Answered step by step

Verified Expert Solution

Question

1 Approved Answer

posted the how to do to help you Ine amount to whion $500 will grow under each of these conditions: a. 8% compounded annually for

posted the how to do to help you

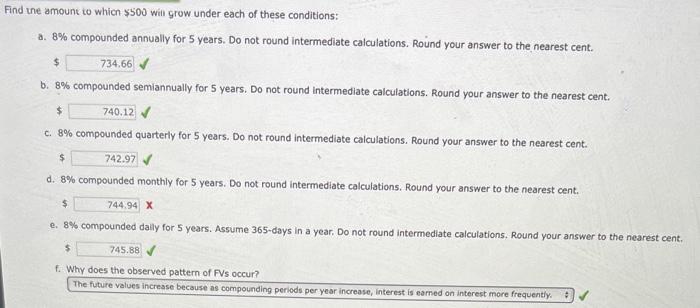

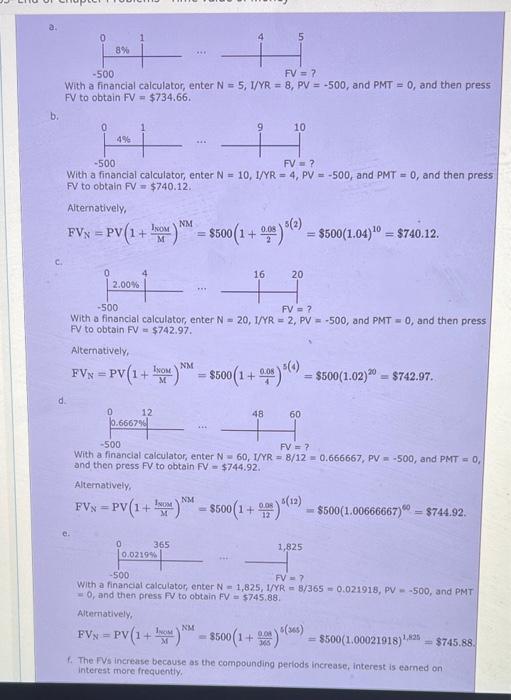

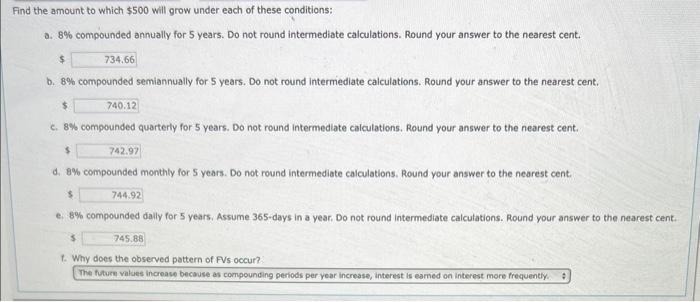

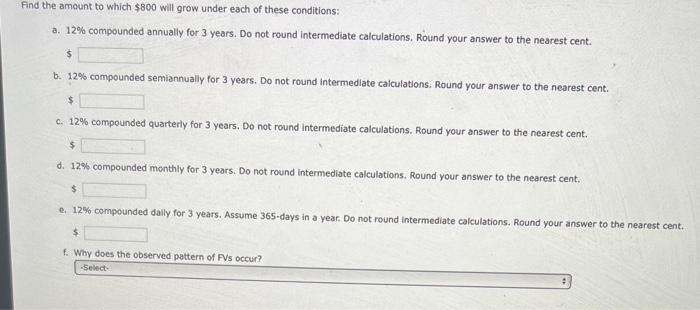

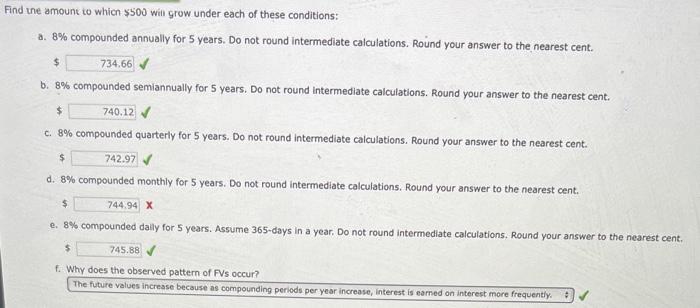

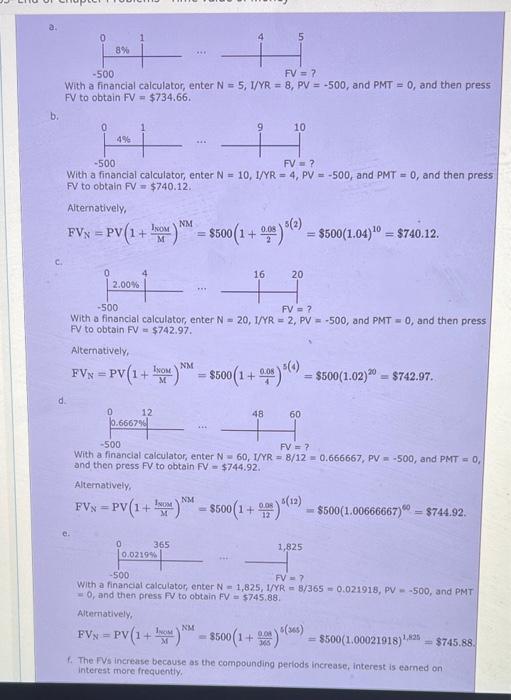

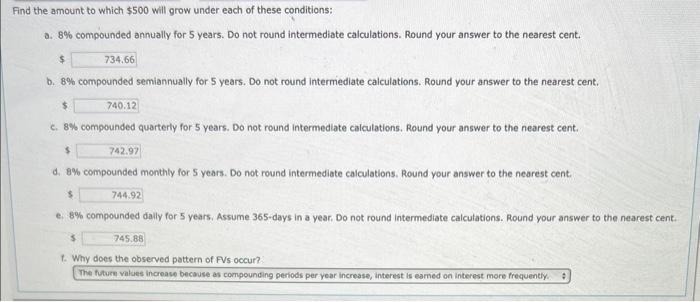

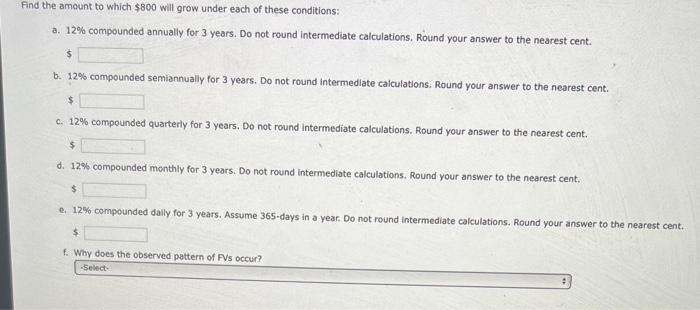

Ine amount to whion $500 will grow under each of these conditions: a. 8% compounded annually for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. b. 8% compounded semiannually for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. c. 8% compounded quarterly for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. d. 8% compounded monthly for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. x e. 8% compounded dally for 5 years. Assume 365-days in a year. Do not round intermediate calculations. Round your answer to the nearest ce f. Why does the observed pattern of FVs occur? The future values increase because as compounding With a financial calculator, enter N=5,I/YR=8,PV=500, and PMT=0, and then press FV to obtain FV=$734,66. With a financial calculator, enter N=10,1/YR=4,PV=500, and PMT=0, and then press FV to obtain FV =$740.12. Alternatively, With a financial calculator, enter N=20,I/YR=2,PV=500, and PMT=0, and then press FV to obtain FV=$742.97. Aiternatively, FVNN=PV(1+MKNoM)NM=$500(1+40.08)5(4)=$500(1.02)20=$742.97 With a financial calculator, enter N=60,1/YR=8/12=0.666667,PV=500, and PMT=0, and then press FV to obtein FV=$744.92. Alternatively, FVN=PV(1+MINmM)NM=$500(1+120.08)6(12)=$500(1.00666667)60=$744.92 e. With a financial calculator, enter N=1,825,1/YR=8/365=0.021918,PV=500, and PMT =0, and then press FV to obtain FV=$745.88 Altematively, f. The FVs increatse becouse as the compounding perlods inerease, interest is eamed on interest more frequently. Find the amount to which $500 will grow under each of these conditions: a. 8% compounded annually for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. b. 8% compounded semiannually for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. c. 8\% compounded quarterly for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. d. 8\% compounded monthly for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. e. 8% compounded dally for 5 years. Assume 365 -days in a year. Do not round intermediate calculations. Round your answer to the nearest cent. 1. Why does the observed pattern of FVs occur? The futurn values increaso because as compounding periods per year increase, interest is eamed on interest more frequently. the amount to which $800 will grow under each of these conditions: a. 12% compounded annually for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ b. 12% compounded semiannually for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. c. 12% compounded quarterly for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ d. 12% compounded monthly for 3 years. Do not round intermediate calculations. Round your answer to the nearest cent. $ e. 12% compounded dally for 3 years. Assume 365 -days in a year. Do not round intermediate calculations. Round your answer to the nearest cent. $ f. Whu dinne the aber-is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started