Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Posting prior years financial stmts for beg bal posting. some extra notes explaining where you got things would be helpful! Thank you. any help is

Posting prior years financial stmts for beg bal posting. some extra notes explaining where you got things would be helpful! Thank you.

Posting prior years financial stmts for beg bal posting. some extra notes explaining where you got things would be helpful! Thank you.

any help is appreciated!

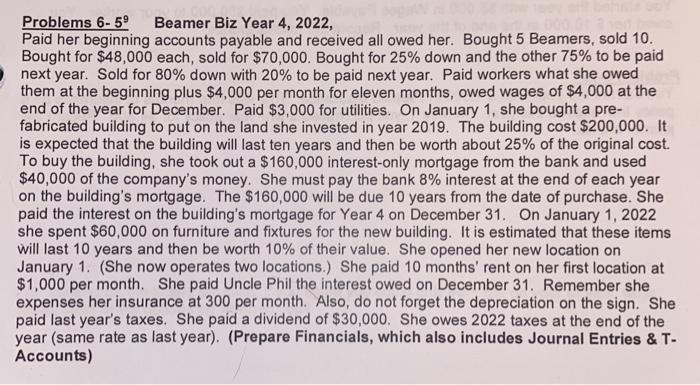

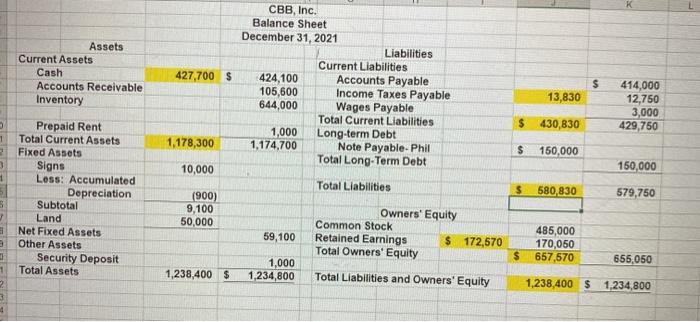

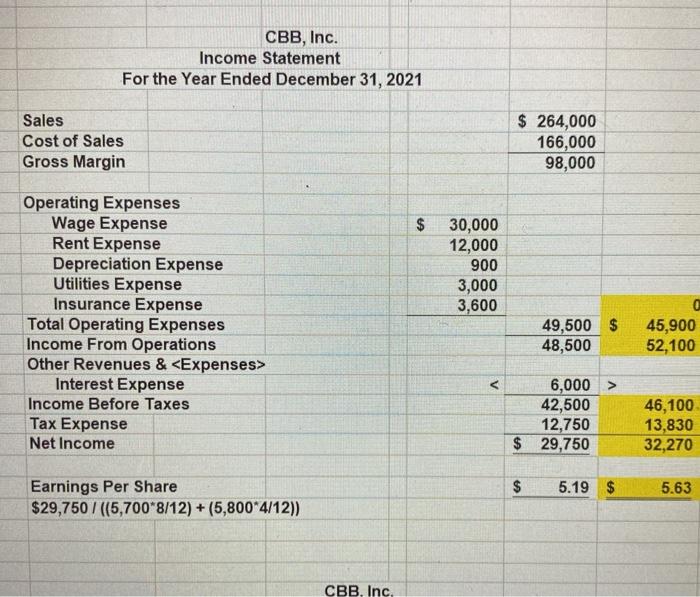

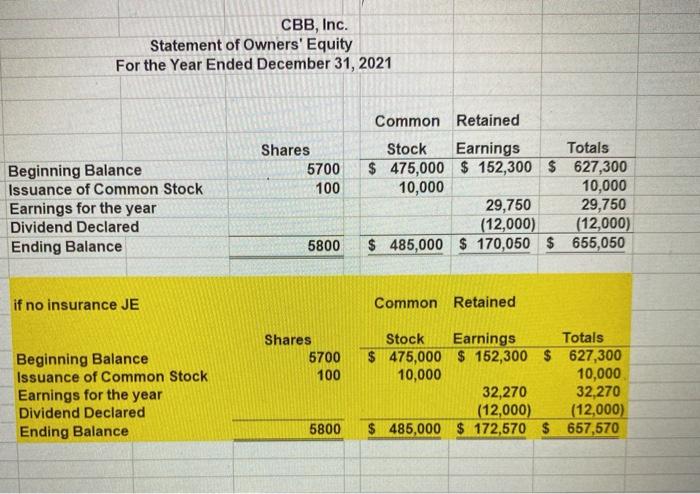

Problems 6-59 Beamer Biz Year 4, 2022, Paid her beginning accounts payable and received all owed her. Bought 5 Beamers, sold 10. Bought for $48,000 each, sold for $70,000. Bought for 25% down and the other 75% to be paid next year. Sold for 80% down with 20% to be paid next year. Paid workers what she owed them at the beginning plus $4,000 per month for eleven months, owed wages of $4,000 at the end of the year for December. Paid $3,000 for utilities. On January 1, she bought a pre- fabricated building to put on the land she invested in year 2019. The building cost $200,000. It is expected that the building will last ten years and then be worth about 25% of the original cost. To buy the building, she took out a $160,000 interest-only mortgage from the bank and used $40,000 of the company's money. She must pay the bank 8% interest at the end of each year on the building's mortgage. The $160,000 will be due 10 years from the date of purchase. She paid the interest on the building's mortgage for Year 4 on December 31. On January 1, 2022 she spent $60,000 on fur iture and fixtures for the new building. It is estimated that these items will last 10 years and then be worth 10% of their value. She opened her new location on January 1. (She now operates two locations.) She paid 10 months' rent on her first location at $1,000 per month. She paid Uncle Phil the interest owed on December 31. Remember she expenses her insurance at 300 per month. Also, do not forget the depreciation on the sign. She paid last year's taxes. She paid a dividend of $30,000. She owes 2022 taxes at the end of the year (same rate as last year). (Prepare Financials, which also includes Journal Entries & T- Accounts) Assets Current Assets Cash Accounts Receivable Inventory 427,700 $ CBB, Inc. Balance Sheet December 31, 2021 Liabilities Current Liabilities 424,100 Accounts Payable 105,600 Income Taxes Payable 644,000 Wages Payable Total Current Liabilities 1,000 Long-term Debt 1,174,700 Note Payable-Phil Total Long-Term Debt $ 13,830 414,000 12,750 3,000 429,750 $ 430,830 3 1 1,178,300 $ 150,000 3 1 10,000 150,000 Total Liabilities $ 580,830 Prepaid Rent Total Current Assets Fixed Assets Signs Less: Accumulated Depreciation Subtotal Land Net Fixed Assets Other Assets Security Deposit Total Assets 579,750 5 (900) 9,100 50,000 59,100 Owners' Equity Common Stock Retained Earnings $ Total Owners' Equity 3 172,570 485,000 170,050 657,570 $ 655,050 1,238,400 $ 1,000 1,234,800 Total Liabilities and Owners' Equity 1,238,400 $ 1,234,800 1 2 3 4 CBB, Inc. Income Statement For the Year Ended December 31, 2021 Sales Cost of Sales Gross Margin $ 264,000 166,000 98,000 $ 30,000 12,000 900 3,000 3,600 Operating Expenses Wage Expense Rent Expense Depreciation Expense Utilities Expense Insurance Expense Total Operating Expenses Income From Operations Other Revenues & Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started