Post an approximately 300-word response to the weeks reading assignment (Ch. 6). There are a number of ways to approach this assignment: consider the reading in relation to its historical or theoretical context; write about an aspect of the weeks reading that you dont understand, or something that jars you; formulate an insightful question or two about the reading and then attempt to answer your own questions; or respond to another students post, building upon it, disagreeing with it, or re-thinking it. In any case, strive for thoughtfulness and nuance.

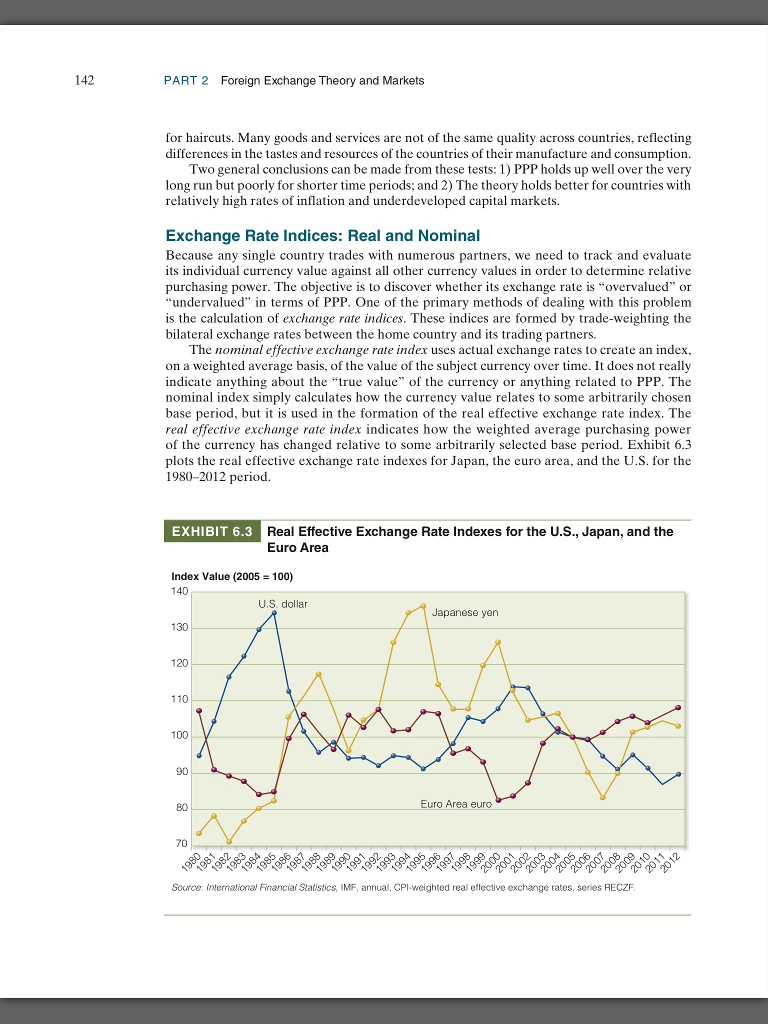

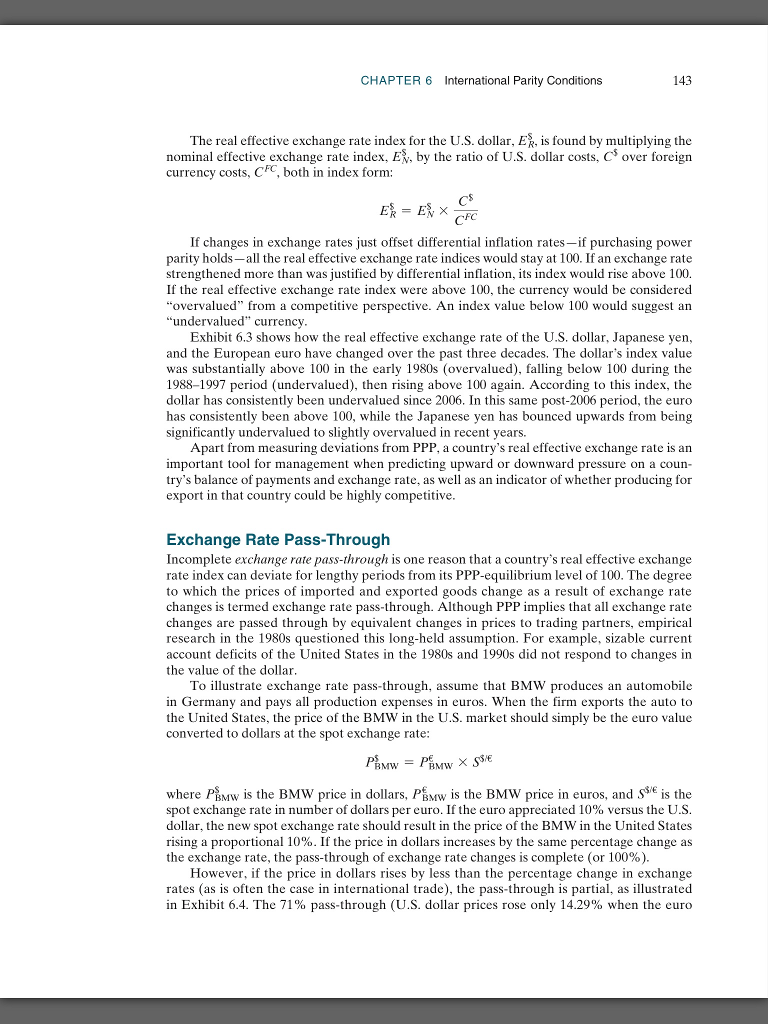

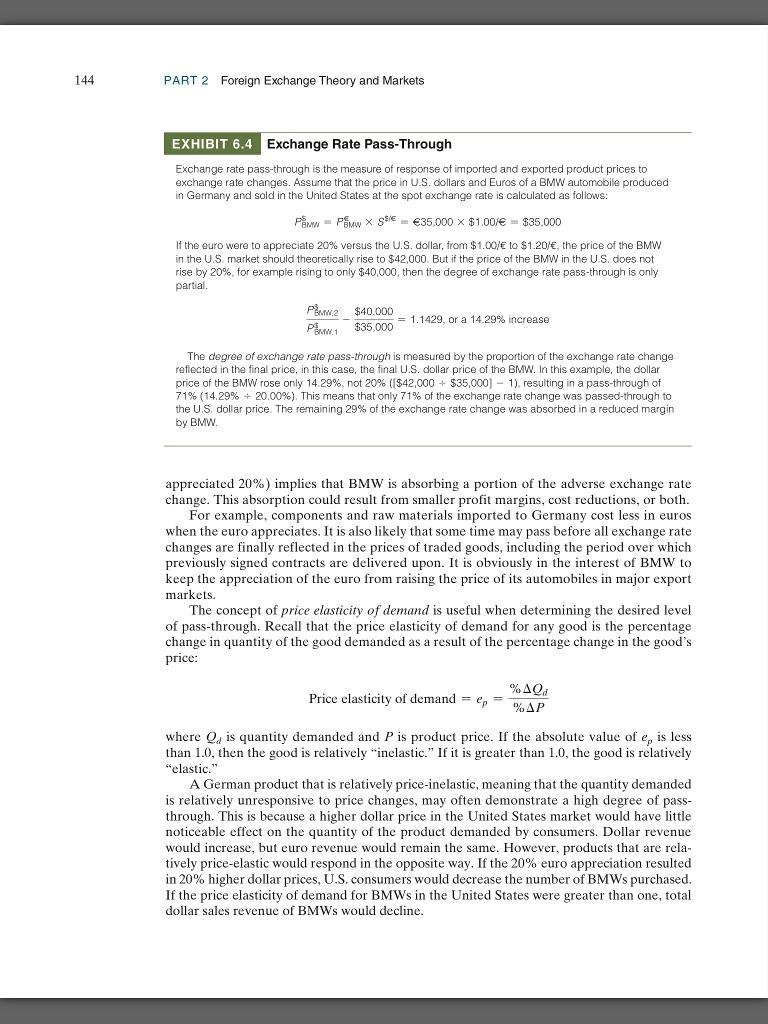

CHAPTER International Parity Conditions if capital freely flowed towards those countries where it could be most profitably employed, there could be no difference in the rate of profit, and no other difference in the real or labour price of commodities, than the additional quantity of labour required to convey them to the various markets where they were to be sold. David Ricardo, Onthe Principles of Political Economy and Taxation, 1817, Chapter 7 LEARNING OBJECTIVES Examine how price levels and price level changes (inflation) in countries determine the exchange rates at which their currencies are traded Show how interest rates reflect inflationary forces within each country and currency E Explain how forward markets for currencies reflect expectations held by market participants about the future spot exchange rate Analyze how, in equilibrium, the spot and forward currency ma are aligned with interest differentials and differentials in expected inflation What are the determinants of exchange rates? Are changes in exchange rates predictable? Managers of MNES, international portfolio investors, importers and exporters, and govern ment officials must deal with these fundamental questions every day. This chapter describes the core financial theories surrounding the determination of exchange rates. Chapter 8 will introduce two other major theoretical schools of thought regarding currency valuation and combine the three different theories in a variety of real-world applications. The economic theories that link exchange rates, price levels, and interest rates are called international parity conditions. In the eyes of many, these international parity conditions form the core of the financial theory that is considered unique to the field of international finance. These theories do not always work out to be "true" when compared to what students and practitioners observe in the real world, but they are central to any understanding of how multinational business is conducted and funded in the world today. And, as is often the case the mistake is not always in the theory itself, but in the way it is interpreted or applied in practice. This chapter concludes with a Mini-Case, Mrs. Watanabe and the Japanese Yen Carry Trade, that demonstrates how both the theory and practice of international parity conditions sometimes combine to form unusual opportunities for profi for those who are willing to bear the risk! 137