Answered step by step

Verified Expert Solution

Question

1 Approved Answer

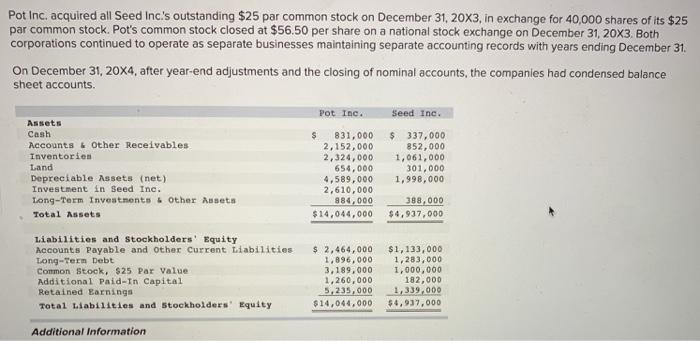

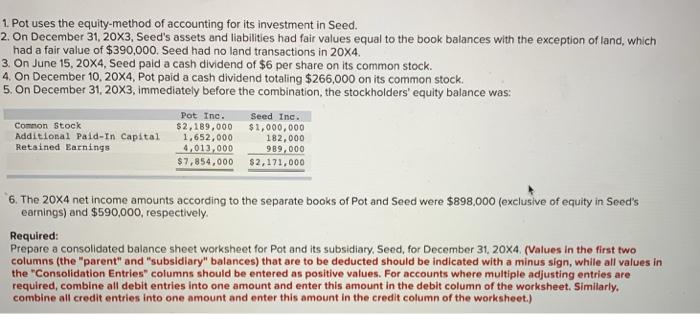

Pot Inc. acquired all Seed Inc's outstanding $25 par common stock on December 31, 20X3, in exchange for 40,000 shares of its $25 par

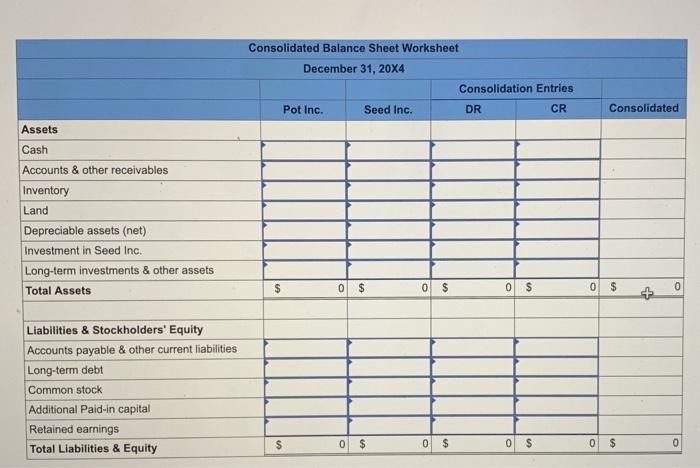

Pot Inc. acquired all Seed Inc's outstanding $25 par common stock on December 31, 20X3, in exchange for 40,000 shares of its $25 par common stock. Pot's common stock closed at $56.50 per share on a national stock exchange on December 31, 20X3. Both corporations continued to operate as separate businesses maintaining separate accounting records with years ending December 31. On December 31, 20X4, after year-end adjustments and the closing of nominal accounts, the companies had condensed balance sheet accounts. Pot Inc. Seed Inc. Assets Cash Accounts & other Receivables Inventorien Land Depreciable Assets (net) Investment in Seed Inc. 831,000 2,152,000 2,324,000 654,000 4,589,000 2,610,000 884,000 $14,044,000 $ 337,000 852,000 1,061,000 301,000 1,998,000 Long-Term Investnents & other Anseta 388,000 Total Assets $4,937,000 Liabilities and Stockholders' Equity Accounts Payable and other Current Liabilities Long-Term Debt Common Stoek, $25 Par Value Additional Paid-In Capital Retained Earnings $ 2,464,000 1,896,000 3,189,000 $1,133,000 1,283,000 1,000,000 182,000 1,339,00 $4,937,000 1,260,000 5,235,000 Total Liabilities and Stockholders' Equity $14,044,000 Additional Information 1. Pot uses the equity-method of accounting for its investment in Seed. 2. On December 31, 20X3, Seed's assets and liabilities had fair values equal to the book balances with the exception of land, which had a fair value of $390,000. Seed had no land transactions in 20X4. 3. On June 15, 20X4, Seed paid a cash dividend of $6 per share on its common stock. 4, On December 1o, 20x4, Pot paid a cash dividend totaling $266,000 on its common stock. 5. On December 31, 20X3, immediately before the combination, the stockholders' equity balance was: Pot Inc. Seed Inc. Common Stock Additional Paid-In Capital Retained Earnings $2,189,000 1,652,000 4,013,000 $1,000,000 182,000 989,000 $7,854,000 $2,171,000 6. The 20x4 net income amounts according to the separate books of Pot and Seed were $898,000 (exclusive of equity in Seed's earnings) and $590,000, respectively. Required: Prepare a consolidated balance sheet worksheet for Pot and its subsidiary, Seed, for December 31, 20X4, (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly. combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Consolidated Balance Sheet Worksheet December 31, 20X4 Consolidation Entries Pot Inc. Seed Inc. DR CR Consolidated Assets Cash Accounts & other receivables Inventory Land Depreciable assets (net) Investment in Seed Inc. Long-term investments & other assets Total Assets 24 %24 Liabilities & Stockholders' Equity Accounts payable & other current liabilities Long-term debt Common stock Additional Paid-in capital Retained earnings Total Liabilities & Equity 2. 2$

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A B E F G H K M N POT INC AND SUBSIDIARY 2 Consolidated Balance Sheet Worksheet In land 390000 30100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started