Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Post the work too DekCo expects to earn operating profit of $12,500,000 and net income of $9,401,000 next year. Depreciation will total $715,000 and the

Post the work too

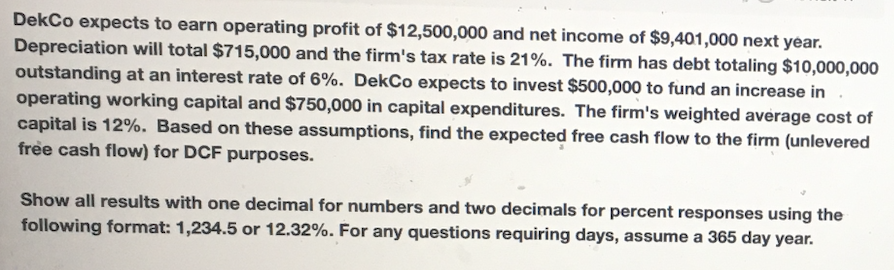

DekCo expects to earn operating profit of $12,500,000 and net income of $9,401,000 next year. Depreciation will total $715,000 and the firm's tax rate is 21%. The firm has debt totaling $10,000,000 outstanding at an interest rate of 6%. DekCo expects to invest $500,000 to fund an increase in operating working capital and $750,000 in capital expenditures. The firm's weighted average cost of capital is 12%. Based on these assumptions, find the expected free cash flow to the firm (unlevered free cash flow) for DCF purposes. Show all results with one decimal for numbers and two decimals for percent responses using the following format: 1,234.5 or 12.32%. For any questions requiring days, assume a 365 day year

DekCo expects to earn operating profit of $12,500,000 and net income of $9,401,000 next year. Depreciation will total $715,000 and the firm's tax rate is 21%. The firm has debt totaling $10,000,000 outstanding at an interest rate of 6%. DekCo expects to invest $500,000 to fund an increase in operating working capital and $750,000 in capital expenditures. The firm's weighted average cost of capital is 12%. Based on these assumptions, find the expected free cash flow to the firm (unlevered free cash flow) for DCF purposes. Show all results with one decimal for numbers and two decimals for percent responses using the following format: 1,234.5 or 12.32%. For any questions requiring days, assume a 365 day year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started