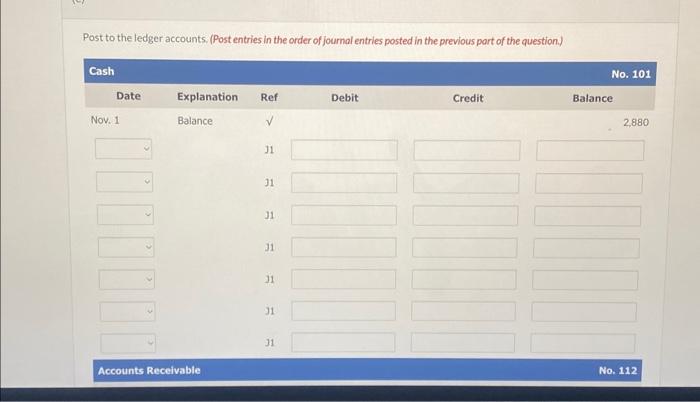

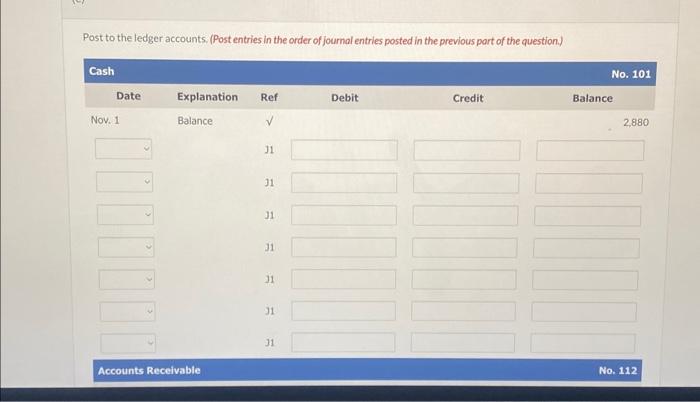

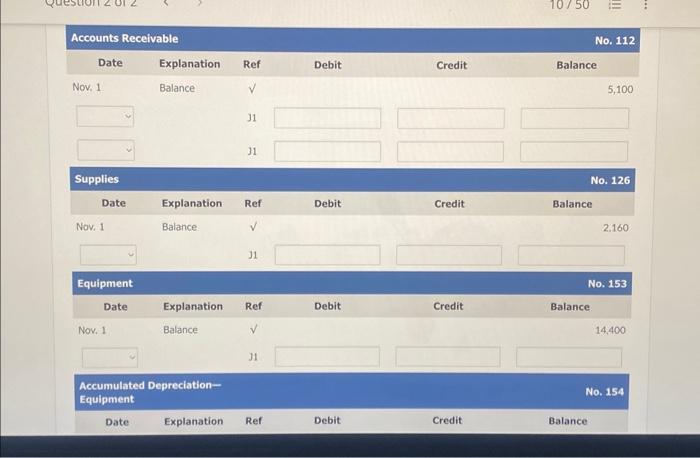

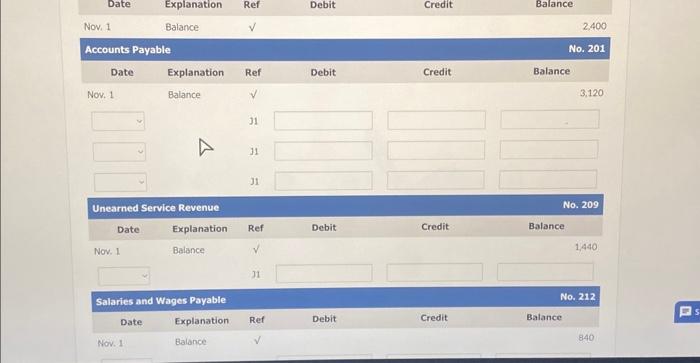

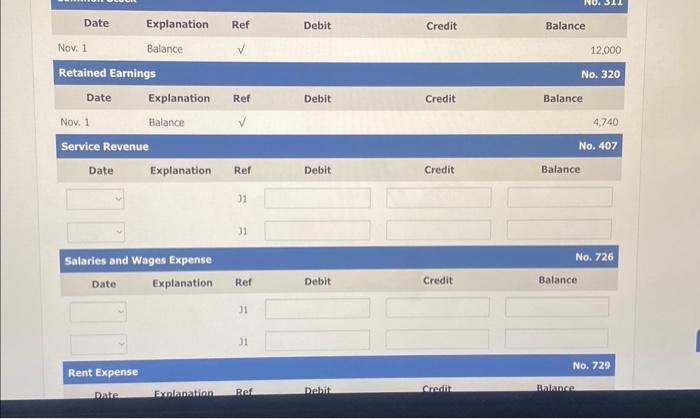

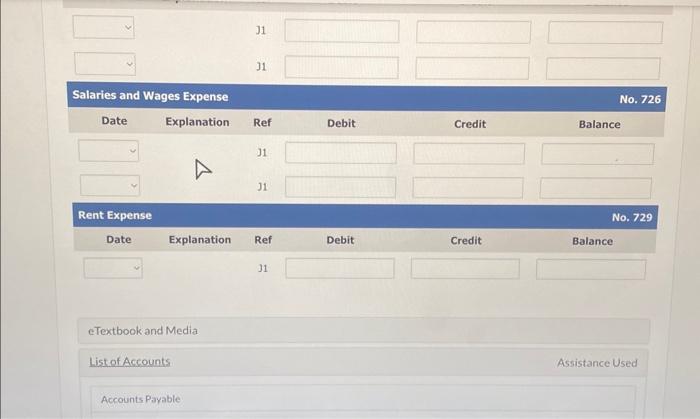

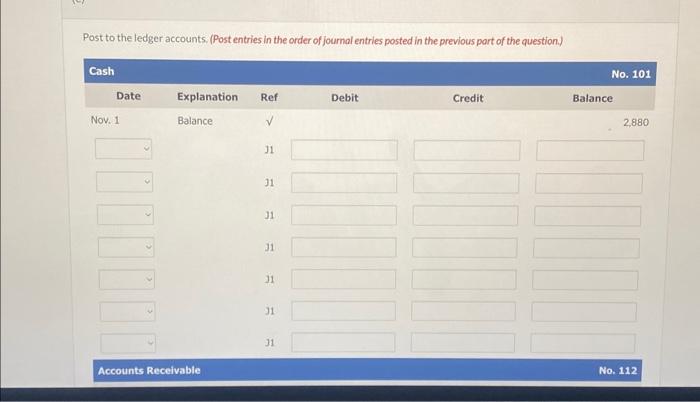

Post to the ledgar accounts (Post entries in the order of journal entries posted in the previous part of the question) Use chart below

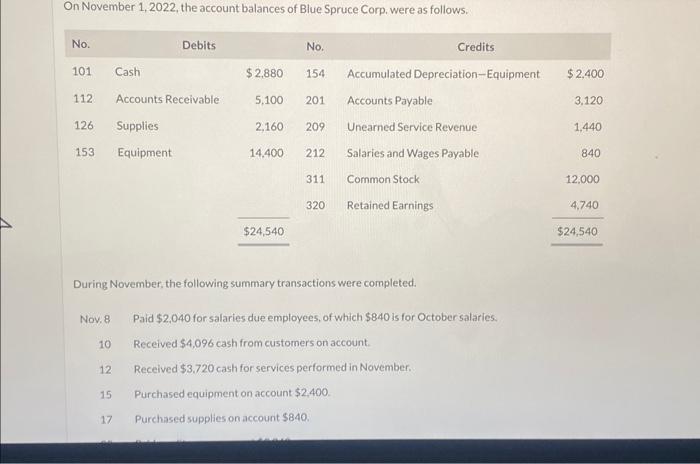

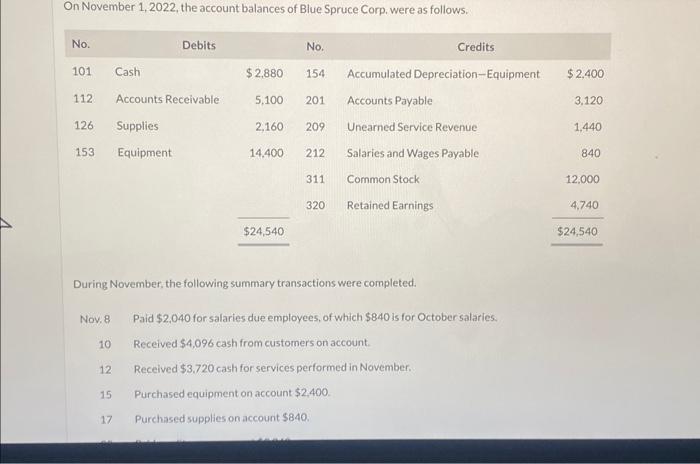

Information:

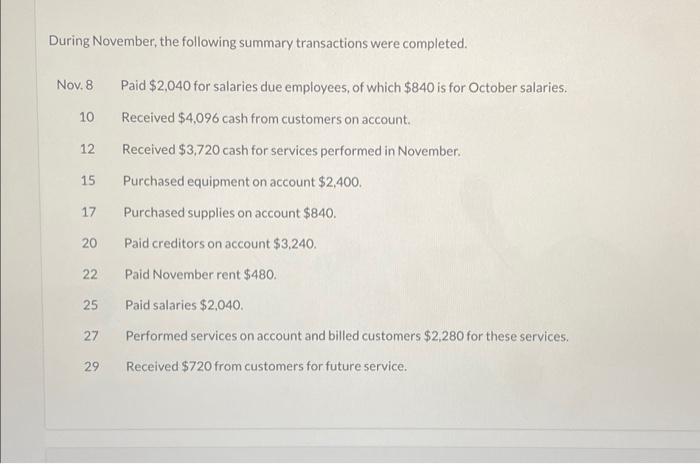

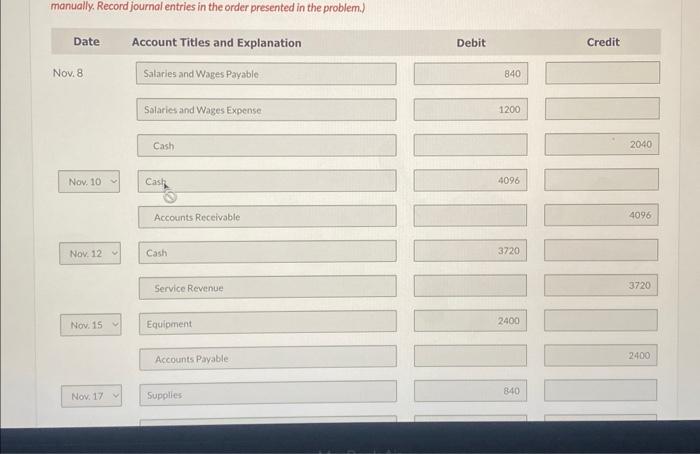

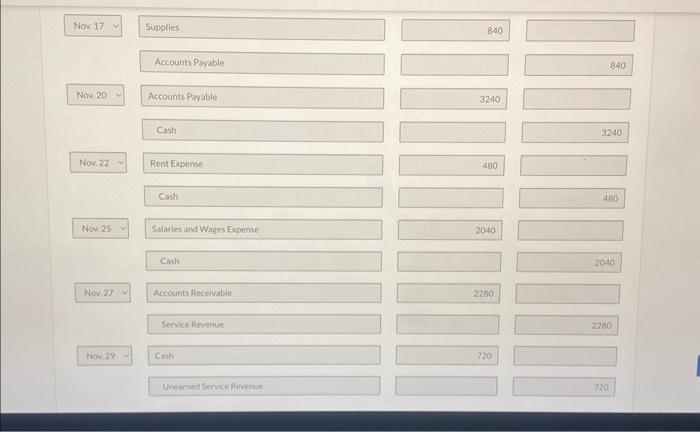

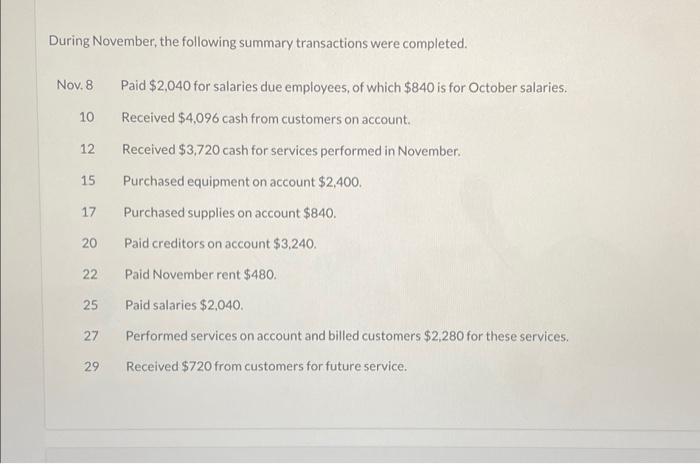

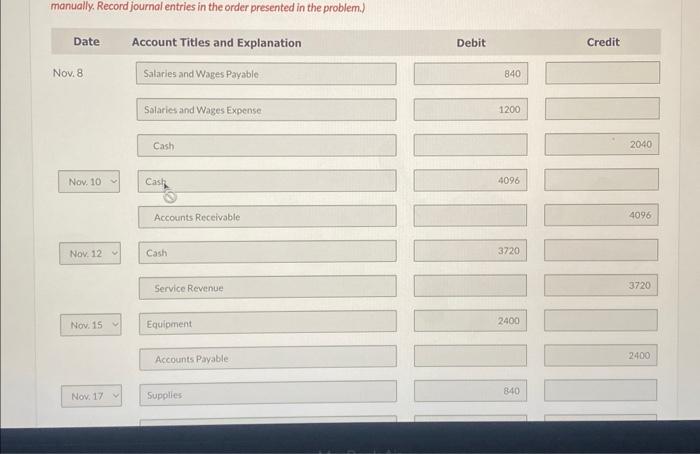

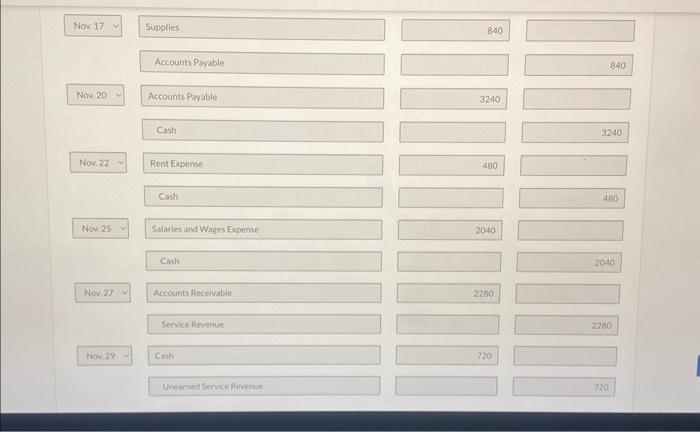

During November, the following summary transactions were completed. Nov. 8 Paid $2,040 for salaries due employees, of which $840 is for October salaries. 10 Received $4,096 cash from customers on account. 12 Received $3,720 cash for services performed in November. 15 Purchased equipment on account $2,400. 17 Purchased supplies on account $840. 20 Paid creditors on account $3,240. 22 Paid November rent $480. 25 Paid salaries $2,040. 27 Performed services on account and billed customers $2,280 for these services. 29 Received $720 from customers for future service. Now, 17 Supglies 840 Accounts Payable 840 Nov 20 Accounts Payable 3240 Cash 3240 Nov.22 Rent Expensie 480 Cash 480 Novi.25 Salaries and Wages Expense 2040 Cash 2040 Now 27 Accounts Receivable 2280 Service Reveriue 2200 Now. 24 cosh 720 Uonamed Secrice Revenue 720 \begin{tabular}{|c|c|c|c|c|c|} \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline Nov. 1 & Balance & & & & 12,000 \\ \hline \multicolumn{5}{|c|}{ Retained Earnings } & No. 320 \\ \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline Nov. 1 & Balance & & & & 4,740 \\ \hline \multicolumn{5}{|c|}{ Service Revenue } & No. 407 \\ \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline 4 & & 3 & & & \\ \hliney & & 31 & & & \\ \hline \multicolumn{5}{|c|}{ Salaries and Wages Expense } & No. 726 \\ \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline & & 31 & & & \\ \hline & & 31 & & & \\ \hline Rent Expense & & & & & No. 729 \\ \hline Date. & Exnlanation & Ref: & Dehit & Credit & Ralance \\ \hline \end{tabular} Accounts Receivable No. 112 \begin{tabular}{|c|c|c|c|c|c|} \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline Nov, 1 & Balance & & & & 5,100 \\ \hline i & & 31 & & & \\ \hline & & 31 & & & \\ \hline Supplies & & & & & No. 126 \\ \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline Nov. 1 & Balance: & & & & 2.160 \\ \hline & & 31 & & & \\ \hline Equipment & & & & & No. 153 \\ \hline Date & Explanation & Ref & Debit & Credit & Balance. \\ \hline Nov. 1 & Balance & & & & 14,400 \\ \hline 6 & & H & & & \\ \hline \begin{tabular}{l} Accumulate \\ Equipment \end{tabular} & preciation- & & & & No. 154 \\ \hline Date & Explanation & Ref & Debit & Credit & Balance \\ \hline \end{tabular} Post to the ledger accounts. (Post entries in the order of journal entries posted in the previous port of the question.) On November 1, 2022, the account balances of Blue Spruce Corp. were as follows. During November, the following summary transactions were completed. Nov. 8 Paid $2,040 for salaries due employees, of which $840 is for October salaries. 10 Recetved $4,096 cash from customers on account 12 Recelved $3.720 cash for services performed in November. 15 Purchased equipment on account $2,400. 17 Purchised supplies on account $840. manually. Record journal entries in the order presented in the problem.)