Question

Posting Same question for the second time.. 1) What impact does the repurchase plan have on M&Ms weighted-average cost of capital? Complete the table below

Posting Same question for the second time..

1) What impact does the repurchase plan have on M&Ms weighted-average cost of capital? Complete the table below (No Corporate Taxes)

| Income Statement | Debt = 0 | Debt = 500 | ||||

| Revenue | 1500 | 1500 | ||||

| Operating expenses | 1375 | 1375 | ||||

| Operating profit | 125 | 125 | ||||

| Interest payments | 0 | |||||

| Taxes | 0 | 0 | ||||

| Net profit | 125 |

| ||||

|

| ||||||

| Dividends | 125 |

| ||||

| Shares outstanding | 62.5 |

| ||||

| Dividends per share | 2.00 |

| ||||

| Cost of Capital | ||||||

| Cost of debt | 4.00% | 4.00% | ||||

| Beta | 0.800 | Levered Beta | ||||

| Cost of equity | CAPM |

| ||||

| WACC | = D / V * Kd (1 - t) + (1 - D/V) * Ke

|

| ||||

| Cash flows | ||||||

| Debt holders | = Interest payments |

| ||||

| Equity holders | = Dividend payments |

| ||||

| Free cash flow | = Op profit |

| ||||

| Value | ||||||

| Debt | = Int payments / Kd |

| ||||

| Equity | = Div payments / Ke |

| ||||

| Total | = Sum or FCF / WACC |

| ||||

| Share price 1 | = Equity / Shares outstanding |

| ||||

| Share price 2 | = DPS / Ke |

| ||||

| Value of Firm | = Value of unlevered + Tax shield |

| ||||

| D/E | = D / (V - D) |

| ||||

| D/V | = D / V |

| ||||

2) How would your analysis in questions 2 and 3 and recommendation in question 4 change if the new tax law is implemented? Please note that, with corporate taxes, the expected debt-to-equity ratio under the share repurchase plan is 0.588, and the number of remaining shares outstanding is 39.4 million. Complete the same table as in question 2 with a tax rate of 20%.

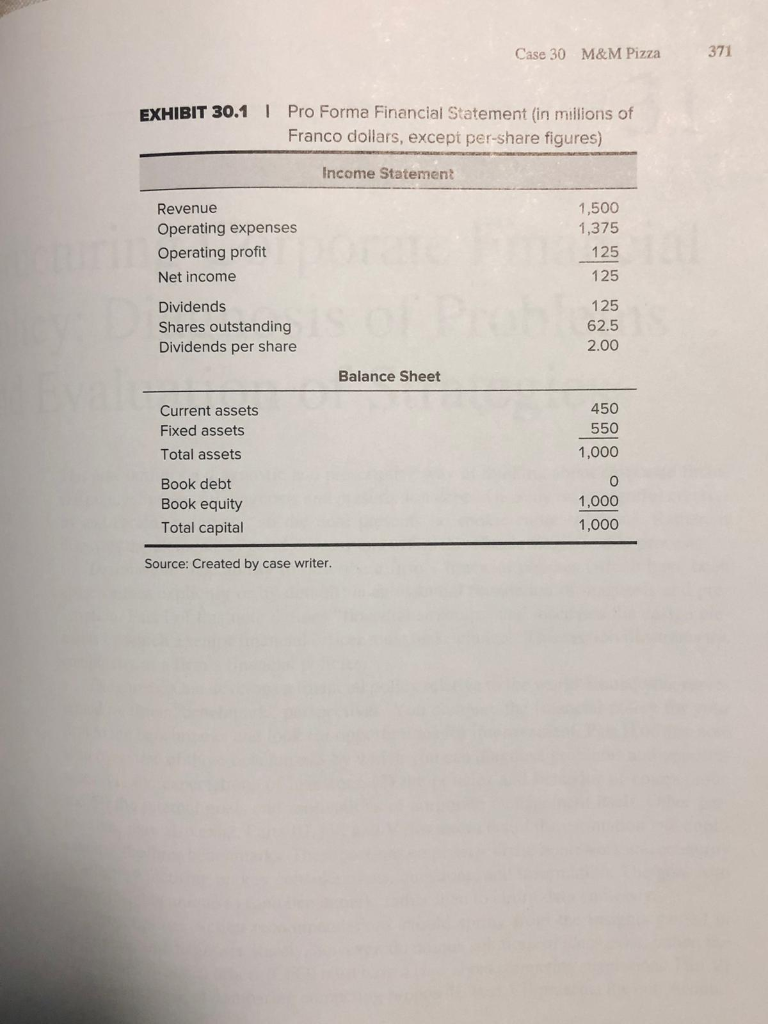

CASE 30 M&M Pizza Twenty-nine-year-old Moe Miller had recently been appointed managing director at M&M Pizza, a premium pizza producer in the small country of Francostan. As a third- generation director of M&M Pizza, Miller was anxious to make his mark on the com- pany with which he had grown up. The business was operating well, with full penetration of the Francostani market, but Miller felt that the financial policies of the company were overly conservative. Despite generating strong and steady profitability of about FS125 million per year over recent memory, M&M Pizza's stock price had been flat for years, at about per share. His new office, Miller discovered, had an unobstructed view of the nearby marble quarry. How wonderfully irrelevant, he thought to himself as he turned to the financial analysis on his desk, with borrowing costs running at only 4%, he felt confident that recapitalizing the balance sheet would create sustained value for M&M owners. His plan called for issuing F$500 million in new company debt and using the proceeds to repurchase F$500 million in company shares. The plan would leave assets, profits, and operations of the business unchanged but allow M&M to borrow at the relatively low prevailing market yields on debt and increase dividends per share. Committed to raising the share price, Miller felt it was time to slice up the company's capital structure a little differently Francostan The Mediterranean island nation of Francostan had a long tradition of political and eco- nomic stability. The country had been under the benevolent rule of a single family for generations. The national economy maintained few ties with neighboring countries, and trade was almost nonexistent. The population was stable, with approximately 12 million prosperous, well-educated inhabitants. The country was known for its exceptional IT and regulation infrastructure; citizens had unrivaled access to business and economic FS Franco dollars. This case was prepared by Michael J. Schill, Associate Professor of Business Administration It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright2013 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an e-mail to sales @.dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means-electronic, mechanical, photocopying, recording. or otherwise-without the permis- sion of the Darden School Foundation. 369 370 Management of the Corporate Capital Structure Part Six information. Economic policies in the country supported stability. Price inflation for the national currency, the Franco dollar, had been near zero for some time and was ex to remain so for the foreseeable future. Short- and long-term ment and business debt were steady at 4%. Occasionally, the economy experienced short periods of economic expansion and contraction. pected interest rates for govern- The country's population was known for its high ethical standards. Business prom ises and financial obligations were considered fully binding. To support the country's practices, the government maintained no bankruptcy law, and all contractual obligations were fully and completely enforced. To encourage economic development, the govern ment did not tax business income. Instead, government tax revenue was levied through personal income taxes. There was a law under consideration to alter the tax policy by ntroducing a 20% corporate income tax. To maintain business investment incentives under the plan, interest payments would be tax deductible. The Recapitalization Decision Miller's proposed recapitalization involved raising F$500 million in cash by issuing new debt at the prevailing 4% borrowing rate and using the cash to repurchase company shares. Miller was confident that shareholders would be better off. Not only would they receive F$500 million in cash, but Miller expected that the share price would rise M&M maintained a dividend policy of returning all company profits to equity holders in the form o dividends. Although total dividends would decline under the new plan Miller anticipated that the reduction in the number of shares would allow for a net in- crease in the dividends paid per remaining share outstanding. With a desire to set the tone of his leadership at M&M, Miller wanted to implement the initiative immediately The accounting office had provided a set of pro forma M&M financial statements for the coming year (Exhibit 30.1) Based on a rudimentary knowledge of corporate finance, Miller estimated the cur rent cost of equity (and WACC) for M&M with the current no-debt policy at 8% based on a market risk premium of 5% and a company beta of 0.8. Miller appreciated that. because equity holders bore the business risk, they deserved to receive a higher return. Nonetheless, from a simple comparison of the 8% cost of equity with the 4% cost of debt, equity appeared to be an expensive source of funds. To Miller, substituting debt r equity was a superior financial policy because it gave the company cheaper cap With other business inputs, the company was aggressive in sourcing quality ma and labor at the lowest available cost. Shouldn't M&M do the same for its capi The recapitalization would change the number of shares outstanding for M&M from 62.5 million to 42.5 million Miller's uncle, Mert, was highly skeptical of Miller's proposal. Uncle Mert claimed that substitut for equity capital shifted more business risk of the firm to equity holders, so they required hig He countered that M&M's beta of 0.8 must increase in the following manner: Levered beta( x+-)x DIE], where t is the corporate tax rate, D is the debt value, and E is the equity the F$500 million share-repurchase proposal, Uncle Mert asserted that M&M's D/E ratio wou debt Unlevered beta) 371 Case 30 M&M Pizza EXHIBIT 30.1 Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement 1,500 1,375 125 125 Revenue Operating expenses Operating profit Net income 125 62.5 2.00 Dividends Shares outstanding Dividends per share Balance Sheet 450 550 1,000 0 1,000 1,000 Current assets Fixed assets Total assets Book debt Book equity Total capital Source: Created by case writer. CASE 30 M&M Pizza Twenty-nine-year-old Moe Miller had recently been appointed managing director at M&M Pizza, a premium pizza producer in the small country of Francostan. As a third- generation director of M&M Pizza, Miller was anxious to make his mark on the com- pany with which he had grown up. The business was operating well, with full penetration of the Francostani market, but Miller felt that the financial policies of the company were overly conservative. Despite generating strong and steady profitability of about FS125 million per year over recent memory, M&M Pizza's stock price had been flat for years, at about per share. His new office, Miller discovered, had an unobstructed view of the nearby marble quarry. How wonderfully irrelevant, he thought to himself as he turned to the financial analysis on his desk, with borrowing costs running at only 4%, he felt confident that recapitalizing the balance sheet would create sustained value for M&M owners. His plan called for issuing F$500 million in new company debt and using the proceeds to repurchase F$500 million in company shares. The plan would leave assets, profits, and operations of the business unchanged but allow M&M to borrow at the relatively low prevailing market yields on debt and increase dividends per share. Committed to raising the share price, Miller felt it was time to slice up the company's capital structure a little differently Francostan The Mediterranean island nation of Francostan had a long tradition of political and eco- nomic stability. The country had been under the benevolent rule of a single family for generations. The national economy maintained few ties with neighboring countries, and trade was almost nonexistent. The population was stable, with approximately 12 million prosperous, well-educated inhabitants. The country was known for its exceptional IT and regulation infrastructure; citizens had unrivaled access to business and economic FS Franco dollars. This case was prepared by Michael J. Schill, Associate Professor of Business Administration It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright2013 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an e-mail to sales @.dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means-electronic, mechanical, photocopying, recording. or otherwise-without the permis- sion of the Darden School Foundation. 369 370 Management of the Corporate Capital Structure Part Six information. Economic policies in the country supported stability. Price inflation for the national currency, the Franco dollar, had been near zero for some time and was ex to remain so for the foreseeable future. Short- and long-term ment and business debt were steady at 4%. Occasionally, the economy experienced short periods of economic expansion and contraction. pected interest rates for govern- The country's population was known for its high ethical standards. Business prom ises and financial obligations were considered fully binding. To support the country's practices, the government maintained no bankruptcy law, and all contractual obligations were fully and completely enforced. To encourage economic development, the govern ment did not tax business income. Instead, government tax revenue was levied through personal income taxes. There was a law under consideration to alter the tax policy by ntroducing a 20% corporate income tax. To maintain business investment incentives under the plan, interest payments would be tax deductible. The Recapitalization Decision Miller's proposed recapitalization involved raising F$500 million in cash by issuing new debt at the prevailing 4% borrowing rate and using the cash to repurchase company shares. Miller was confident that shareholders would be better off. Not only would they receive F$500 million in cash, but Miller expected that the share price would rise M&M maintained a dividend policy of returning all company profits to equity holders in the form o dividends. Although total dividends would decline under the new plan Miller anticipated that the reduction in the number of shares would allow for a net in- crease in the dividends paid per remaining share outstanding. With a desire to set the tone of his leadership at M&M, Miller wanted to implement the initiative immediately The accounting office had provided a set of pro forma M&M financial statements for the coming year (Exhibit 30.1) Based on a rudimentary knowledge of corporate finance, Miller estimated the cur rent cost of equity (and WACC) for M&M with the current no-debt policy at 8% based on a market risk premium of 5% and a company beta of 0.8. Miller appreciated that. because equity holders bore the business risk, they deserved to receive a higher return. Nonetheless, from a simple comparison of the 8% cost of equity with the 4% cost of debt, equity appeared to be an expensive source of funds. To Miller, substituting debt r equity was a superior financial policy because it gave the company cheaper cap With other business inputs, the company was aggressive in sourcing quality ma and labor at the lowest available cost. Shouldn't M&M do the same for its capi The recapitalization would change the number of shares outstanding for M&M from 62.5 million to 42.5 million Miller's uncle, Mert, was highly skeptical of Miller's proposal. Uncle Mert claimed that substitut for equity capital shifted more business risk of the firm to equity holders, so they required hig He countered that M&M's beta of 0.8 must increase in the following manner: Levered beta( x+-)x DIE], where t is the corporate tax rate, D is the debt value, and E is the equity the F$500 million share-repurchase proposal, Uncle Mert asserted that M&M's D/E ratio wou debt Unlevered beta) 371 Case 30 M&M Pizza EXHIBIT 30.1 Pro Forma Financial Statement (in millions of Franco dollars, except per-share figures) Income Statement 1,500 1,375 125 125 Revenue Operating expenses Operating profit Net income 125 62.5 2.00 Dividends Shares outstanding Dividends per share Balance Sheet 450 550 1,000 0 1,000 1,000 Current assets Fixed assets Total assets Book debt Book equity Total capital Source: Created by case writer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started