Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As part of its continuing product development strategy, CMR Group is considering launching a new retail drug called Pains No More! which has just

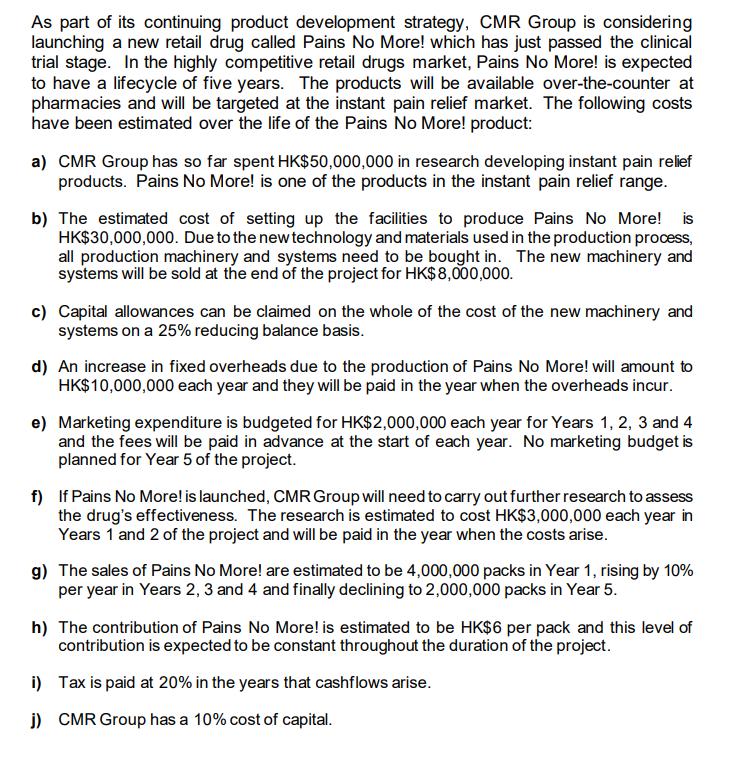

As part of its continuing product development strategy, CMR Group is considering launching a new retail drug called Pains No More! which has just passed the clinical trial stage. In the highly competitive retail drugs market, Pains No More! is expected to have a lifecycle of five years. The products will be available over-the-counter at pharmacies and will be targeted at the instant pain relief market. The following costs have been estimated over the life of the Pains No More! product: a) CMR Group has so far spent HK$50,000,000 in research developing instant pain relief products. Pains No More! is one of the products in the instant pain relief range. b) The estimated cost of setting up the facilities to produce Pains No More! is HK$30,000,000. Due to the new technology and materials used in the production process, all production machinery and systems need to be bought in. The new machinery and systems will be sold at the end of the project for HK$8,000,000. c) Capital allowances can be claimed on the whole of the cost of the new machinery and systems on a 25% reducing balance basis. d) An increase in fixed overheads due to the production of Pains No More! will amount to HK$10,000,000 each year and they will be paid in the year when the overheads incur. e) Marketing expenditure is budgeted for HK$2,000,000 each year for Years 1, 2, 3 and 4 and the fees will be paid in advance at the start of each year. No marketing budget is planned for Year 5 of the project. f) If Pains No More! is launched, CMR Group will need to carry out further research to assess the drug's effectiveness. The research is estimated to cost HK$3,000,000 each year in Years 1 and 2 of the project and will be paid in the year when the costs arise. g) The sales of Pains No More! are estimated to be 4,000,000 packs in Year 1, rising by 10% per year in Years 2, 3 and 4 and finally declining to 2,000,000 packs in Year 5. h) The contribution of Pains No More! is estimated to be HK$6 per pack and this level of contribution is expected to be constant throughout the duration of the project. i) Tax is paid at 20% in the years that cashflows arise. j) CMR Group has a 10% cost of capital.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Net Present Value NPV The NPV of the Pains No More project is HK165819000 2 Internal Rate of Return IRR The IRR of the Pains No More project ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started