Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Posted this question multiple times and have yet to receive a response would really appreciate the help the question is not incomplete this is all

Posted this question multiple times and have yet to receive a response would really appreciate the help

the question is not incomplete this is all of the information which has been given

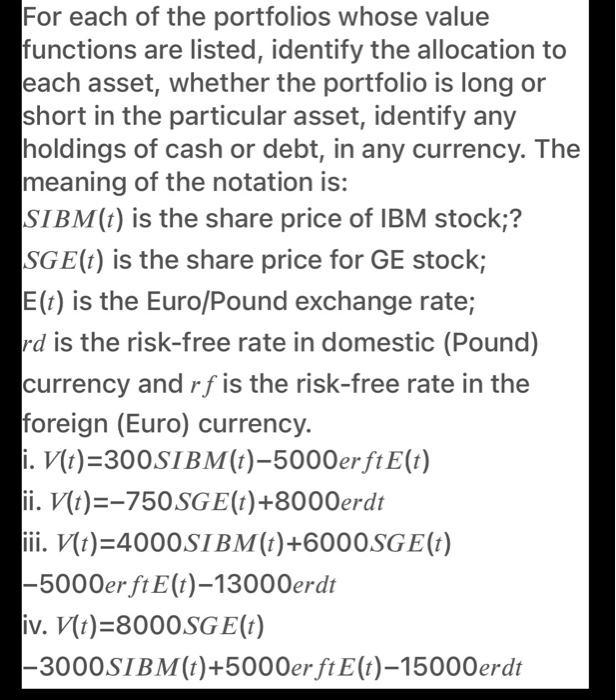

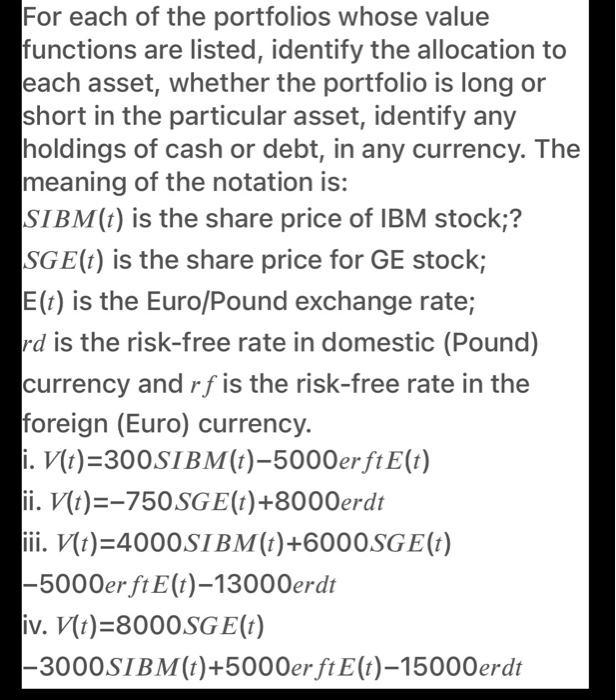

For each of the portfolios whose value functions are listed, identify the allocation to each asset, whether the portfolio is long or short in the particular asset, identify any holdings of cash or debt, in any currency. The meaning of the notation is: SIBM(t) is the share price of IBM stock;? SE(t) is the share price for GE stock; E(t) is the Euro/Pound exchange rate; rd is the risk-free rate in domestic (Pound) currency and rf is the risk-free rate in the foreign (Euro) currency. i. V(t)=300SIBM(t)-5000erftE(t) ii. V(t)=-750SGE(t)+8000erdt iii. V(t)=4000SIBM(t)+6000SGE(t) -5000er ft E(t)-13000erdt iv. V(t)=8000SGE(t) -3000SIBM(t)+5000er ft E(t)-15000erdt For each of the portfolios whose value functions are listed, identify the allocation to each asset, whether the portfolio is long or short in the particular asset, identify any holdings of cash or debt, in any currency. The meaning of the notation is: SIBM(t) is the share price of IBM stock;? SE(t) is the share price for GE stock; E(t) is the Euro/Pound exchange rate; rd is the risk-free rate in domestic (Pound) currency and rf is the risk-free rate in the foreign (Euro) currency. i. V(t)=300SIBM(t)-5000erftE(t) ii. V(t)=-750SGE(t)+8000erdt iii. V(t)=4000SIBM(t)+6000SGE(t) -5000er ft E(t)-13000erdt iv. V(t)=8000SGE(t) -3000SIBM(t)+5000er ft E(t)-15000erdt Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started