Answered step by step

Verified Expert Solution

Question

1 Approved Answer

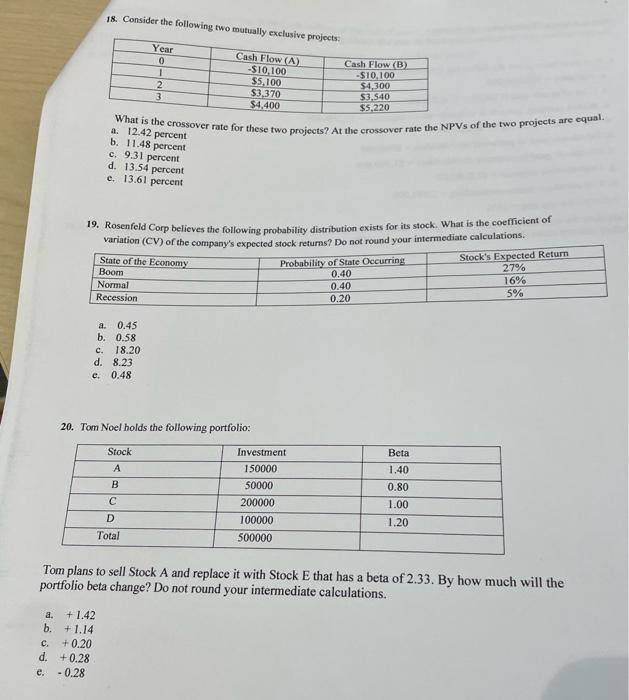

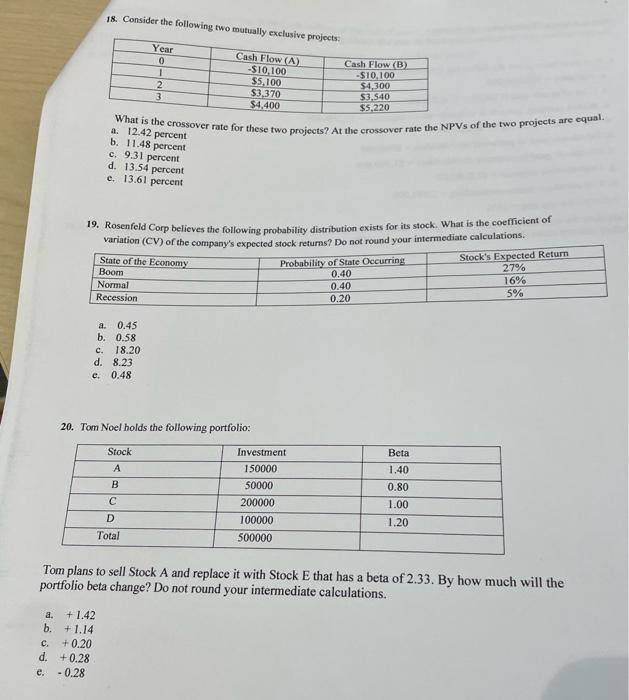

post letter answer only 18. Consider the following two mutually exclusive projects Year Cash Flow (A) 0 Cash Flow (B) -$10,100 1 -$10,100 S5,100 2

post letter answer only

18. Consider the following two mutually exclusive projects Year Cash Flow (A) 0 Cash Flow (B) -$10,100 1 -$10,100 S5,100 2 $4,300 $3,370 3 $3,540 $4,400 $5.220 What is the crossover rate for these two projects? At the crossover rate the NPVs of the two projects are equal a. 12.42 percent b. 11.48 percent c. 9.31 percent d. 13.54 percent e. 13.61 percent 19. Rosenfeld Corp believes the following probability distribution exists for its stock. What is the coefficient of variation (CV) of the company's expected stock returns? Do not round your intermediate calculations. State of the Economy Boom Normal Recession Probability of State Occurring 0.40 0.40 0.20 Stock's Expected Return 27% 16% 5% a. 0.45 b. 0.58 c. 18.20 d. 8.23 e. 0.48 20. Tom Noel holds the following portfolio: Stock B Investment 150000 50000 200000 100000 500000 Beta 1.40 0.80 1.00 1.20 D Total Tom plans to sell Stock A and replace it with Stock E that has a beta of 2.33. By how much will the portfolio beta change? Do not round your intermediate calculations. a. + 1.42 b. +1.14 c. + 0.20 d. +0.28 e. - 0.28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started