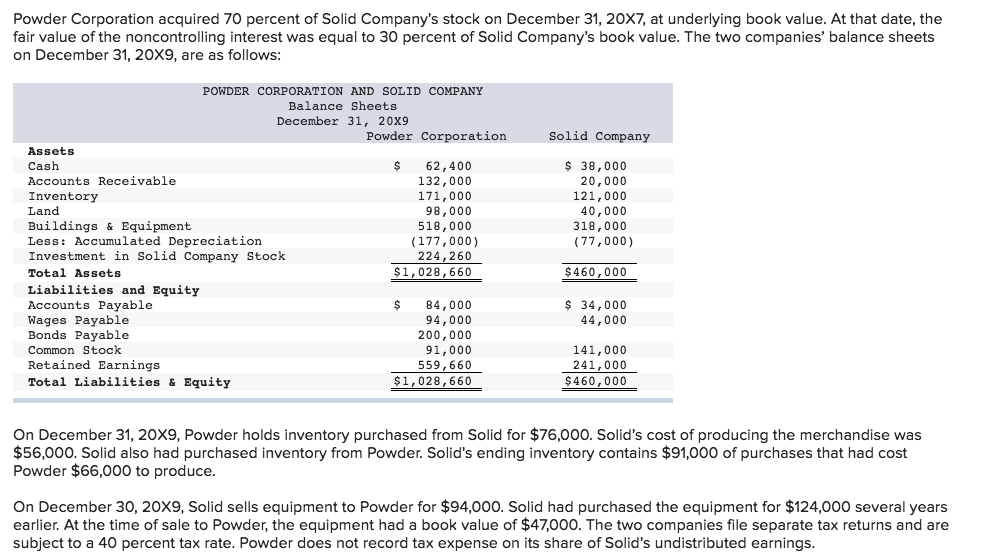

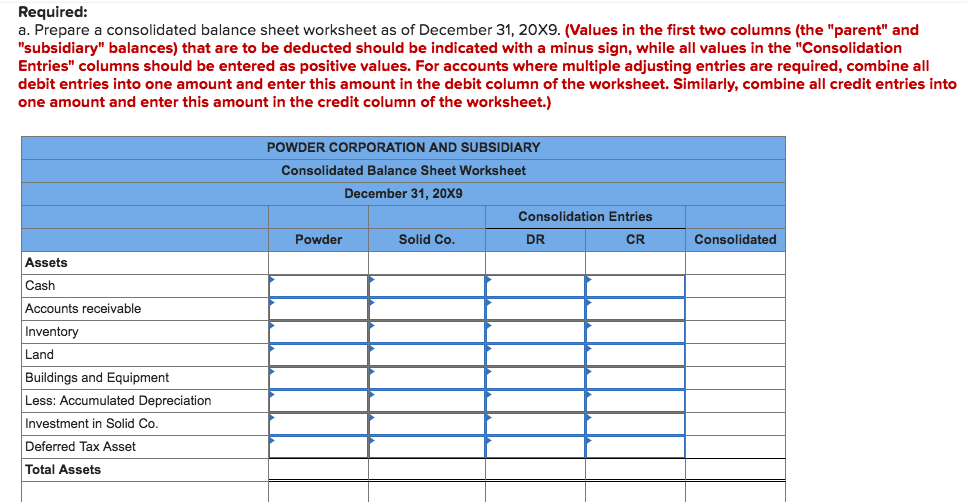

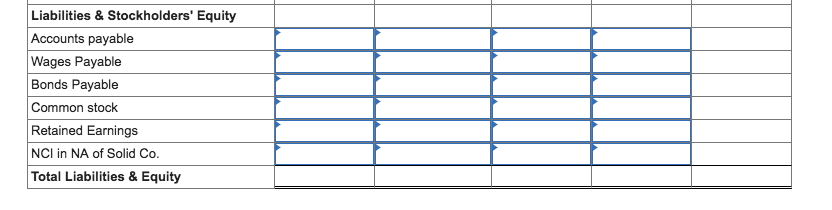

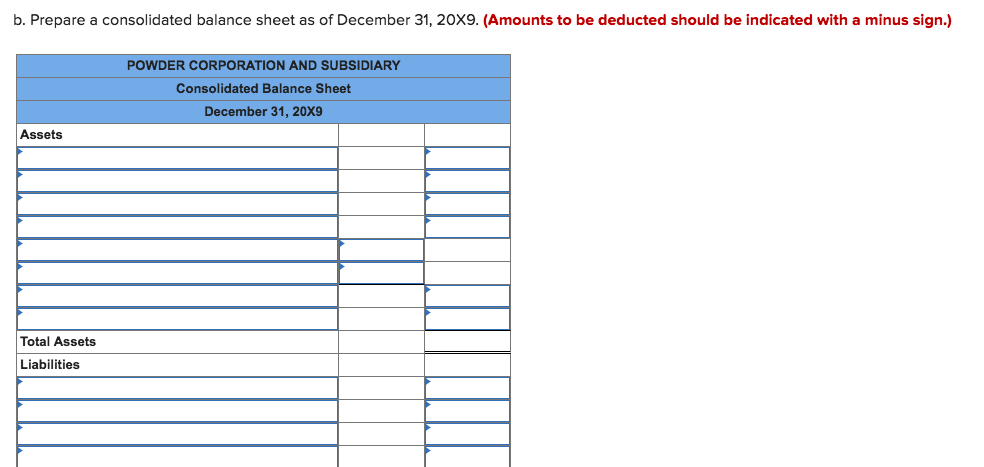

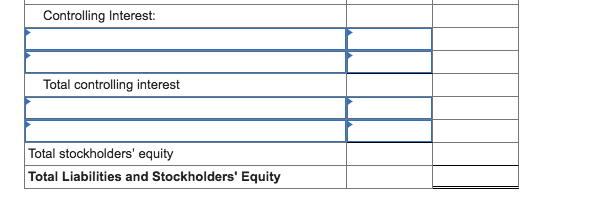

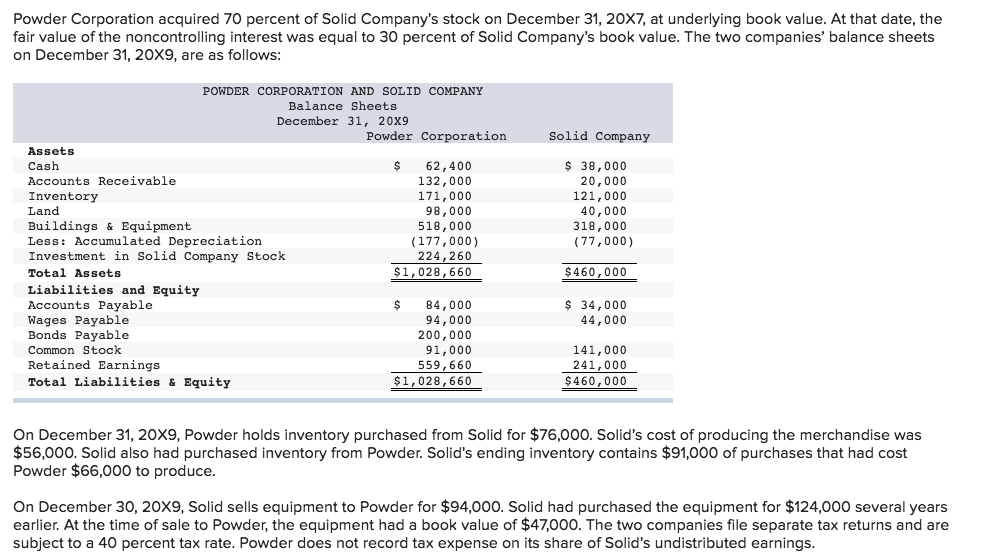

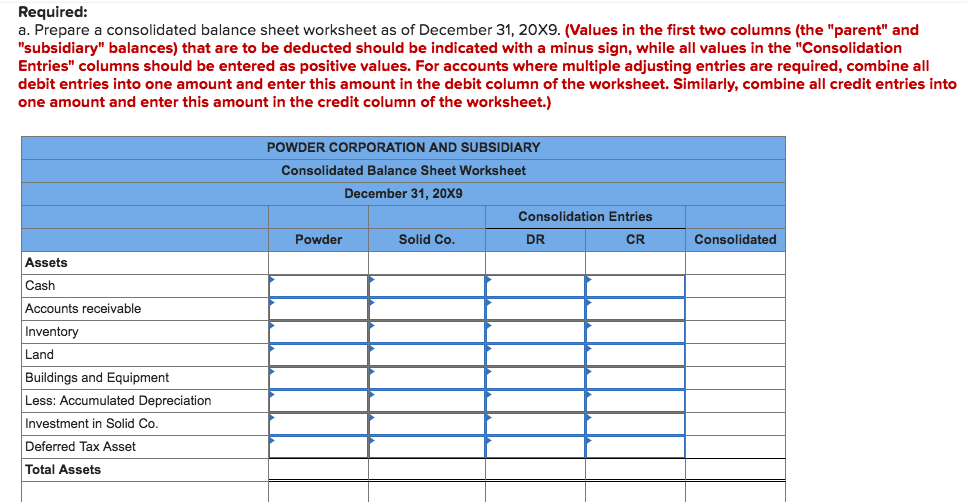

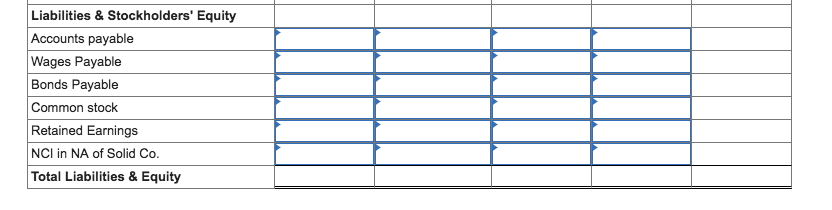

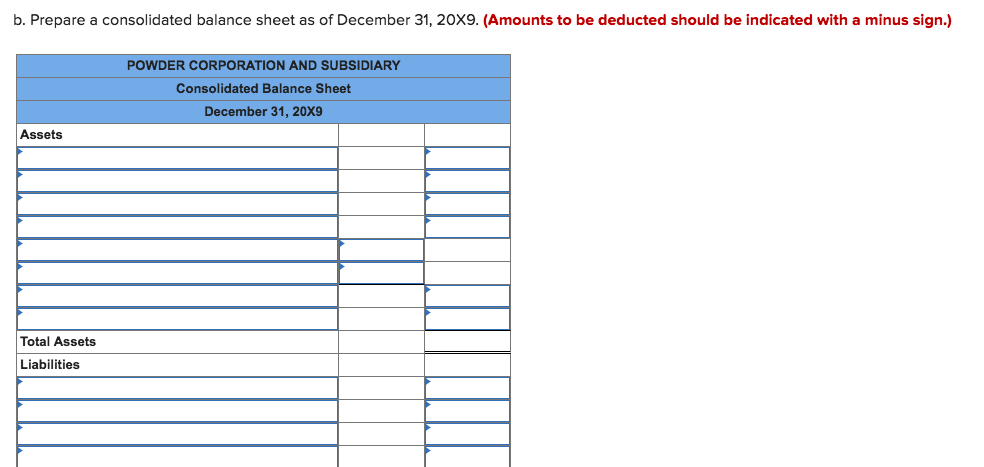

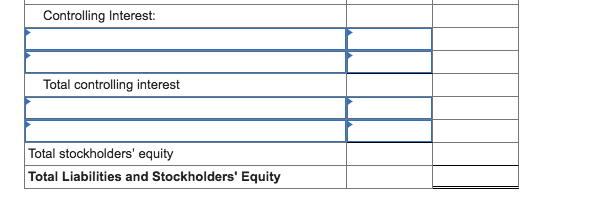

Powder Corporation acquired 70 percent of Solid Company's stock on December 31, 20X7, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 30 percent of Solid Company's book value. The two companies' balance sheets on December 31, 20X9, are as follows: POWDER CORPORATION AND SOLID COMPANY Balance Sheets December 31, 20x9 Powder Corporation Solid Company Assets Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Solid Company Stock Total Assets Liabilities and Equity Accounts Payable Wages Payable Bonds Payable Common Stock Retained Earnings Total Liabilities &Equity $62,400 132,000 171,000 98,000 518,000 38,000 20,000 121,000 40,000 318,000 (77,000) (177,000) 224,260 $1,028,660 $460,000 $84,000 94,000 200,000 91,000 559,660 $1,028,660 $34,000 44,000 141,000 241,000 $460,000 On December 31, 20X9, Powder holds inventory purchased from Solid for $76,000. Solid's cost of producing the merchandise was $56,000. Solid also had purchased inventory from Powder. Solid's ending inventory contains $91,000 of purchases that had cost Powder $66,000 to produce On December 30, 20x9, Solid sells equipment to Powder for $94,000. Solid had purchased the equipment for $124,000 several years earlier. At the time of sale to Powder, the equipment had a book value of $47,000. The two companies file separate tax returns and are subject to a 40 percent tax rate. Powder does not record tax expense on its share of Solid's undistributed earnings Required: a. Prepare a consolidated balance sheet worksheet as of December 31, 20X9. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) POWDER CORPORATION AND SUBSIDIARY Consolidated Balance Sheet Worksheet December 31, 20X9 onsolidation Entries Powder Solid Co DR CR Consolidated Assets Cash Accounts receivable Inventory Land Buildings and Equipment Less: Accumulated Depreciation Investment in Solid Co Deferred Tax Asset Total Assets Liabilities & Stockholders' Equity Accounts payable Wages Payable Bonds Payable Common stock Retained Earnings NCI in NA of Solid Co Total Liabilities & Equity b. Prepare a consolidated balance sheet as of December 31, 20X9. (Amounts to be deducted should be indicated with a minus sign.) POWDER CORPORATION AND SUBSIDIARY Consolidated Balance Sheet December 31, 20x9 Assets Total Assets Liabilities Controlling Interest Total controlling interest Total stockholders' equity Total Liabilities and Stockholders' Equity Powder Corporation acquired 70 percent of Solid Company's stock on December 31, 20X7, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 30 percent of Solid Company's book value. The two companies' balance sheets on December 31, 20X9, are as follows: POWDER CORPORATION AND SOLID COMPANY Balance Sheets December 31, 20x9 Powder Corporation Solid Company Assets Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Solid Company Stock Total Assets Liabilities and Equity Accounts Payable Wages Payable Bonds Payable Common Stock Retained Earnings Total Liabilities &Equity $62,400 132,000 171,000 98,000 518,000 38,000 20,000 121,000 40,000 318,000 (77,000) (177,000) 224,260 $1,028,660 $460,000 $84,000 94,000 200,000 91,000 559,660 $1,028,660 $34,000 44,000 141,000 241,000 $460,000 On December 31, 20X9, Powder holds inventory purchased from Solid for $76,000. Solid's cost of producing the merchandise was $56,000. Solid also had purchased inventory from Powder. Solid's ending inventory contains $91,000 of purchases that had cost Powder $66,000 to produce On December 30, 20x9, Solid sells equipment to Powder for $94,000. Solid had purchased the equipment for $124,000 several years earlier. At the time of sale to Powder, the equipment had a book value of $47,000. The two companies file separate tax returns and are subject to a 40 percent tax rate. Powder does not record tax expense on its share of Solid's undistributed earnings Required: a. Prepare a consolidated balance sheet worksheet as of December 31, 20X9. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) POWDER CORPORATION AND SUBSIDIARY Consolidated Balance Sheet Worksheet December 31, 20X9 onsolidation Entries Powder Solid Co DR CR Consolidated Assets Cash Accounts receivable Inventory Land Buildings and Equipment Less: Accumulated Depreciation Investment in Solid Co Deferred Tax Asset Total Assets Liabilities & Stockholders' Equity Accounts payable Wages Payable Bonds Payable Common stock Retained Earnings NCI in NA of Solid Co Total Liabilities & Equity b. Prepare a consolidated balance sheet as of December 31, 20X9. (Amounts to be deducted should be indicated with a minus sign.) POWDER CORPORATION AND SUBSIDIARY Consolidated Balance Sheet December 31, 20x9 Assets Total Assets Liabilities Controlling Interest Total controlling interest Total stockholders' equity Total Liabilities and Stockholders' Equity