Answered step by step

Verified Expert Solution

Question

1 Approved Answer

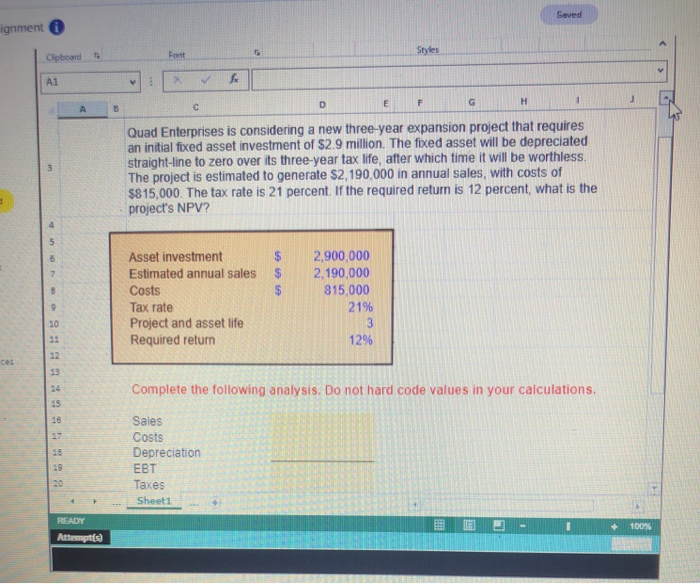

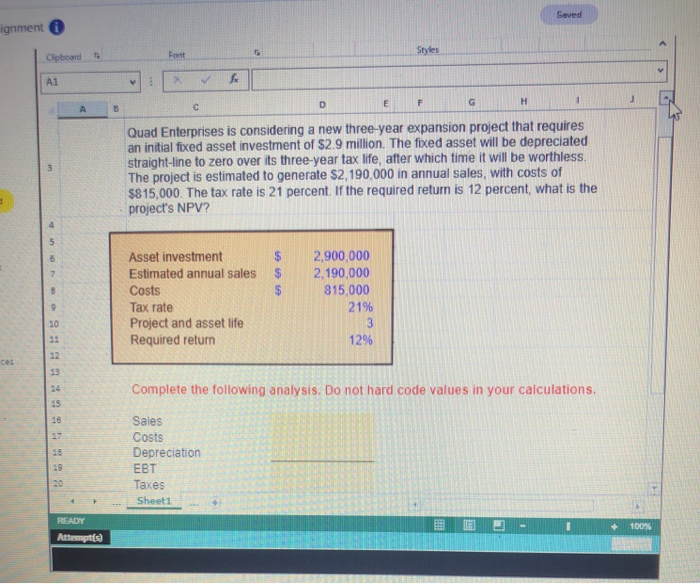

POST ANSWERS AS EXCEL FORMULAS Coved gnment i Clipboard Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment

POST ANSWERS AS EXCEL FORMULAS

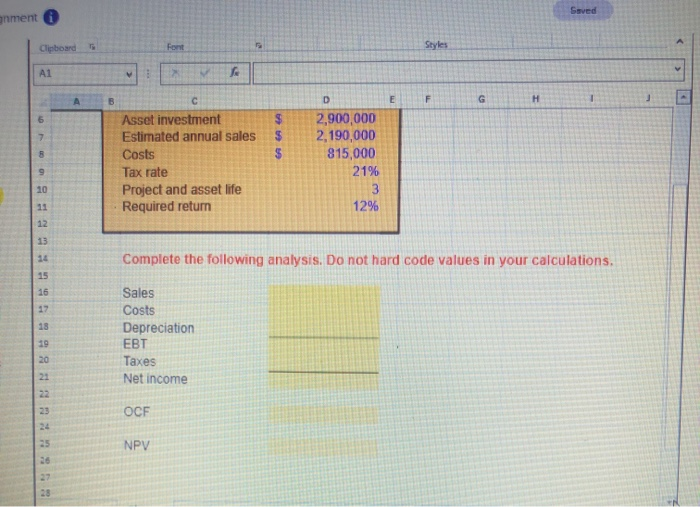

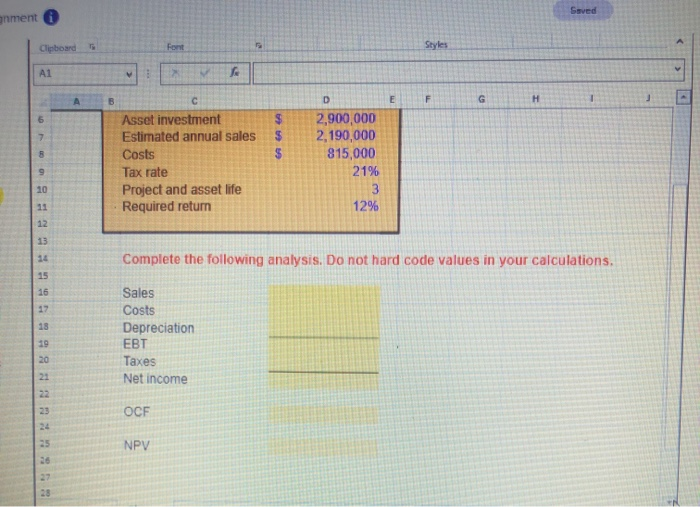

Coved gnment i Clipboard Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? $ Asset investment Estimated annual sales Costs Tax rate Project and asset life Required return 2,900,000 2,190,000 815,000 21% soos Complete the following analysis. Do not hard code values in your calculations. Sales Costs Depreciation EBT Taxes Sheet1 READY Attempte 100% nment Clipboard Asset investment Estimated annual sales Costs Tax rate Project and asset life Required return 2,900,000 2,190,000 815,000 21% Complete the following analysis. Do not hard code values in your calculations, Sales Costs Depreciation EBT Taxes Net income OCF NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started