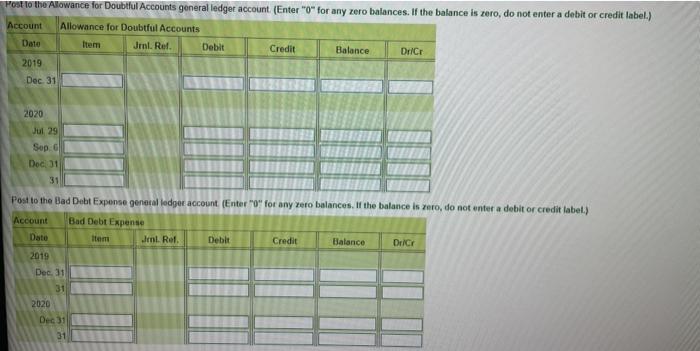

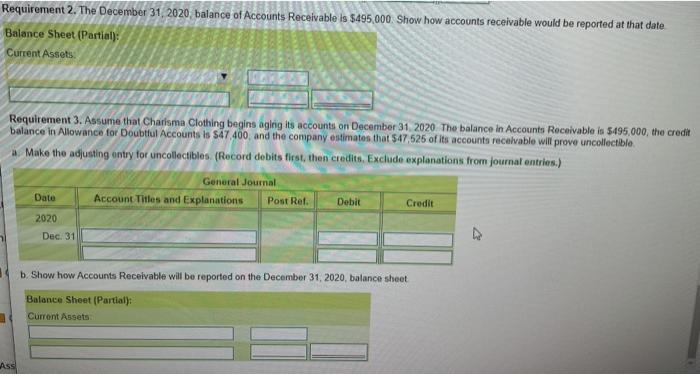

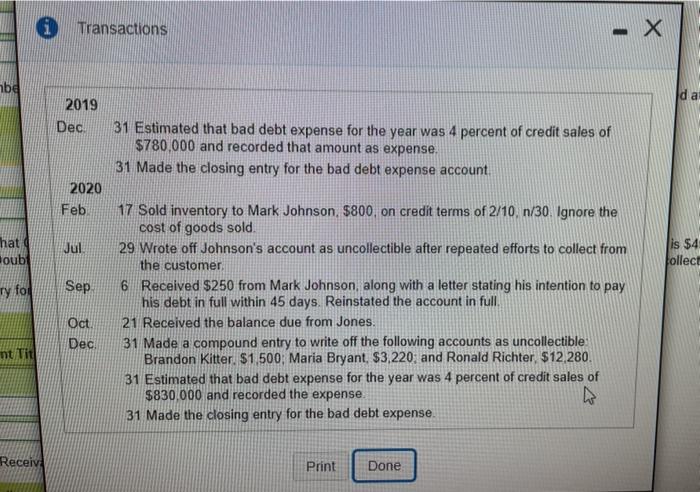

Post to the Allowance for Doubtful Accounts general ledger account (Enter "0" for any zero balances. If the balance is zero, do not enter a debitor credit label.) Account Allowance for Doubtful Accounts Date Item Jenl. Rel. Debit Credit Balance DrICE 2019 Dec 31 2020 Jul 29 Sop G Dec 31 Post to the Bad Debt Expense general ledge account (Enter" for any rero balances. If the balance is zero, do not enter a debitor credit label.) Account Bad Debt Expense Date Item Jml Rel. Debit Credit Balance Del 2019 Dec. 31 31 2020 Dec 31 31 Requirement 2. The December 31, 2020 balance of Accounts Receivable is $495.000. Show how accounts receivable would be reported at that date Balance Sheet (Partial): Current Assets Requirement 3. Assume that Charisma Clothing begins aging its accounts on December 31 2020 The balance in Accounts Receivable in 5495,000, the credit balance in Allowance for Doubtful Accounts is $47.400, and the company estimates that 547,525 of its accounts receivable will prove uncollectible a. Make the adjusting entry for uncollectibles (Record debits first, then credits. Exclude explanations from journal entries.) General Journal Account Titles and Explanations Post Rel. Date Debit Credit 2020 Dec 31 b. Show how Accounts Receivable will be reported on the December 31, 2020, balance sheet Balance Sheet (Partial): Current Assets Ass 1 Transactions be da 2019 Dec 31 Estimated that bad debt expense for the year was 4 percent of credit sales of $780,000 and recorded that amount as expense. 31 Made the closing entry for the bad debt expense account 2020 Feb That Jul is $4 follect oubt Ty for Sep 17 Sold inventory to Mark Johnson, $800, on credit terms of 2/10 n/30. Ignore the cost of goods sold 29 Wrote off Johnson's account as uncollectible after repeated efforts to collect from the customer 6 Received $250 from Mark Johnson, along with a letter stating his intention to pay his debt in full within 45 days. Reinstated the account in full 21 Received the balance due from Jones, 31 Made a compound entry to write off the following accounts as uncollectible Brandon Kitter. $1,500Maria Bryant, $3,220, and Ronald Richter $12,280 31 Estimated that bad debt expense for the year was 4 percent of credit sales of $830,000 and recorded the expense. 31 Made the closing entry for the bad debt expense. Oct. Dec nt Tit Receive Print Done