Answered step by step

Verified Expert Solution

Question

1 Approved Answer

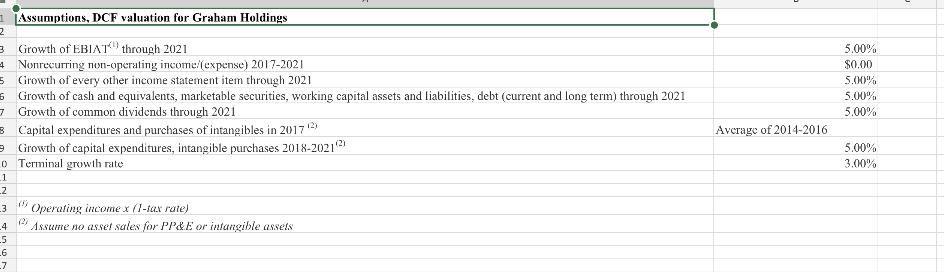

1 Assumptions, DCF valuation for Graham Holdings 2 3 Growth of EBIAT through 2021 4 Nonrecurring non-operating income/(expense) 2017-2021 5 Growth of every other

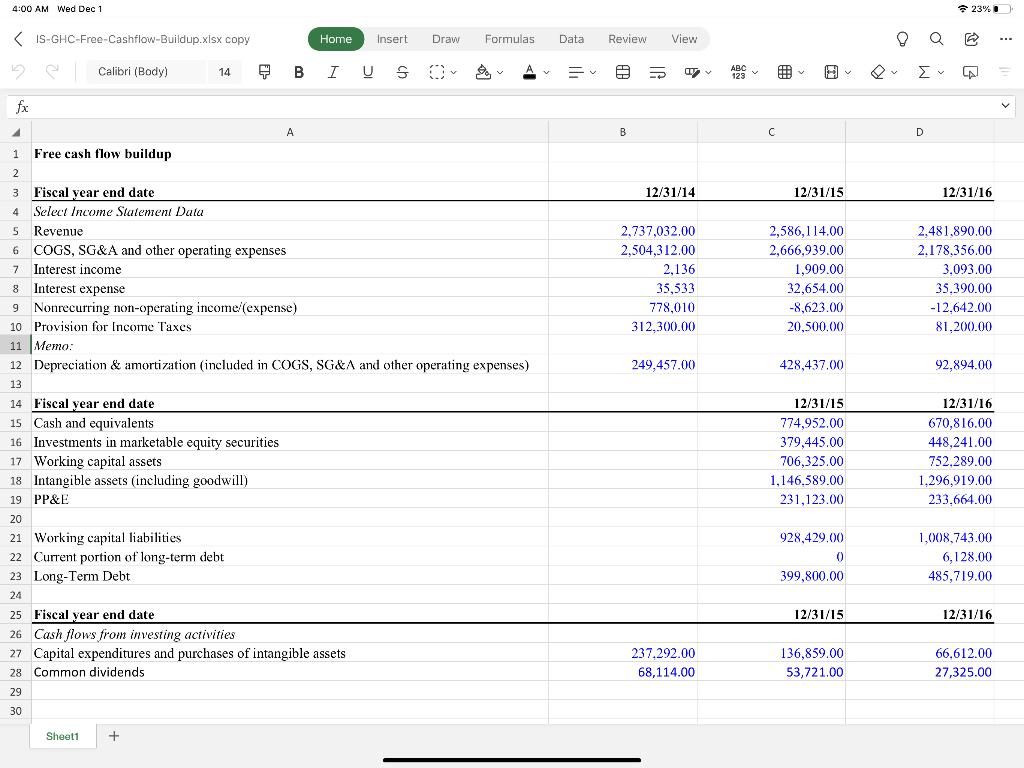

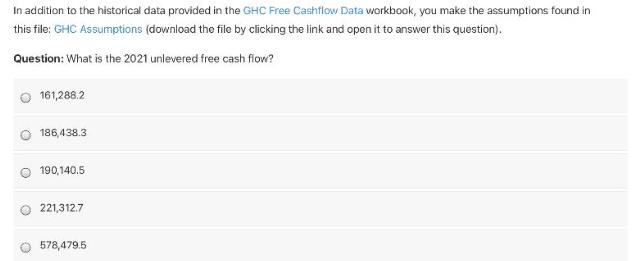

1 Assumptions, DCF valuation for Graham Holdings 2 3 Growth of EBIAT through 2021 4 Nonrecurring non-operating income/(expense) 2017-2021 5 Growth of every other income statement item through 2021 6 Growth of cash and equivalents, marketable securities, working capital assets and liabilities, debt (current and long term) through 2021 7 Growth of common dividends through 2021 (2) 8 Capital expenditures and purchases of intangibles in 2017 Growth of capital expenditures, intangible purchases 2018-20212) o Terminal growth rate 1 _2 (8) (2) 3 Operating incomex (1-tax rate) 4567 Assume no asset sales for PP&E or intangible assets Average of 2014-2016 5.00% $0.00 5.00% 5.00% 5.00% 5.00% 3.00% 4:00 AM Wed Dec 1 5 fx IS-GHC-Free-Cashflow-Buildup.xlsx copy e Calibri (Body) A 1 2 3 Fiscal year end date 4 Select Income Statement Data Free cash flow buildup 14 5 Revenue 6 COGS, SG&A and other operating expenses 7 Interest income Interest expense 9 Nonrecurring non-operating income/(expense) 10 Provision for Income Taxes 14 Fiscal year end date 15 Cash and equivalents 16 Investments in marketable equity securities 17 Working capital assets 18 Intangible assets (including goodwill) 19 PP&E A 20 21 Working capital liabilities. 22 Current portion of long-term debt 23 Long-Term Debt 24 Sheet1 + Home BIUS 0 11 Memo: 12 Depreciation & amortization (included in COGS, SG&A and other operating expenses) 13 Insert Draw 25 Fiscal year end date 26 Cash flows from investing activities 27 Capital expenditures and purchases of intangible assets 28 Common dividends 29 30 Formulas Data Review View B 12/31/14 2,737,032,00 2,504,312.00 2,136 35,533 778,010 312,300.00 249,457.00 237,292.00 68,114.00 ABC 123 H 12/31/15 2,586,114.00 2,666,939.00 1,909.00 32,654.00 -8,623.00 20,500.00 428,437.00 12/31/15 774,952.00 379,445.00 706,325.00 1,146,589.00 231,123.00 928,429.00 0 399,800.00 12/31/15 136,859.00 53,721.00 8 v V D 23% @ LAI 12/31/16 2,481,890.00 2.178.356.00 3,093.00 35.390.00 -12,642.00 81,200.00 92,894.00 12/31/16 670,816.00 448,241.00 752,289.00 1,296,919.00 233.664.00 1,008,743.00 6,128.00 485,719.00 12/31/16 66,612.00 27,325.00 ... V In addition to the historical data provided in the GHC Free Cashflow Data workbook, you make the assumptions found in this file: GHC Assumptions (download the file by clicking the link and open it to answer this question). Question: What is the 2021 unlevered free cash flow? 161,288.2 186,438.3 O 190,140.5 221,312.7 578,479.5

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The 2021 unlevered free cash flow is 2213127 CALCULATION Revenue in 2021 30398825 Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started