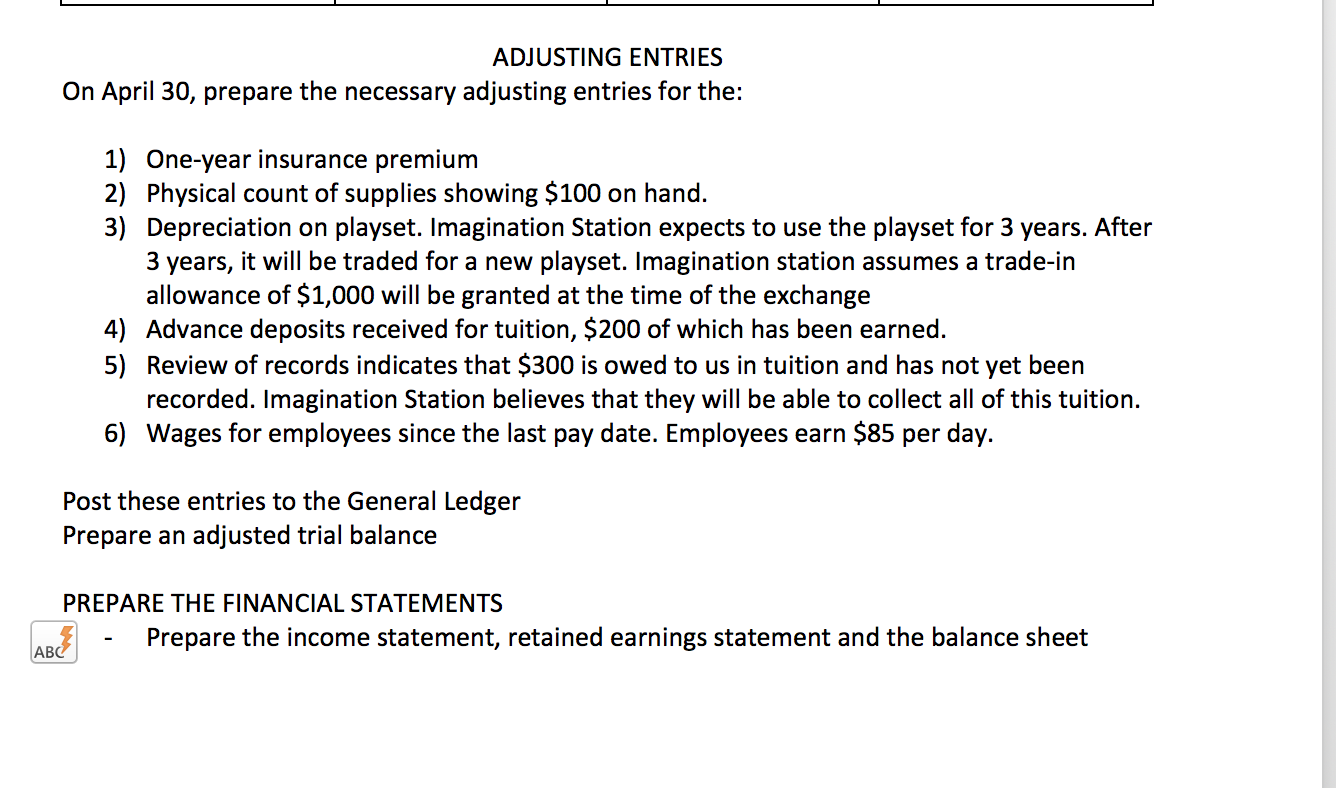

Post these entries to the General Ledger

Prepare an adjusted trial balance

PREPARE THE FINANCIAL STATEMENTS

- Prepare the income statement, retained earnings statement and the balance sheet

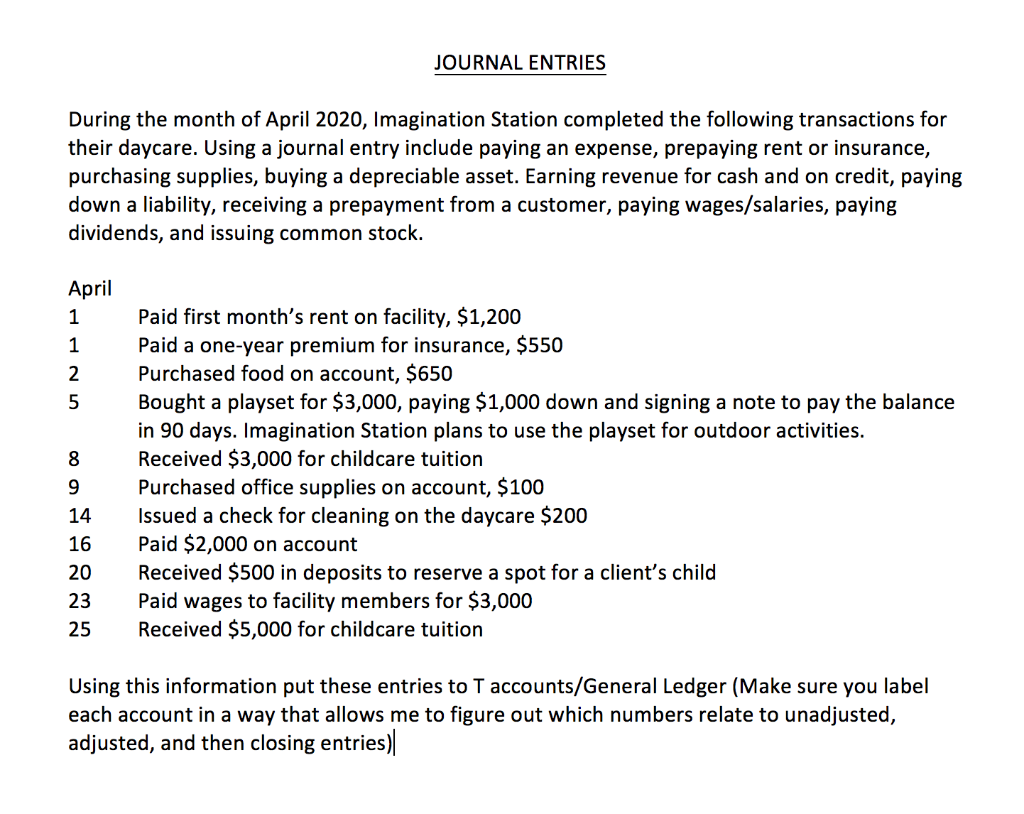

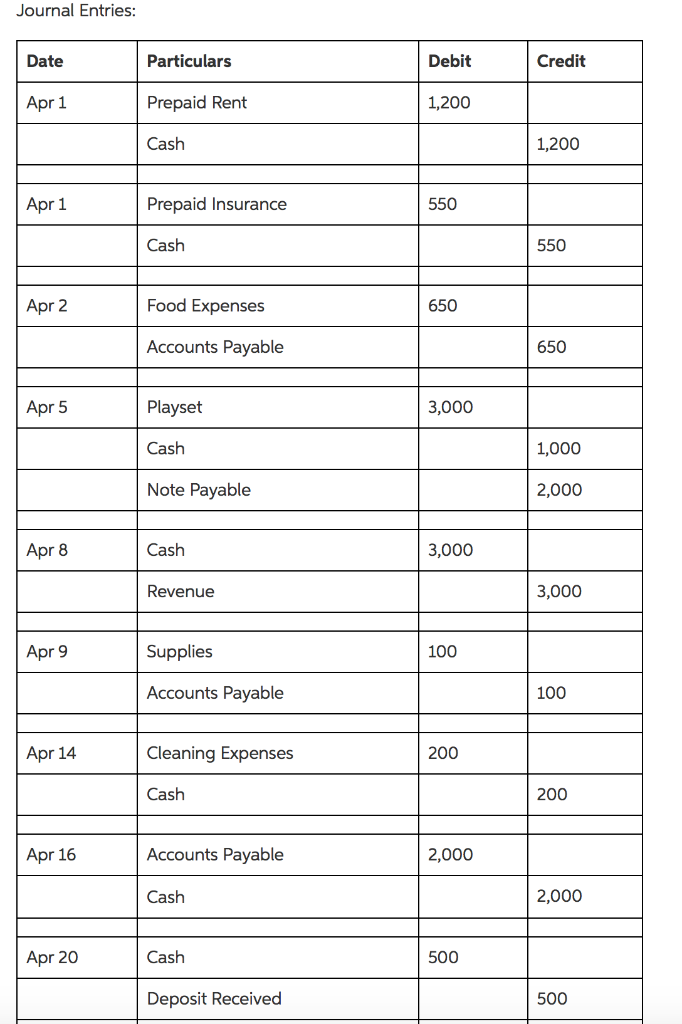

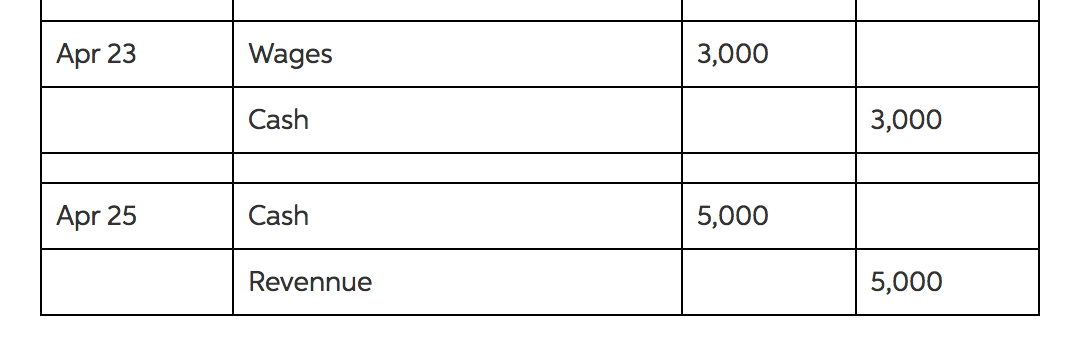

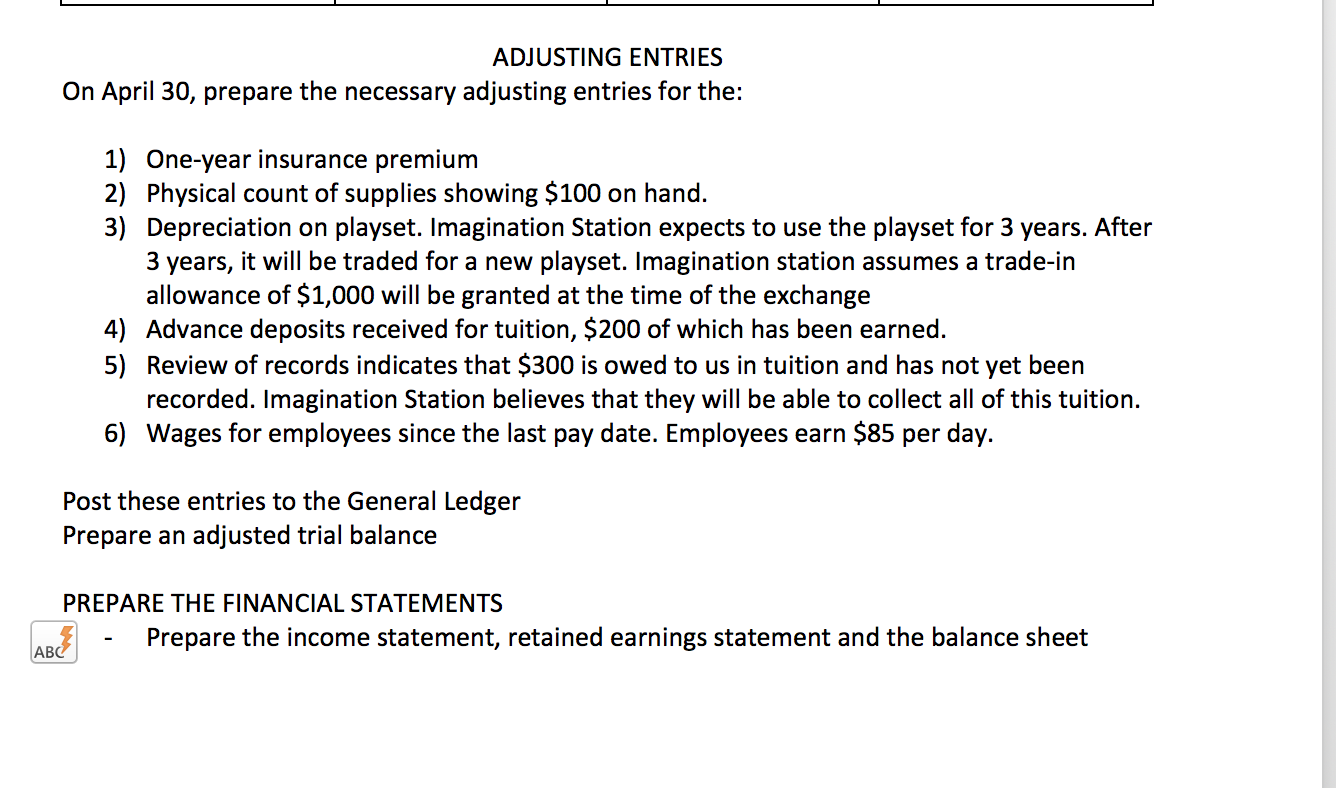

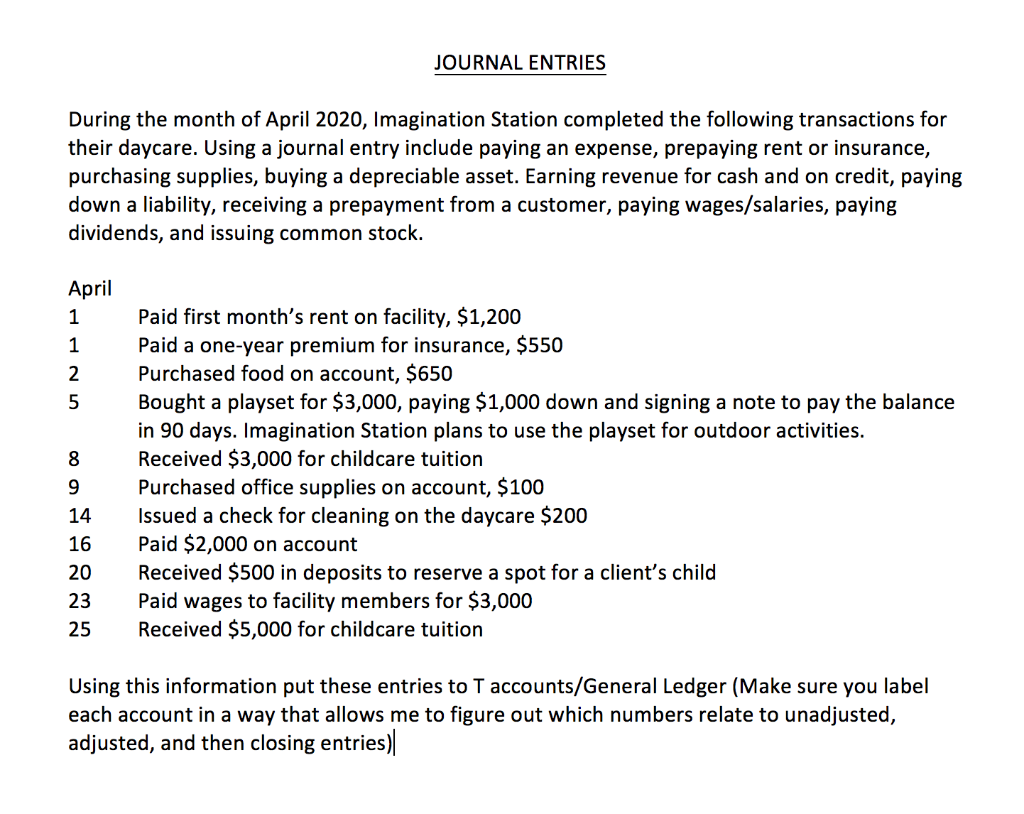

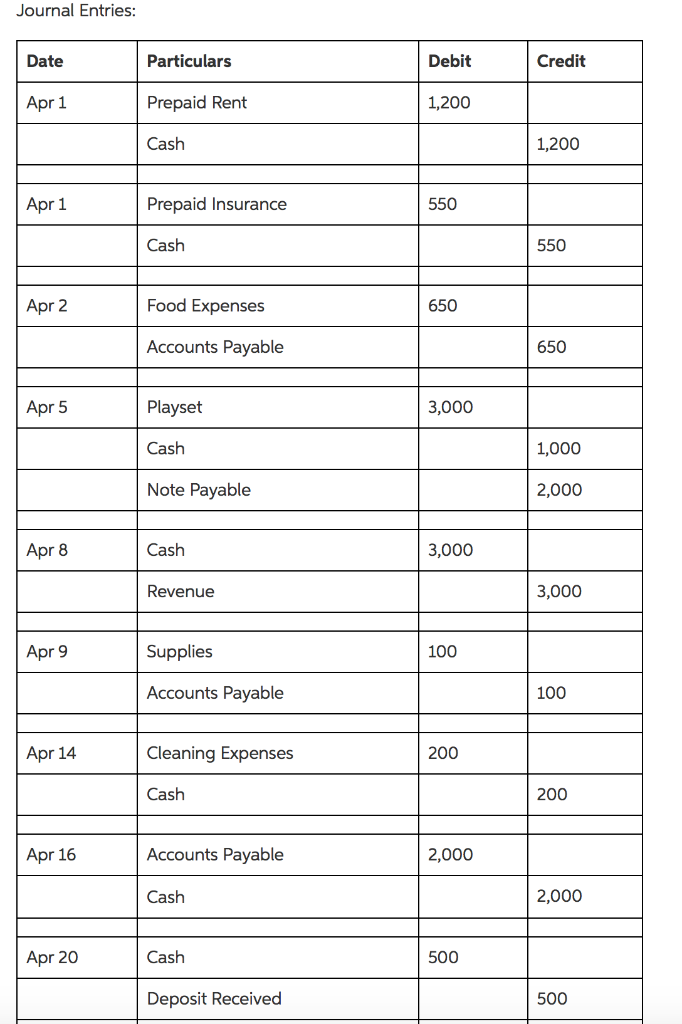

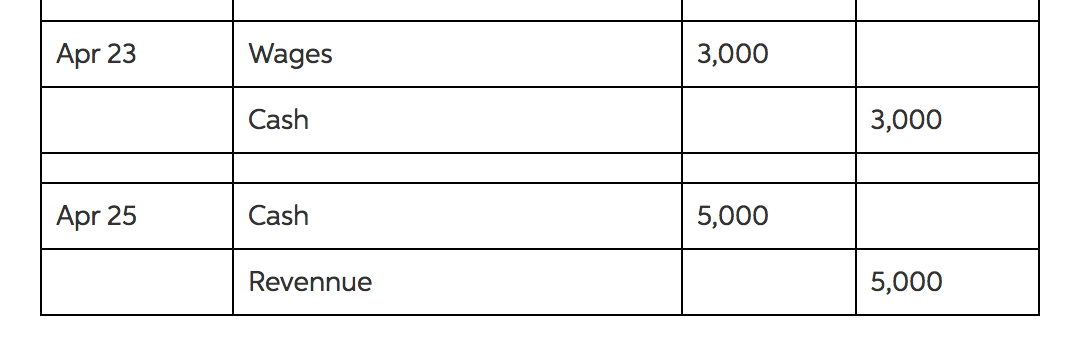

JOURNAL ENTRIES During the month of April 2020, Imagination Station completed the following transactions for their daycare. Using a journal entry include paying an expense, prepaying rent or insurance, purchasing supplies, buying a depreciable asset. Earning revenue for cash and on credit, paying down a liability, receiving a prepayment from a customer, paying wages/salaries, paying dividends, and issuing common stock. April 1 1 2 5 8 9 14 16 20 23 25 Paid first month's rent on facility, $1,200 Paid a one-year premium for insurance, $550 Purchased food on account, $650 Bought a playset for $3,000, paying $1,000 down and signing a note to pay the balance in 90 days. Imagination Station plans to use the playset for outdoor activities. Received $3,000 for childcare tuition Purchased office supplies on account, $100 Issued a check for cleaning on the daycare $200 Paid $2,000 on account Received $500 in deposits to reserve a spot for a client's child Paid wages to facility members for $3,000 Received $5,000 for childcare tuition Using this information put these entries to T accounts/General Ledger (Make sure you label each account in a way that allows me to figure out which numbers relate to unadjusted, adjusted, and then closing entries)| Journal Entries: Date Particulars Debit Credit Apr 1 Prepaid Rent 1,200 Cash 1,200 Apr 1 Prepaid Insurance 550 Cash 550 Apr 2 Food Expenses 650 Accounts Payable 650 Apr 5 Playset 3,000 Cash 1,000 Note Payable 2,000 Apr 8 Cash 3,000 Revenue 3,000 Apr 9 Supplies 100 Accounts Payable 100 Apr 14 Cleaning Expenses 200 Cash 200 Apr 16 Accounts Payable 2,000 Cash 2,000 Apr 20 Cash 500 Deposit Received 500 Apr 23 Wages 3,000 Cash 3,000 Apr 25 Cash 5,000 Revennue 5,000 ADJUSTING ENTRIES On April 30, prepare the necessary adjusting entries for the: 1) One-year insurance premium 2) Physical count of supplies showing $100 on hand. 3) Depreciation on playset. Imagination Station expects to use the playset for 3 years. After 3 years, it will be traded for a new playset. Imagination station assumes a trade-in allowance of $1,000 will be granted at the time of the exchange 4) Advance deposits received for tuition, $200 of which has been earned. 5) Review of records indicates that $300 is owed to us in tuition and has not yet been recorded. Imagination Station believes that they will be able to collect all of this tuition. 6) Wages for employees since the last pay date. Employees earn $85 per day. Post these entries to the General Ledger Prepare an adjusted trial balance PREPARE THE FINANCIAL STATEMENTS Prepare the income statement, retained earnings statement and the balance sheet ABC JOURNAL ENTRIES During the month of April 2020, Imagination Station completed the following transactions for their daycare. Using a journal entry include paying an expense, prepaying rent or insurance, purchasing supplies, buying a depreciable asset. Earning revenue for cash and on credit, paying down a liability, receiving a prepayment from a customer, paying wages/salaries, paying dividends, and issuing common stock. April 1 1 2 5 8 9 14 16 20 23 25 Paid first month's rent on facility, $1,200 Paid a one-year premium for insurance, $550 Purchased food on account, $650 Bought a playset for $3,000, paying $1,000 down and signing a note to pay the balance in 90 days. Imagination Station plans to use the playset for outdoor activities. Received $3,000 for childcare tuition Purchased office supplies on account, $100 Issued a check for cleaning on the daycare $200 Paid $2,000 on account Received $500 in deposits to reserve a spot for a client's child Paid wages to facility members for $3,000 Received $5,000 for childcare tuition Using this information put these entries to T accounts/General Ledger (Make sure you label each account in a way that allows me to figure out which numbers relate to unadjusted, adjusted, and then closing entries)| Journal Entries: Date Particulars Debit Credit Apr 1 Prepaid Rent 1,200 Cash 1,200 Apr 1 Prepaid Insurance 550 Cash 550 Apr 2 Food Expenses 650 Accounts Payable 650 Apr 5 Playset 3,000 Cash 1,000 Note Payable 2,000 Apr 8 Cash 3,000 Revenue 3,000 Apr 9 Supplies 100 Accounts Payable 100 Apr 14 Cleaning Expenses 200 Cash 200 Apr 16 Accounts Payable 2,000 Cash 2,000 Apr 20 Cash 500 Deposit Received 500 Apr 23 Wages 3,000 Cash 3,000 Apr 25 Cash 5,000 Revennue 5,000 ADJUSTING ENTRIES On April 30, prepare the necessary adjusting entries for the: 1) One-year insurance premium 2) Physical count of supplies showing $100 on hand. 3) Depreciation on playset. Imagination Station expects to use the playset for 3 years. After 3 years, it will be traded for a new playset. Imagination station assumes a trade-in allowance of $1,000 will be granted at the time of the exchange 4) Advance deposits received for tuition, $200 of which has been earned. 5) Review of records indicates that $300 is owed to us in tuition and has not yet been recorded. Imagination Station believes that they will be able to collect all of this tuition. 6) Wages for employees since the last pay date. Employees earn $85 per day. Post these entries to the General Ledger Prepare an adjusted trial balance PREPARE THE FINANCIAL STATEMENTS Prepare the income statement, retained earnings statement and the balance sheet ABC