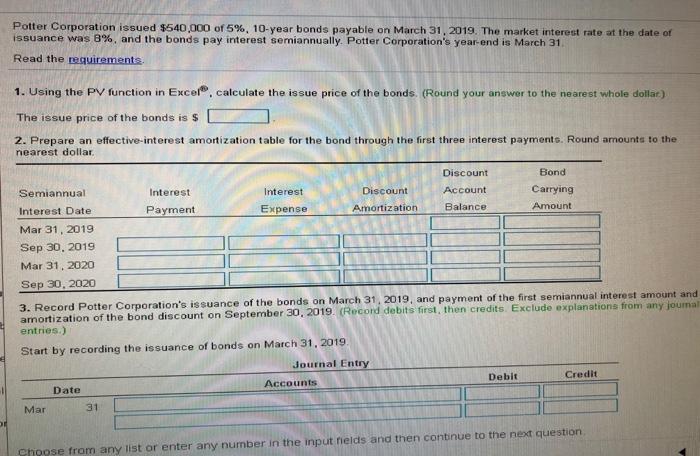

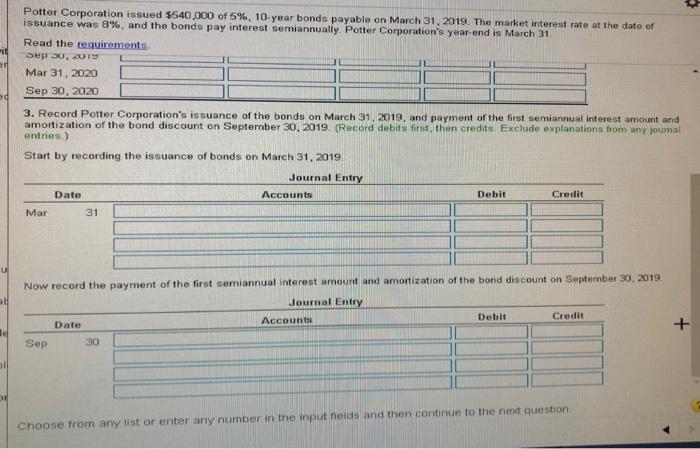

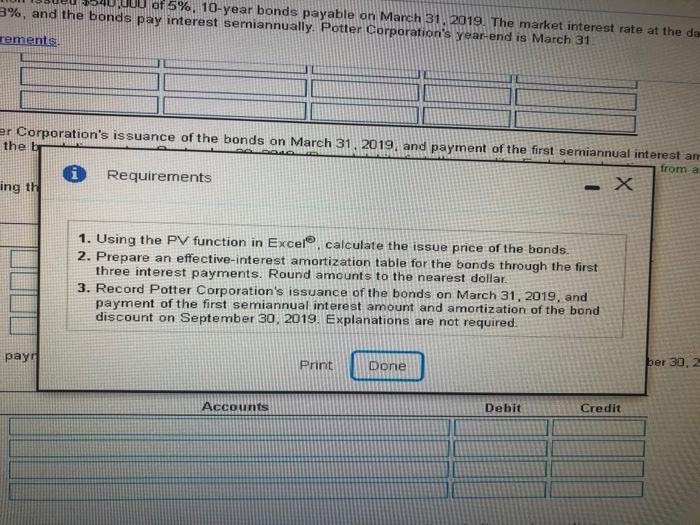

Potter Corporation issued $540,000 of 5%, 10-year bonds payable on March 31, 2019. The market interest rate at the date of issuance was 8%, and the bonds pay interest semiannually. Potter Corporation's year-end is March 31 Read the requirements, 1. Using the PV function in Excel. calculate the issue price of the bonds. (Round your answer to the nearest whole dollar) The issue price of the bonds is $ 2. Prepare an effective-interest amortization table for the bond through the first three interest payments. Round amounts to the nearest dollar Discount Bond Semiannual Interest Interest Discount Account Carrying Interest Date Payment Expense Amortization Balance Amount Mar 31, 2019 Sep 30, 2019 Mar 31, 2020 Sep 30, 2020 3. Record Potter Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019. (Record debits first, then credits Exclude explanations from any joumal entries.) Start by recording the issuance of bonds on March 31, 2019 Journal Entry Date Accounts Debit Credit Mar 31 Choose from any list or enter any number in the input hields and then continue to the next question 21 ed Potter Corporation issued $540,000 of 5%, 10-year bonds payable on March 31, 2019. The market interest rate at the date of issuance was 8%, and the bonds pay interest semiannually Potter Corporation's year and is March 31 Read the requirements Sepu, 2019 Mar 31, 2020 Sep 30, 2020 3. Record Potter Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019. (Record debits first, then credits Exclude explanations from any joumal entries) Start by recording the issuance of bonds on March 31, 2019 Journal Entry Date Accounts Debit Credit Mar 31 Now record the payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019 Journal Entry Date Account Debit Credit Sep 30 + il Choose from any list or enter any number in the input nelds and then continue to the next question JUU of 5%. 10-year bonds payable on March 31, 2019. The market interest rate at the da 3%, and the bonds pay interest semiannually. Potter Corporation's year-end is March 31 rements er Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest am the b from a Requirements ing the - 1. Using the PV function in Excel. calculate the issue price of the bonds 2. Prepare an effective-interest amortization table for the bonds through the first three interest payments. Round amounts to the nearest dollar. 3. Record Potter Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019. Explanations are not required. pay Print Done ber 30, 2 Accounts Debit Credit