Answered step by step

Verified Expert Solution

Question

1 Approved Answer

post letter answer only 1. An investor bought common shares of a company from its underwriters at the IPO. The stock is listed (and traded

post letter answer only

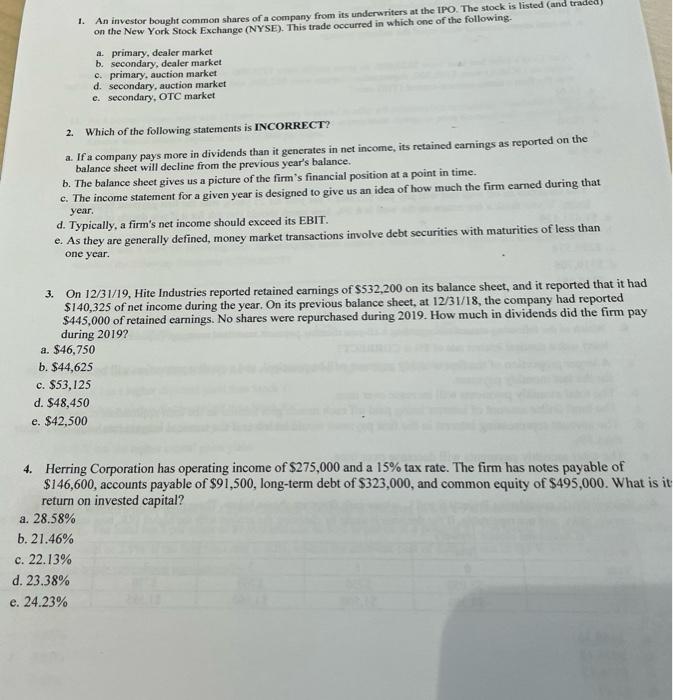

1. An investor bought common shares of a company from its underwriters at the IPO. The stock is listed (and traded on the New York Stock Exchange (NYSE). This trade occurred in which one of the following. a. primary, dealer market b. secondary, dealer market c. primary, auction market d. secondary, auction market c. secondary, OTC market 2. Which of the following statements is INCORRECT? a. If a company pays more in dividends than it generates in net income, its retained earnings as reported on the balance sheet will decline from the previous year's balance. b. The balance sheet gives us a picture of the firm's financial position at a point in time. c. The income statement for a given year is designed to give us an idea of how much the firm earned during that year. d. Typically, a firm's net income should exceed its EBIT. e. As they are generally defined, money market transactions involve debt securities with maturities of less than one year. 3. On 12/31/19, Hite Industries reported retained earnings of $532,200 on its balance sheet, and it reported that it had $140,325 of net income during the year. On its previous balance sheet, at 12/31/18, the company had reported $445,000 of retained earnings. No shares were repurchased during 2019. How much in dividends did the firm pay during 2019? a. $46,750 b. $44,625 c. $53,125 d. $48,450 e. $42,500 4. Herring Corporation has operating income of $275,000 and a 15% tax rate. The firm has notes payable of $146,600, accounts payable of $91,500, long-term debt of $323,000, and common equity of $495,000. What is it return on invested capital? a. 28.58% b. 21.46% c. 22.13% d. 23.38% e. 24.23%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started