Answered step by step

Verified Expert Solution

Question

1 Approved Answer

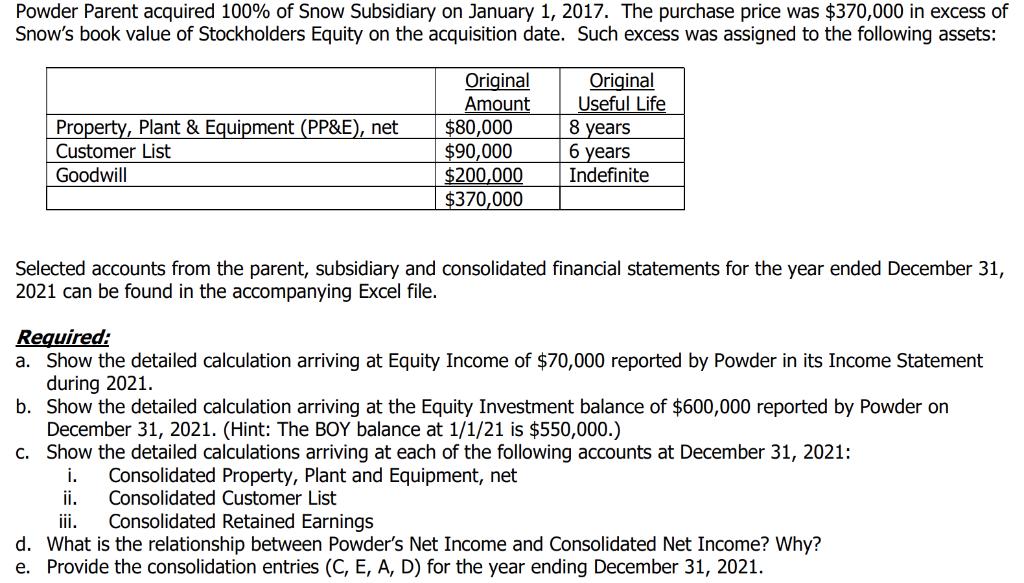

Powder Parent acquired 100% of Snow Subsidiary on January 1, 2017. The purchase price was $370,000 in excess of Snow's book value of Stockholders

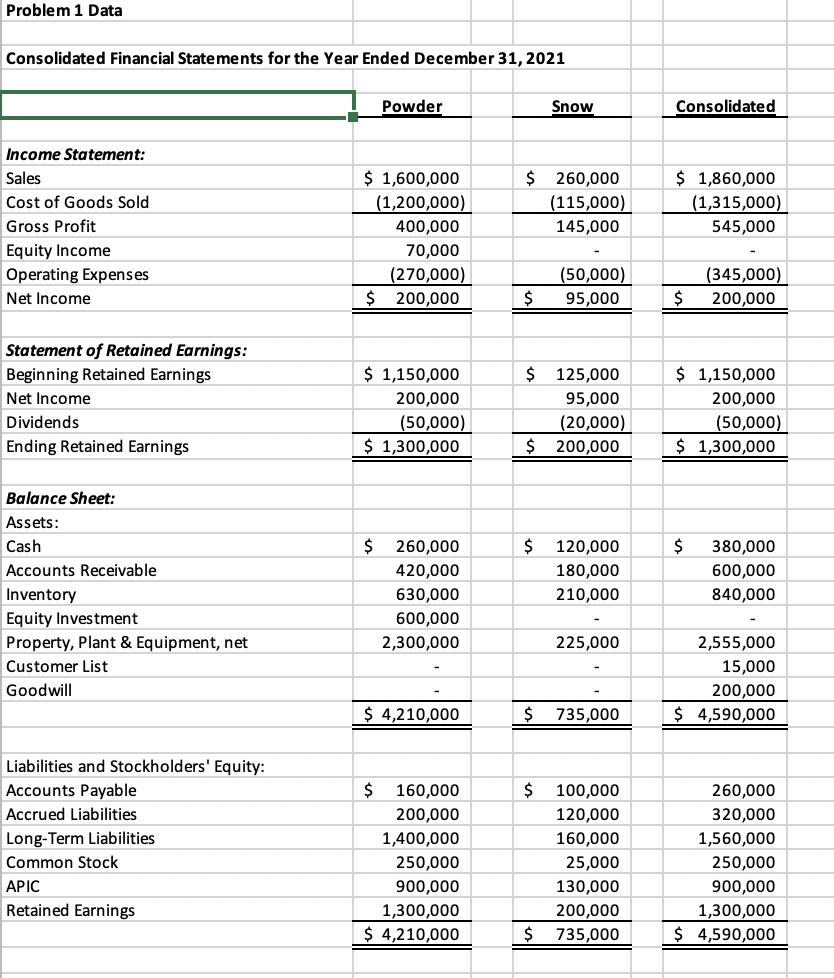

Powder Parent acquired 100% of Snow Subsidiary on January 1, 2017. The purchase price was $370,000 in excess of Snow's book value of Stockholders Equity on the acquisition date. Such excess was assigned to the following assets: Property, Plant & Equipment (PP&E), net Customer List Goodwill Original Amount $80,000 $90,000 $200,000 $370,000 Original Useful Life 8 years 6 years Indefinite Selected accounts from the parent, subsidiary and consolidated financial statements for the year ended December 31, 2021 can be found in the accompanying Excel file. Required: a. Show the detailed calculation arriving at Equity Income of $70,000 reported by Powder in its Income Statement during 2021. b. Show the detailed calculation arriving at the Equity Investment balance of $600,000 reported by Powder on December 31, 2021. (Hint: The BOY balance at 1/1/21 is $550,000.) c. Show the detailed calculations arriving at each of the following accounts at December 31, 2021: i. Consolidated Property, Plant and Equipment, net ii. Consolidated Customer List Consolidated Retained Earnings iii. d. What is the relationship between Powder's Net Income and Consolidated Net Income? Why? e. Provide the consolidation entries (C, E, A, D) for the year ending December 31, 2021. Problem 1 Data Consolidated Financial Statements for the Year Ended December 31, 2021 Income Statement: Sales Cost of Goods Sold Gross Profit Equity Income Operating Expenses Net Income Statement of Retained Earnings: Beginning Retained Earnings Net Income Dividends Ending Retained Earnings Balance Sheet: Assets: Cash Accounts Receivable Inventory Equity Investment Property, Plant & Equipment, net Customer List Goodwill Liabilities and Stockholders' Equity: Accounts Payable Accrued Liabilities Long-Term Liabilities Common Stock APIC Retained Earnings Powder $ 1,600,000 (1,200,000) 400,000 70,000 (270,000) $ 200,000 $ 1,150,000 200,000 (50,000) $ 1,300,000 $ 260,000 420,000 630,000 600,000 2,300,000 $ 4,210,000 $ 160,000 200,000 1,400,000 250,000 900,000 1,300,000 $ 4,210,000 Snow $ 260,000 (115,000) 145,000 $ (50,000) 95,000 $ 125,000 95,000 (20,000) $ 200,000 $ 120,000 180,000 210,000 225,000 $ 735,000 $ 100,000 120,000 160,000 25,000 130,000 200,000 $ 735,000 Consolidated $ 1,860,000 (1,315,000) 545,000 $ (345,000) 200,000 $ 1,150,000 200,000 (50,000) $ 1,300,000 $ 380,000 600,000 840,000 2,555,000 15,000 200,000 $ 4,590,000 260,000 320,000 1,560,000 250,000 900,000 1,300,000 $4,590,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of Equity Income of 70000 reported by Powder in its Income Statement during 2021 Equity Income Snows Net Income Powders Ownership Percentage Equity Income 70000 Given Snows Net Income Sn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started