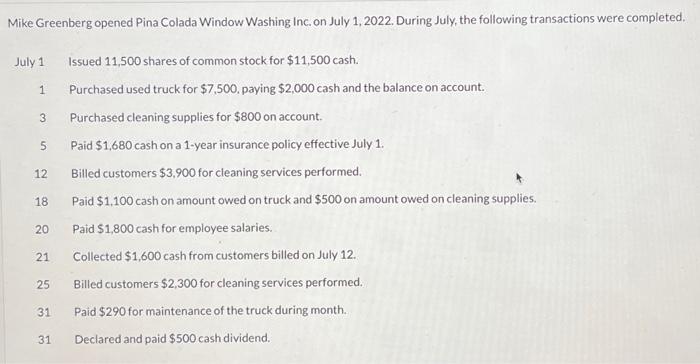

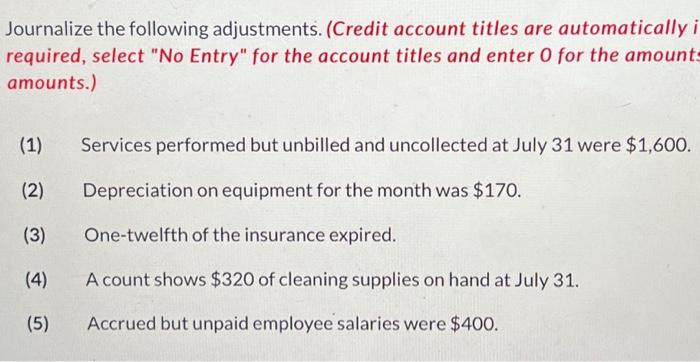

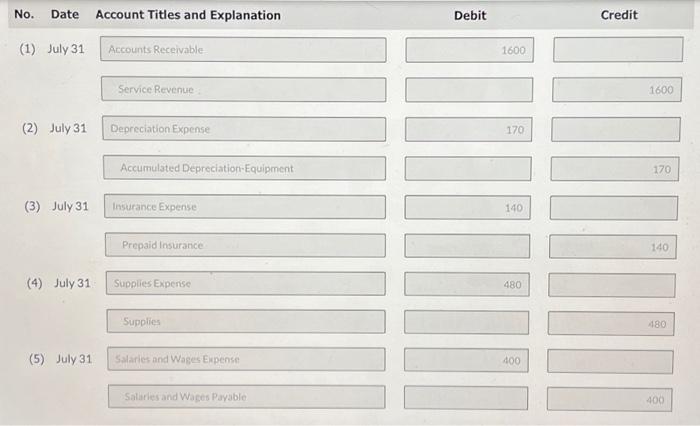

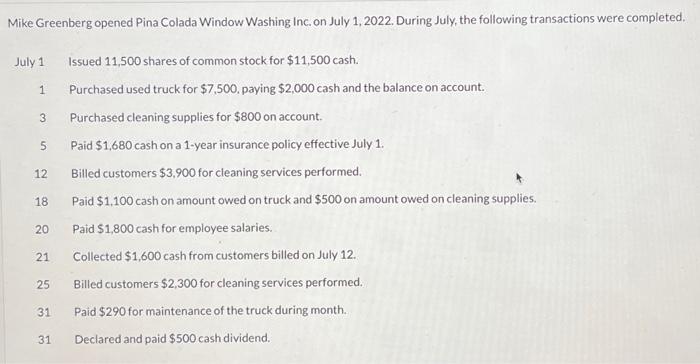

Mike Greenberg opened Pina Colada Window Washing Inc. on July 1, 2022. During July, the following transactions were completed. July 1 Issued 11,500 shares of common stock for $11,500 cash. 1 Purchased used truck for $7,500, paying $2,000 cash and the balance on account. 3 Purchased cleaning supplies for $800 on account. 5 Paid $1,680 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,900 for cleaning services performed. 18 Paid $1,100 cash on amount owed on truck and $500 on amount owed on cleaning supplies. 20 Paid $1,800 cash for employee salaries. 21 Collected $1,600 cash from customers billed on July 12 . 25 Billed customers $2,300 for cleaning services performed. 31 Paid $290 for maintenance of the truck during month. 31 Declared and paid $500 cash dividend. Journalize the following adjustments. (Credit account titles are automatically i required, select "No Entry" for the account titles and enter 0 for the amount: amounts.) (1) Services performed but unbilled and uncollected at July 31 were $1,600. (2) Depreciation on equipment for the month was $170. (3) One-twelfth of the insurance expired. (4) A count shows $320 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $400. No. Date Account Titles and Explanation Debit Credit (1) July 31 Accounts Receivable Service Revenue (2) July 31 Depreciation Expense Accumulated Depreciation-Equipment (3) July 31 Insurance Expense (4) July 31 Supplies Experise (5) July 31 Post adjusting entries to the T-accounts. (Post entries in the order of journal entries presented in Accounts Receivable Supplies Prepaid Insurance 7/5 1,680 \begin{tabular}{lc} & Equipn \\ \hline 7/1 & 7,500 \\ \hline 7/31Bal. & 7,500 \end{tabular} Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Common Stock \begin{tabular}{r|lr} \hline & 7/1 & 11,500 \\ \hline & 7/31Bal. & 11,500 \end{tabular} Dividends \begin{tabular}{ll} \hline 7/31 & 500 \\ \hline 7/31 Bal. & 500 \\ \hline \end{tabular} Service Revenue 7/12 3,900 7/25 2,300 Maintenance and Repairs Expense 7/31Bal7/31 290 Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense 7/20 1,800