Post Inc. acquired at book value 80% of the voting shares of Scrip Inc. on January 1, 2020, when Scrip reported common stock of

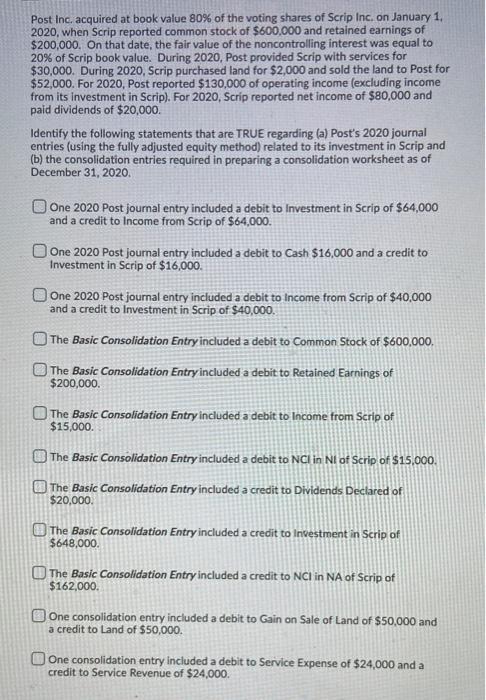

Post Inc. acquired at book value 80% of the voting shares of Scrip Inc. on January 1, 2020, when Scrip reported common stock of $600,000 and retained earnings of $200,000. On that date, the fair value of the noncontrolling interest was equal to 20% of Scrip book value. During 2020, Post provided Scrip with services for $30,000. During 2020, Scrip purchased land for $2,000 and sold the land to Post for $52,000. For 2020, Post reported $130,000 of operating income (excluding income from its investment in Scrip). For 2020, Scrip reported net income of $80,000 and paid dividends of $20,000. Identify the following statements that are TRUE regarding (a) Post's 2020 journal entries (using the fully adjusted equity method) related to its investment in Scrip and (b) the consolidation entries required in preparing a consolidation worksheet as of December 31, 2020. One 2020 Post journal entry included a debit to Investment in Scrip of $64,000 and a credit to Income from Scrip of $64,000. One 2020 Post journal entry included a debit to Cash $16,000 and a credit to Investment in Scrip of $16,000. One 2020 Post journal entry included a debit to Income from Scrip of $40,000 and a credit to Investment in Scrip of $40,000. The Basic Consolidation Entry included a debit to Common Stock of $600,000. The Basic Consolidation Entry included a debit to Retained Earnings of $200,000. The Basic Consolidation Entry included a debit to Income from Scrip of $15,000. The Basic Consolidation Entry included a debit to NCI in NI of Scrip of $15,000. The Basic Consolidation Entry included a credit to Dividends Declared of $20,000. The Basic Consolidation Entry included a credit to Investment in Scrip of $648,000. The Basic Consolidation Entry included a credit to NCI in NA of Scrip of $162,000. One consolidation entry included a debit to Gain on Sale of Land of $50,000 and a credit to Land of $50,000. One consolidation entry included a debit to Service Expense of $24,000 and a credit to Service Revenue of $24,000.

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SLNO Particulars TrueFalse Reason 1 In 2020 post Journal entry Included a debit to investment scrip ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started