Answered step by step

Verified Expert Solution

Question

1 Approved Answer

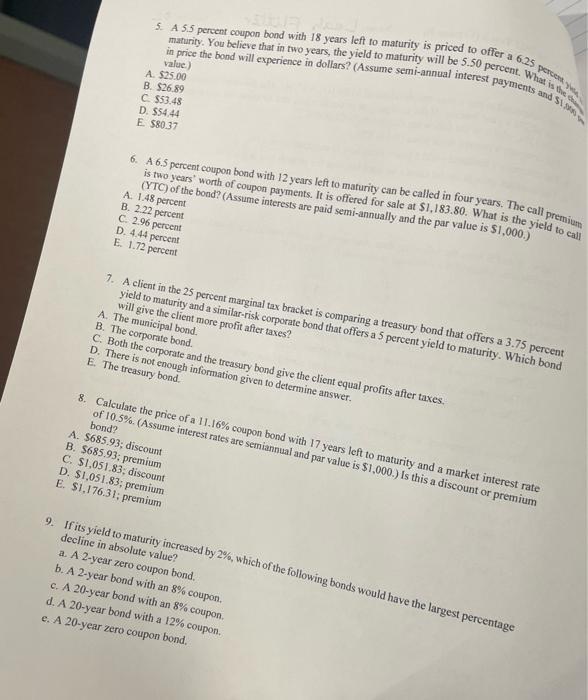

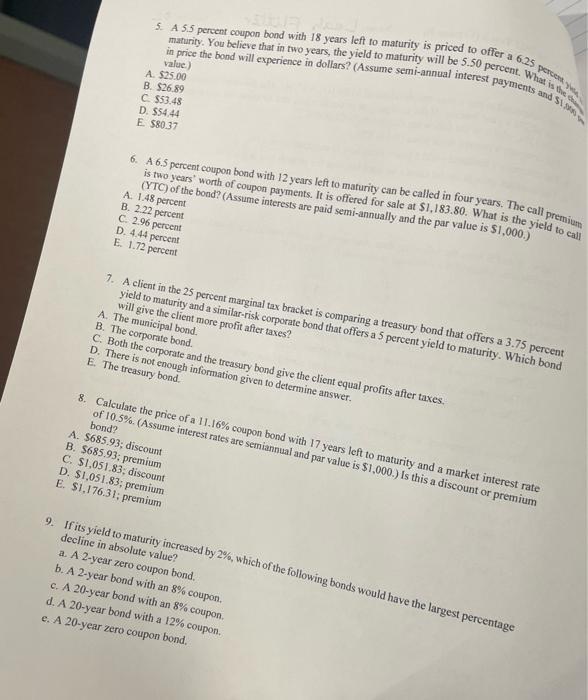

post letter answer only 5.A 5.5 percent coupon bond with 18 years left to maturity is priced to offer a 6.25 maturity. You believe that

post letter answer only

5.A 5.5 percent coupon bond with 18 years left to maturity is priced to offer a 6.25 maturity. You believe that in two years, the yield to maturity will be 5.50 percent. What is the in price the bond will experience in dollars? (Assume semi-annual interest payments and 1 value) A $25.00 B. $26.89 C$53.48 D. $54.44 E $80.37 pero 6. A 6.5 percent coupon bond with 12 years left to maturity can be called in four years. The call premium (YTC) of the bond? (Assume interests are paid semi-annually and the par value is $1,000.) is two years worth of coupon payments. It is offered for sale at $1,183.80. What is the yield to com A 1.48 percent B. 2.22 percent C. 2.96 percent D. 4.44 percent E. 1.72 percent 7. A client in the 25 percent marginal tax bracket is comparing a treasury bond that offers a 3.75 percent yield to maturity and a similar-risk corporate bond that offers a 5 percent yield to maturity. Which bond will give the client more profit after taxes? A. The municipal bond. B. The corporate bond C. Both the corporate and the treasury bond give the client equal profits after taxes. D. There is not enough information given to determine answer. E. The treasury bond 8. Calculate the price of a 11.16% coupon bond with 17 years left to maturity and a market interest rate of 10.5%. (Assume interest rates are semiannual and par value is $1,000.) Is this a discount or premium bond? A. $685.93; discount B. 5685.93; premium C. $1.051.83; discount D. $1,051.83; premium E. $1,176.31; premium 9. If its yield to maturity increased by 2%, which of the following bonds would have the largest percentage decline in absolute value? a. A 2-year zero coupon bond. b. A 2-year bond with an 8% coupon C. A 20-year bond with an 8% coupon d. A 20-year bond with a 12% coupon. e. A 20-year zero coupon bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started