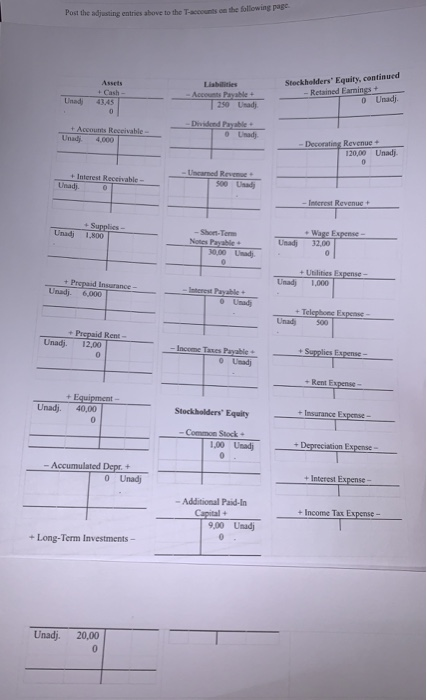

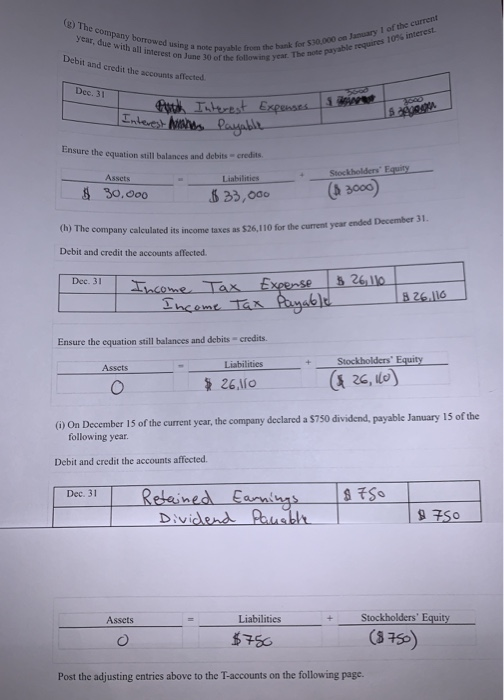

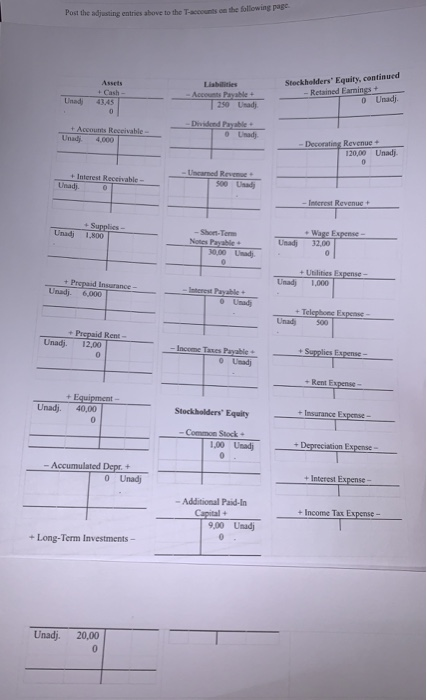

Post the adjusting entries above to the T-accounts on the following page.

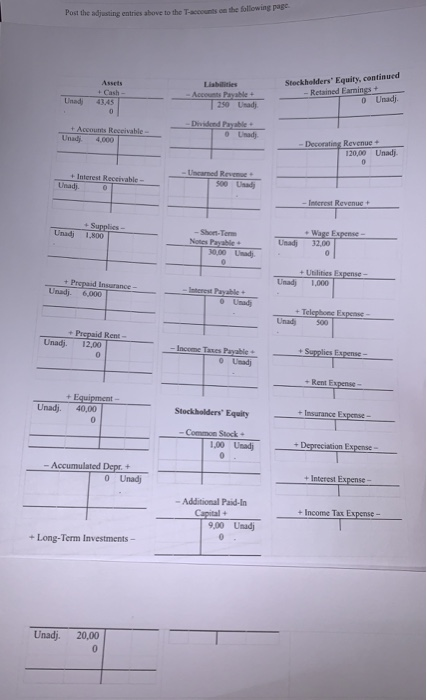

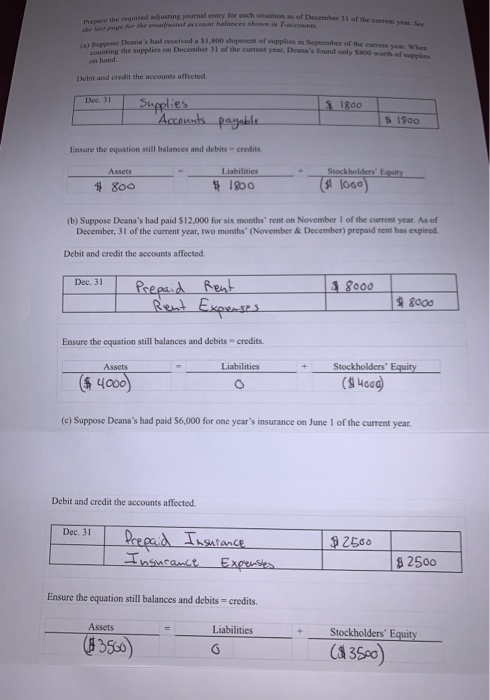

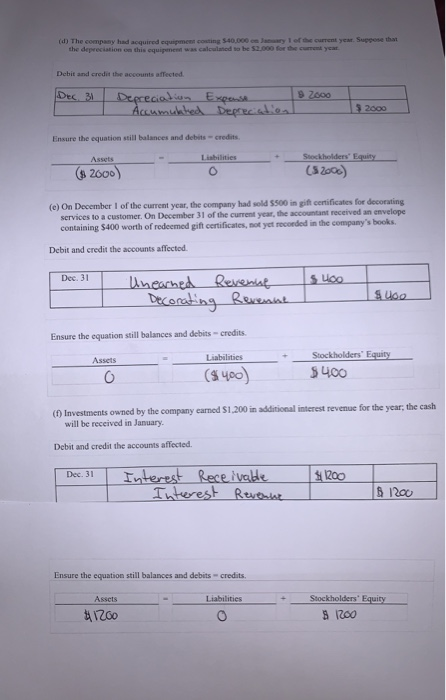

Post the adjusting entries above to the act on the following page Assets Liabilities Accounts Payable 250 rady Stockholders' Equity, continued Retained Earnings + 0 Unadj. + Accounts Receivable Unaj 4.000 Lady Decorating Revenue 120,00 Unadi - dvere Interest Receivable- Unadi Supplies Unadj 1.500 -Short-Term Unad - Wage Expense 32.00 10.00 + Utilities Expense- Unadj 1.000 + Prepaid Insurance - Unad 6.000 - Telephone Expo Unad 500 + Prepaid Rent- Unadj 12.00 -Income Taxes Payable + Equipment Unadj. 40,00 Stockholders' Equity -Common Stock 1,00 Uradi - Accumulated Depr. + o Unadj - Additional Paid-In Capital + 9,00 Unadi + Income Tax Expense - +Long-Term Investments - Unadj. 20,00 journal for each of December hecned a 51,800 spect of li bero in the supplies on December of the eye. Dema's found the Debet ad credit the accounts affected Dec. 31 IROO - Accounts payable 1900 Ensure the equation still balances and debits -credits Liabilities $1800 Stockholders (st 1000) $ 800 (b) Suppose Deana's had paid $12,000 for six months' rent on November of the current year. As of December, 31 of the current year, two months' (November & December) prepaid rent has expired Debit and credit the accounts affected. Dec 31 1 Prepaid Rent 3 8000 I Rent Expenses 98000 Ensure the equation still balances and debits -credits. Aseelso Liabilities Liabilities ($ 4000) . Stockholders' Equity (4000) (c) Suppose Deana's had paid $6,000 for one year's insurance on June 1 of the current year. Debit and credit the accounts affected. Dec. 31 Prepaid T Insurance e Insurance Expenses $2560 $ 2500 Ensure the equation still balances and debits = credits. Assets Liabilities (83500) Stockholders' Equity (3500 (d) The company hadquired tog 540.000 to Debit and are the accounts affected Dec. 31 2000 Depreciation Accumukted Expense Depreciation Ensure the equation still balances and debts-credits Libilities Stockholders' Equity (52000) (2000) (e) On December 1 of the current year, the company had sold 5500 is gift certificates for decorating services to a customer. On December 31 of the current year, the accountant received an envelope containing 5400 worth of redeemed gift certificates, not yet recorded in the company's books Debit and credit the accounts affected. | Dec. 31 Unearned Decorating Revenue Revenue Ensure the equation still balances and debits credits Assets Liabilities Stockholders' Equity $400 (5400 (1) Investments owned by the company cared $1,200 in additional interest revenue for the year, the cash will be received in January Debit and credit the accounts affected | Dec. 31 Interest Receivable Interest Revenue $1200 S 1200 Ensure the equation still balances and debits -credits AN Liabilities Stockholders' Equity 81200 #1700 (2) The company borrowed using year, due with all interest on e 5 30.000 hemote paleh 000 on January 1 of the current payable requires 10% interest Debit and credit the accounts affected me Dec. 31 Puth Interest Expenses. W e Interest and Payable Ensure the equation till balances and debts -credits Assets $ 30,000 Liabilities $33,000 Stockholders' Equity $3000) ) The company calculated its income taxes as $26.110 for the current year ended December 31. Debit and credit the accounts affected. Income Tax Income Expense $ 26, 110 Payable Tax 18 26.116 Ensure the equation still balances and debits -credits + Liabilities 26.110 Stockholders' Equity 26,160 0 (i) On December 15 of the current year, the company declared a $750 dividend, payable January 15 of the following year Debit and credit the accounts affected. | Dec. 31 Retained Dividend Earnings pauable 9750 Assets Stockholders' Equity Liabilities $756 Post the adjusting entries above to the T-accounts on the following page. Post the adjusting entries above to the act on the following page Assets Liabilities Accounts Payable 250 rady Stockholders' Equity, continued Retained Earnings + 0 Unadj. + Accounts Receivable Unaj 4.000 Lady Decorating Revenue 120,00 Unadi - dvere Interest Receivable- Unadi Supplies Unadj 1.500 -Short-Term Unad - Wage Expense 32.00 10.00 + Utilities Expense- Unadj 1.000 + Prepaid Insurance - Unad 6.000 - Telephone Expo Unad 500 + Prepaid Rent- Unadj 12.00 -Income Taxes Payable + Equipment Unadj. 40,00 Stockholders' Equity -Common Stock 1,00 Uradi - Accumulated Depr. + o Unadj - Additional Paid-In Capital + 9,00 Unadi + Income Tax Expense - +Long-Term Investments - Unadj. 20,00 journal for each of December hecned a 51,800 spect of li bero in the supplies on December of the eye. Dema's found the Debet ad credit the accounts affected Dec. 31 IROO - Accounts payable 1900 Ensure the equation still balances and debits -credits Liabilities $1800 Stockholders (st 1000) $ 800 (b) Suppose Deana's had paid $12,000 for six months' rent on November of the current year. As of December, 31 of the current year, two months' (November & December) prepaid rent has expired Debit and credit the accounts affected. Dec 31 1 Prepaid Rent 3 8000 I Rent Expenses 98000 Ensure the equation still balances and debits -credits. Aseelso Liabilities Liabilities ($ 4000) . Stockholders' Equity (4000) (c) Suppose Deana's had paid $6,000 for one year's insurance on June 1 of the current year. Debit and credit the accounts affected. Dec. 31 Prepaid T Insurance e Insurance Expenses $2560 $ 2500 Ensure the equation still balances and debits = credits. Assets Liabilities (83500) Stockholders' Equity (3500 (d) The company hadquired tog 540.000 to Debit and are the accounts affected Dec. 31 2000 Depreciation Accumukted Expense Depreciation Ensure the equation still balances and debts-credits Libilities Stockholders' Equity (52000) (2000) (e) On December 1 of the current year, the company had sold 5500 is gift certificates for decorating services to a customer. On December 31 of the current year, the accountant received an envelope containing 5400 worth of redeemed gift certificates, not yet recorded in the company's books Debit and credit the accounts affected. | Dec. 31 Unearned Decorating Revenue Revenue Ensure the equation still balances and debits credits Assets Liabilities Stockholders' Equity $400 (5400 (1) Investments owned by the company cared $1,200 in additional interest revenue for the year, the cash will be received in January Debit and credit the accounts affected | Dec. 31 Interest Receivable Interest Revenue $1200 S 1200 Ensure the equation still balances and debits -credits AN Liabilities Stockholders' Equity 81200 #1700 (2) The company borrowed using year, due with all interest on e 5 30.000 hemote paleh 000 on January 1 of the current payable requires 10% interest Debit and credit the accounts affected me Dec. 31 Puth Interest Expenses. W e Interest and Payable Ensure the equation till balances and debts -credits Assets $ 30,000 Liabilities $33,000 Stockholders' Equity $3000) ) The company calculated its income taxes as $26.110 for the current year ended December 31. Debit and credit the accounts affected. Income Tax Income Expense $ 26, 110 Payable Tax 18 26.116 Ensure the equation still balances and debits -credits + Liabilities 26.110 Stockholders' Equity 26,160 0 (i) On December 15 of the current year, the company declared a $750 dividend, payable January 15 of the following year Debit and credit the accounts affected. | Dec. 31 Retained Dividend Earnings pauable 9750 Assets Stockholders' Equity Liabilities $756 Post the adjusting entries above to the T-accounts on the following page