Answered step by step

Verified Expert Solution

Question

1 Approved Answer

post letter answer only 14. Which of the following statements is CORRECT? Azero-coupon bond's price decreases over time as the bond approaches to its maturity.

post letter answer only

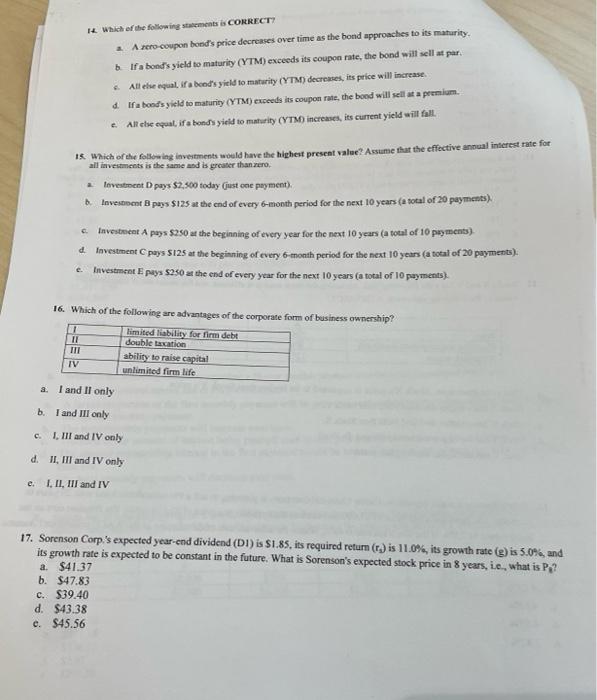

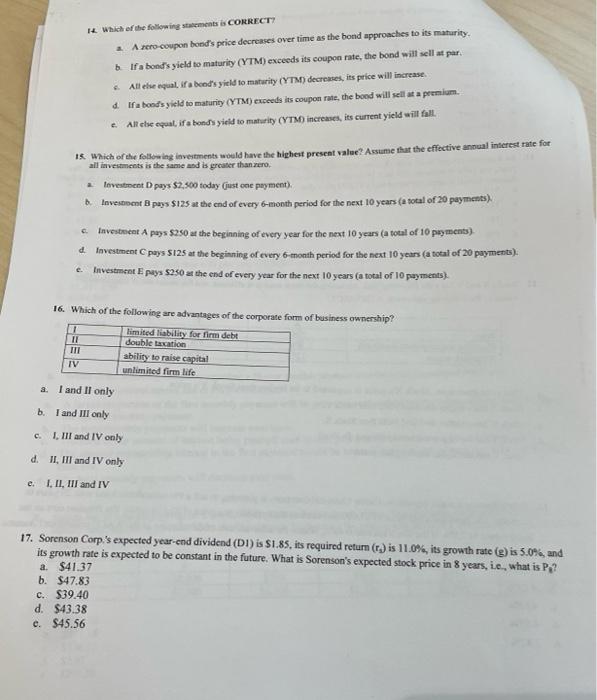

14. Which of the following statements is CORRECT? Azero-coupon bond's price decreases over time as the bond approaches to its maturity. b Ifa bond's yield to maturity (YTM) exceeds its coupon rate, the bond will sell at par All else equal ta bood's yield to maturity CYTM) decreases, its price will increase d Ifa bond's yield to maturity (YTM) exceeds its coupon rate, the bood will sell at a premium c. AR ehe equal, ifa bonds yield to maturity CYTM increases, its current yield will fall. " Which of the following investments would have the highest present value? Assume that the effective annual interest rate for all investments is the same and is greater than zero. - lovestment pays $2,500 today (just one payment) Investment 3 pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) & Investment Cpays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) Investment Epays $250 at the end of every year for the next 10 years (a total of 10 payments) 16. Which of the following are advantages of the corporate form of business ownership? LE II M IV limited liability for fim debt double taxation ability to raise capital unlimited firm life a. I and II only b. I and III only C. I, III and IV only d. II, III and IV only e. I, II, III and IV 17. Sorenson Corp.'s expected year-end dividend (DI) is $1.85, its required return (r) is 11.0%, its growth rate (g) is 5.0%, and its growth rate is expected to be constant in the future. What is Sorenson's expected stock price in 8 years, ie, what is P3 a $41.37 b. $47.83 c. $39.40 d. $43.38 e. $45.56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started