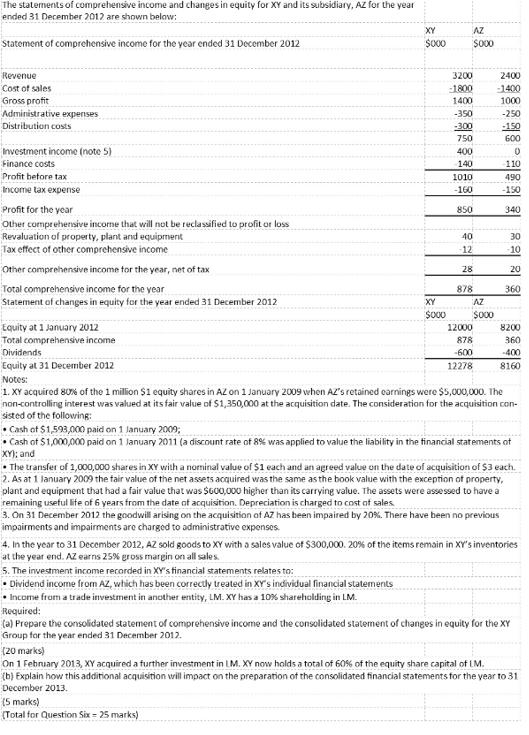

The statements of comprehensive income and changes in equity for XY and its subsidiary, AZ for the year ended 31 December 2012 are shown

The statements of comprehensive income and changes in equity for XY and its subsidiary, AZ for the year ended 31 December 2012 are shown below: XY AZ Statement of comprehensive income for the year ended 31 December 2012 S00 S00 Revenue 3200 2400 Cost of sales -1800 1400 Gross profit 1400 1000 Administrative expenses -350 -250 Distribution costs -300 -150 750 600 Investment income (note 5) 400 Finance costs 140 110 Profit betore tax 1010 490 Income tax expense -160 -150 Profit for the year 850 340 Other comprehersive income that will not be reclassified to profit or loss Revaluation of property, plant and equipment Tax effect of other comprehensive income 40 30 12 10 Other comprehensive income tor the year, net of tax 28 20 Total comprehensive income for the year Statement of changes in equity for the year ended 31 December 2012 878 360 XY AZ S000 Equity at 1 January 2012 12000 8200 Total comprehensive income 878 360 Dividends Equity at 31 December 2012 -600 -400 12278 8160 Notes: 1. XY acquired 80% of the 1 million $1 equity shares in AZ on 1 January 2009 when AZ's retained carnings were $5,000,000. The non-controlling interest was valued at its fair value of S1,350,000 at the acquisition date. The consideration for the acquisition con- sisted of the following: Cash ot $1,593,000 paid on 1 lanuary 2009; Cash of $1,000,000 paid on 1 lanuary 2011 (a discount rate of 8% was applied to value the liability in the financial statements of XY); and The transfer of 1,000,000 shares in XY vwith a nominal value of $1 each and an agreed value on the date of acquisition of $3 each. 2. As at 1 lanuary 2009 the fair value of the net assets acquired was the same as the book value with the exception of property, plant and equipment that had a fair value that was $600,00 higher than its carrying value. The assets were assessed to have a remaining useful life of 6 years from the date of acquisition. Depreciation is charged to cost af sales 3. On 31 December 2012 the goodwill arising on the acquisition of AZ has been impaired by 20%. There have been no previous impairments and impairments are charged to administrative expenses. 4. In the year to 31 December 2012, AZ sold goods to XY with a sales value of $300,000. 20% of the items remain in XY's inventories at the year end. AZ earns 25% gross margin on all sales. 5. The investment income recorded in XY's financial statements relates to: Dividend income from AZ, which has been correctly treated in XY's individual financial statements Income from a trade investment in another entity, LM. XY has a 10% shareholding in LM. Required: (a) Prepare the consolidated statement of comprehensive income and the consolidated statement of changes in equity for the XY Group for the year ended 31 December 2012. (20 marks) On 1 February 2013, XY acquired a further investment in LM. XY now holds a total of 60% of the equity share capital of LM. (b) Explain how this additional acquisition will impact on the preparation ot the consolidated financial statements for the year to 31 December 2013. (5 marks) (Total for Question Six = 25 marks)

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Consolidated statement of comprehensive income Consolidated statement of comprehensive income for the year ended 31 December 2012 for the XY Group all workings in 000 000 Revenue 3200 2400 300 W1 53...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started