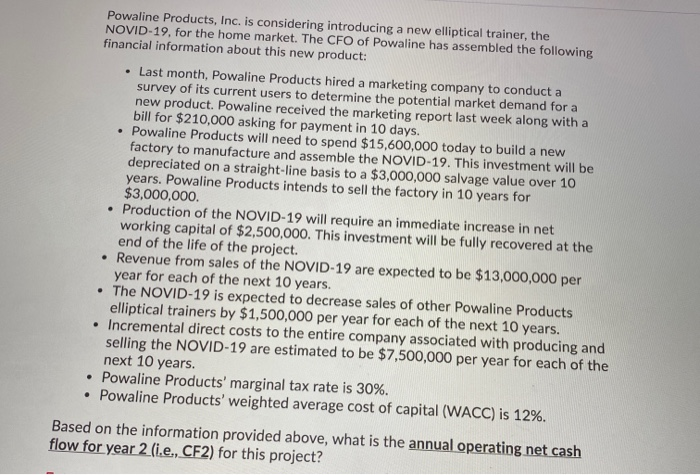

Powaline Products, Inc. is considering introducing a new elliptical trainer, the NOVID-19, for the home market. The CFO of Powaline has assembled the following financial information about this new product: Last month, Powaline Products hired a marketing company to conduct a survey of its current users to determine the potential market demand for a new product. Powaline received the marketing report last week along with a bill for $210,000 asking for payment in 10 days. Powaline Products will need to spend $15,600,000 today to build a new factory to manufacture and assemble the NOVID-19. This investment will be depreciated on a straight-line basis to a $3,000,000 salvage value over 10 years. Powaline Products intends to sell the factory in 10 years for $3,000,000 Production of the NOVID-19 will require an immediate increase in net working capital of $2,500,000. This investment will be fully recovered at the end of the life of the project. Revenue from sales of the NOVID-19 are expected to be $13,000,000 per year for each of the next 10 years. The NOVID-19 is expected to decrease sales of other Powaline Products elliptical trainers by $1,500,000 per year for each of the next 10 years. Incremental direct costs to the entire company associated with producing and selling the NOVID-19 are estimated to be $7,500,000 per year for each of the next 10 years. Powaline Products' marginal tax rate is 30%. Powaline Products' weighted average cost of capital (WACC) is 12%. Based on the information provided above, what is the annual operating net cash flow for year 2 (i.e., CF2) for this project? and are estimated to be $7,500,000 per year for each of the next 10 years. Powaline Products' marginal tax rate is 30%. Powaline Products' weighted average cost of capital (WACC) is 12%. Based on the information provided above, what is the annual operating net cash flow for year 2 (i.e., CF2) for this project? Enter your answer as a dollar amount rounded, if necessary, to 0 decimal places. Do not include the dollar sign or any commas in your answer. For example, record $14,240,716.84 as 14240717. If the final value is a net cash outflow, put a hyphen before your number with no space between the hyphen and the number. For example, enter a cash outflow of $1,243,200 as -1243200