Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Post the journal entries into ledger accounts 1. Bought office equipment from Peckoff Equipment Co. on 30-day credit terms, $1,390. Purchase Invoice #2071. Ledger Entries:

Post the journal entries into ledger accounts

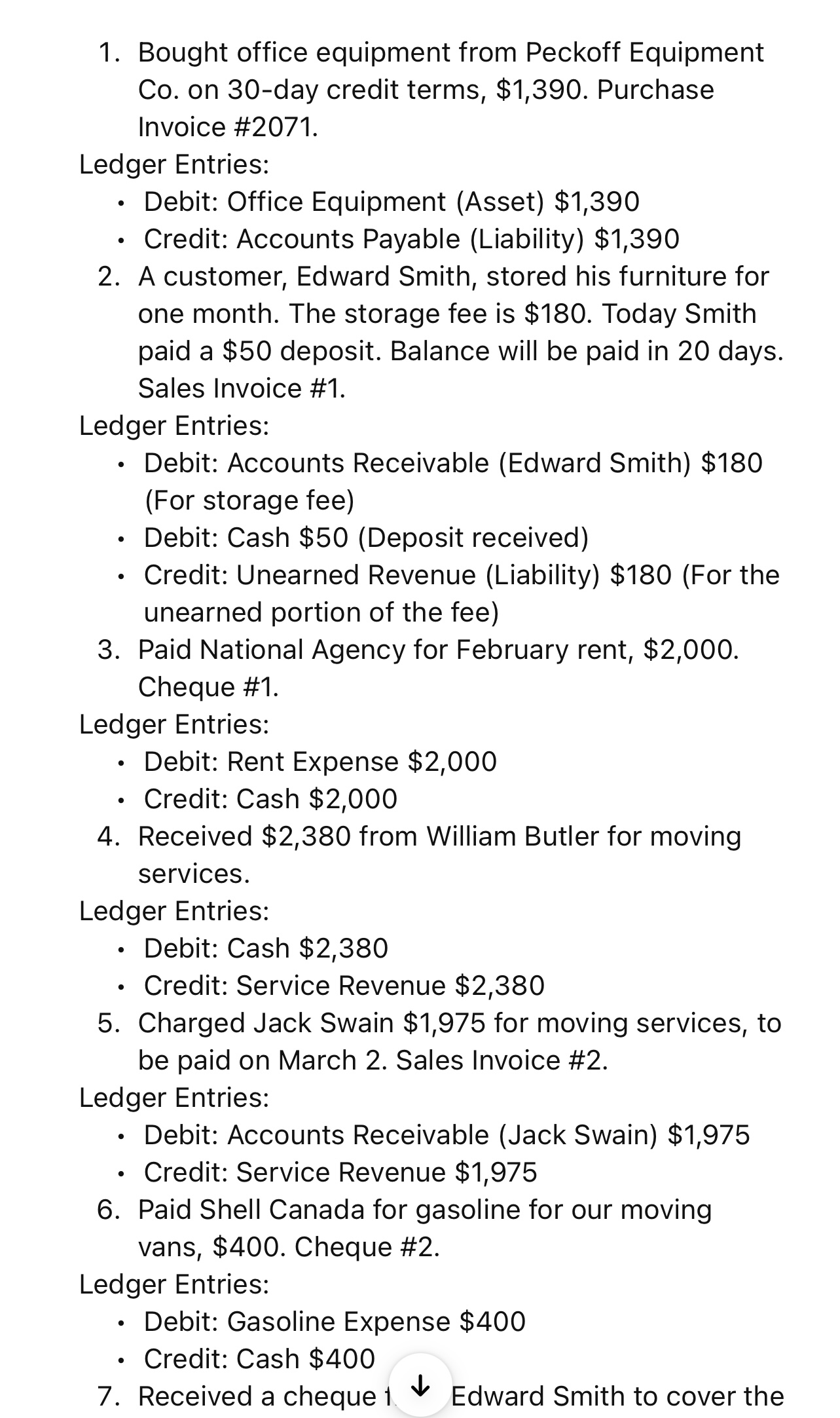

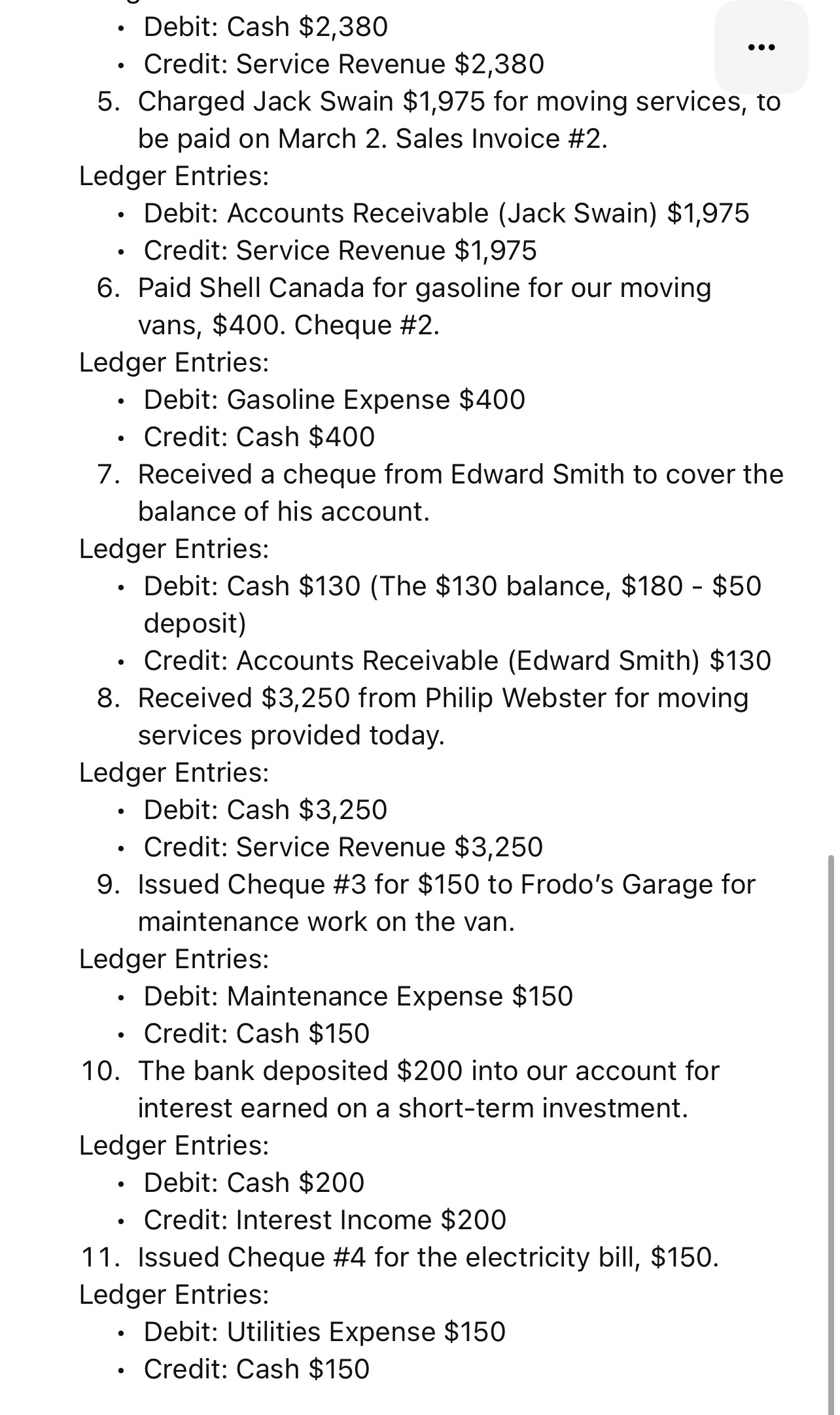

1. Bought office equipment from Peckoff Equipment Co. on 30-day credit terms, $1,390. Purchase Invoice #2071. Ledger Entries: . Debit: Office Equipment (Asset) $1,390 Credit: Accounts Payable (Liability) $1,390 2. A customer, Edward Smith, stored his furniture for one month. The storage fee is $180. Today Smith paid a $50 deposit. Balance will be paid in 20 days. Sales Invoice #1. Ledger Entries: Debit: Accounts Receivable (Edward Smith) $180 (For storage fee) Debit: Cash $50 (Deposit received) Credit: Unearned Revenue (Liability) $180 (For the unearned portion of the fee) 3. Paid National Agency for February rent, $2,000. Cheque #1. Ledger Entries: Debit: Rent Expense $2,000 Credit: Cash $2,000 4. Received $2,380 from William Butler for moving services. Ledger Entries: Debit: Cash $2,380 Credit: Service Revenue $2,380 5. Charged Jack Swain $1,975 for moving services, to be paid on March 2. Sales Invoice #2. Ledger Entries: Debit: Accounts Receivable (Jack Swain) $1,975 Credit: Service Revenue $1,975 6. Paid Shell Canada for gasoline for our moving. vans, $400. Cheque #2. Ledger Entries: Debit: Gasoline Expense $400 Credit: Cash $400 7. Received a cheque 1. Edward Smith to cover the

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided transactions here are the correct ledger entries for each transaction 5 Charge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started