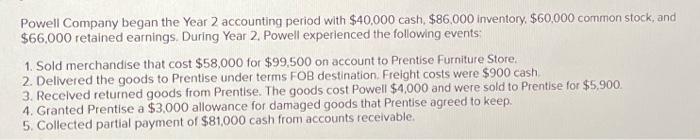

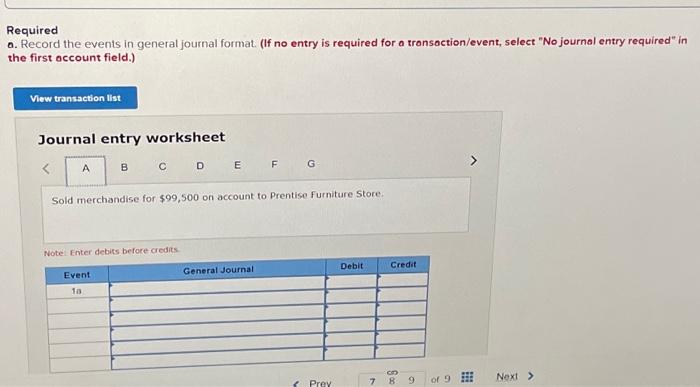

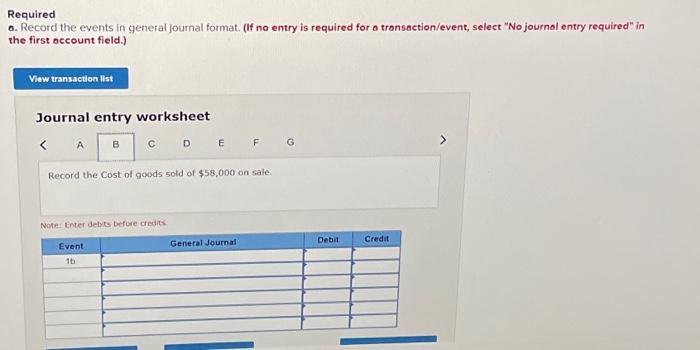

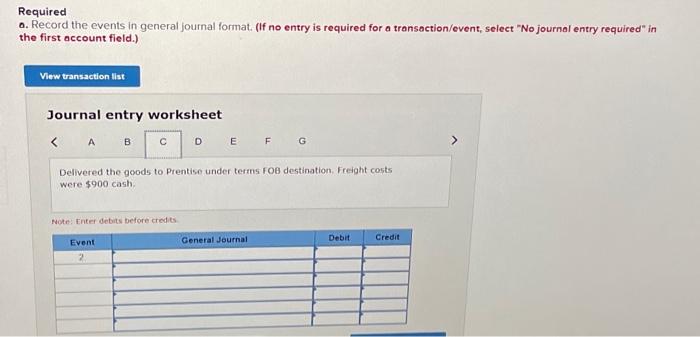

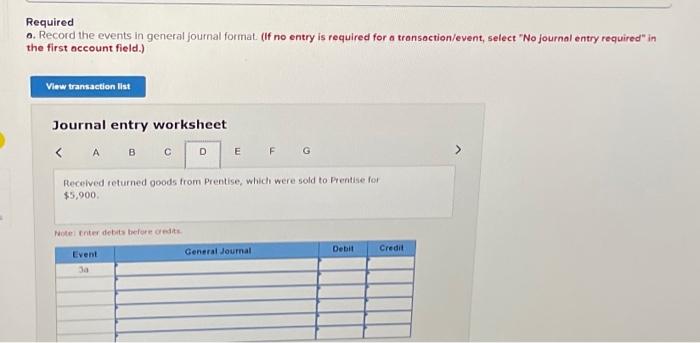

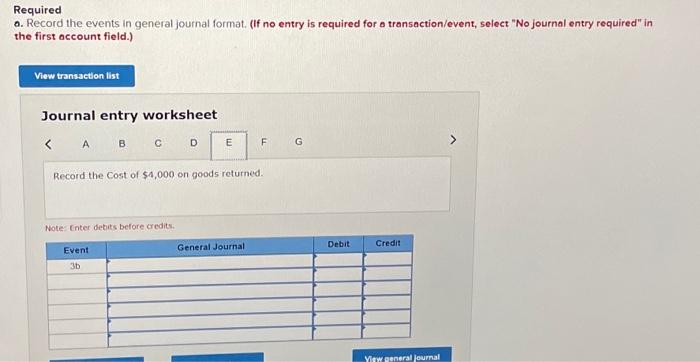

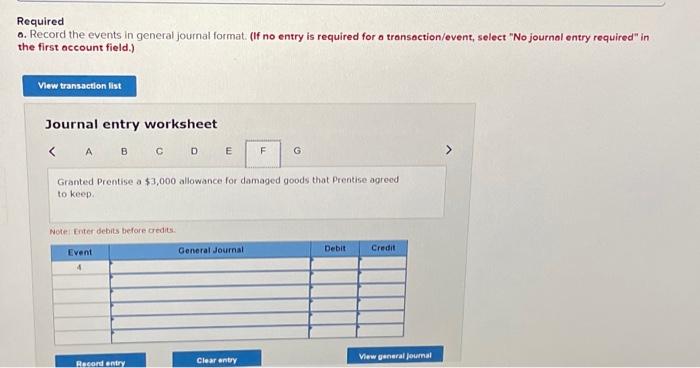

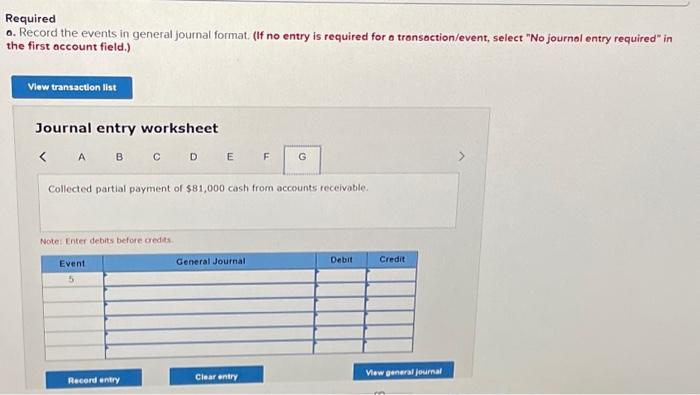

Powell Company began the Year 2 accounting period with $40,000 cash, $86,000 inventory, $60,000 common stock, and $66.000 retained earnings. During Year 2. Powell experienced the following events 1. Sold merchandise that cost $58,000 for $99,500 on account to Prentise Furniture Store. 2. Dellvered the goods to Prentise under terms FOB destination. Freight costs were $900 cash. 3. Recelved returned goods from Prentise. The goods cost Powell $4,000 and were sold to Prentise for $5,900. 4. Granted Prentise a $3,000 allowance for damaged goods that Prentise agreed to keep. 5. Collected partial payment of $81,000 cash from accounts receivable. Required . Record the events in general journal format. (If no entry is required for a tronsoction/event, select "No journol entry required" in the first occount field.) Journal entry worksheet B C D E F Collected partial payment of $81,000 cash from accounts receivable. Note Enter debits before credits. Required o. Record the events in general joumal format. (If no entry is required for a transoction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note Enter debits before cedits. Required o. Record the events in general journal format. (If no entry is required for a tronsoction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Delivered the goods to Prentise under terms FOB destination. Freight costs were $900 cash. Note: Enter debits before credits. Required . Record the events in general journal format. (If no entry is required for o tronsoction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the Cost of goods sold of $58,000 on sale Note Enter debes before credits. Required a. Record the events in general journal format. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Cnter debits before credits. Required a. Record the events in general journal format. (If no entry is required for a tronsoction/event, select "No journal entry required" in the first occount field.) Journal entry worksheet C D E F G Sold merchandise for $99,500 on account to Prentise furniture Store. Note Enter debits before credits Required o. Record the events in general journal format. (If no entry is required for a tronsoction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Recoived returned goods from Prentise, which were sold to Prentise for $5,900