Answered step by step

Verified Expert Solution

Question

1 Approved Answer

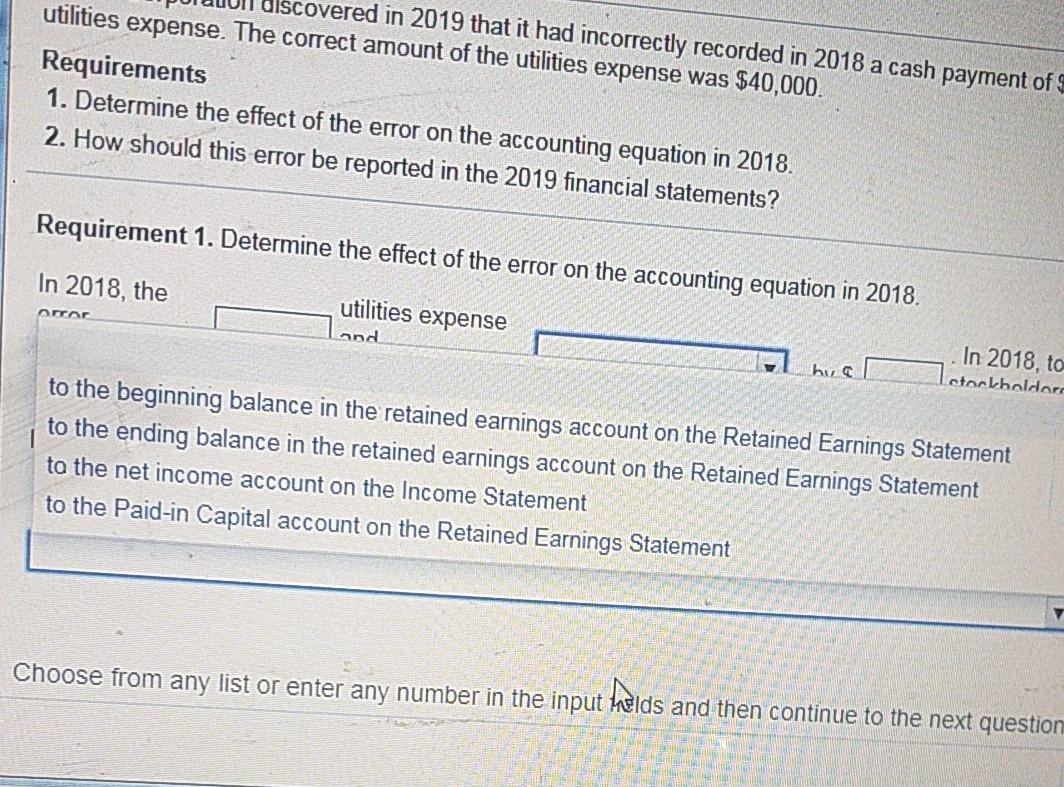

Powell Corporation discovered in 2019 that it had incorrectly recorded in 2018 a cash payment of $45,000 for utilities expense. The correct amount of the

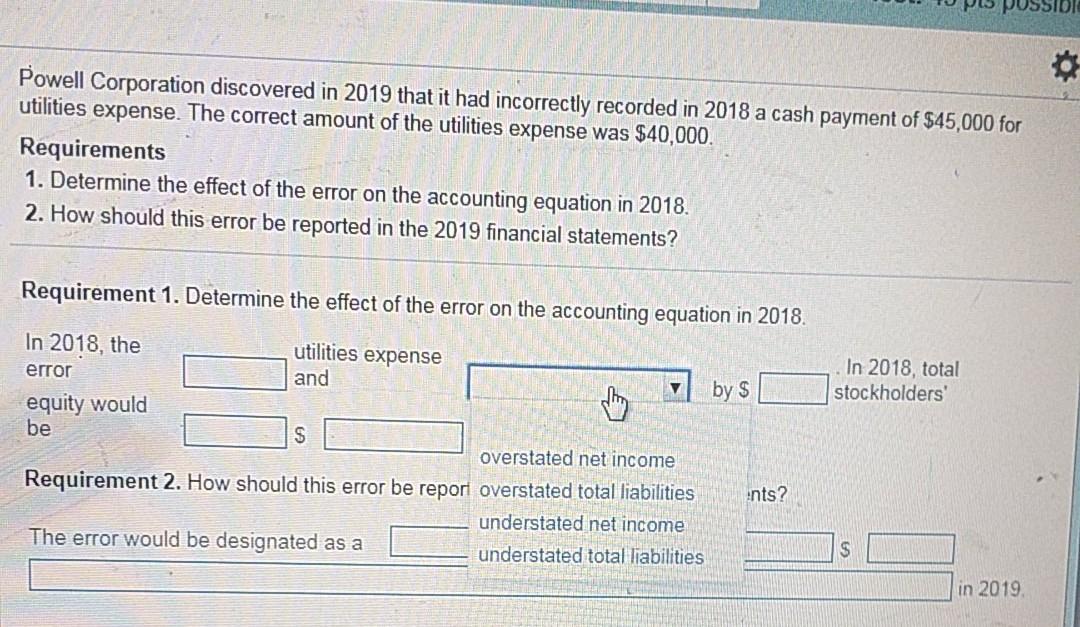

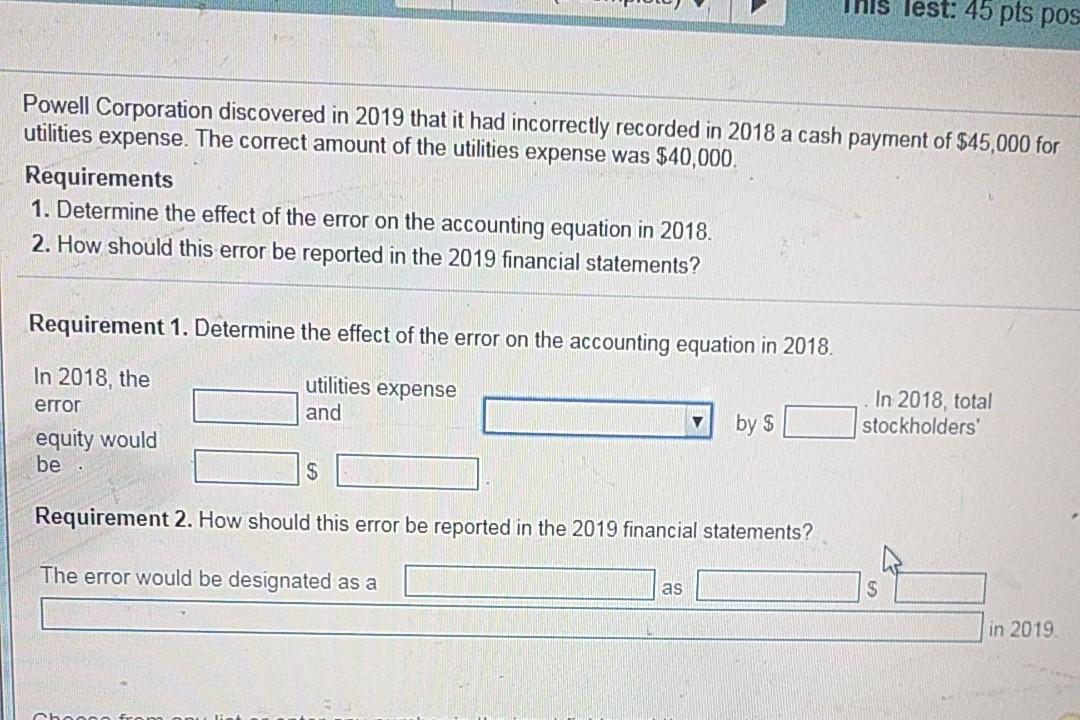

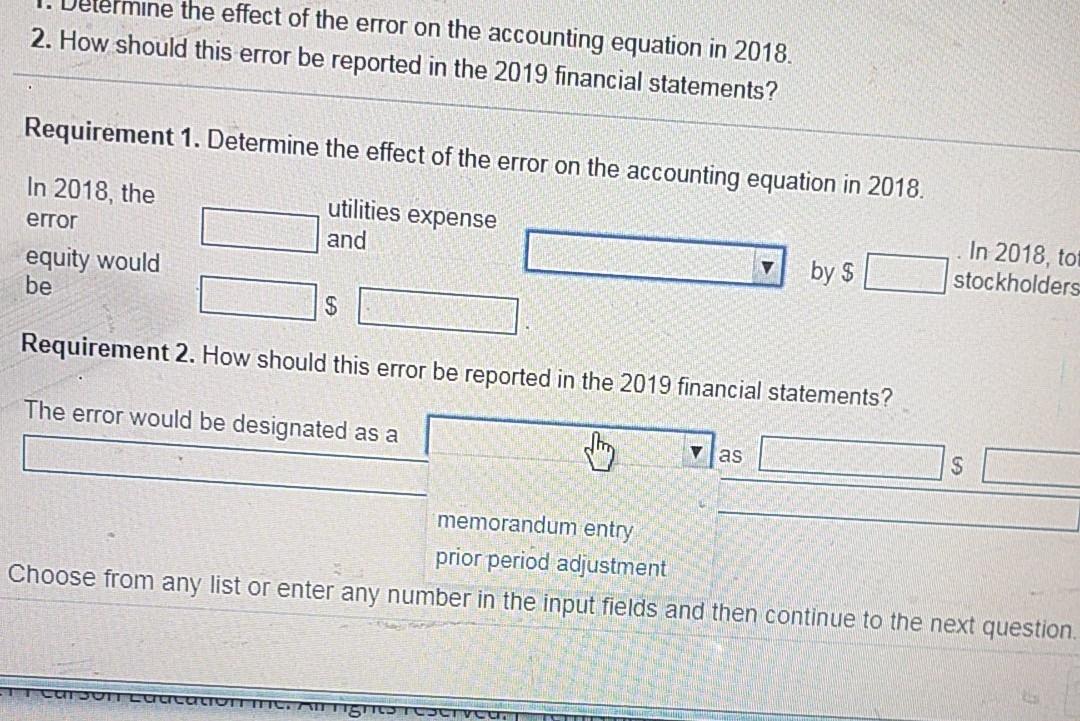

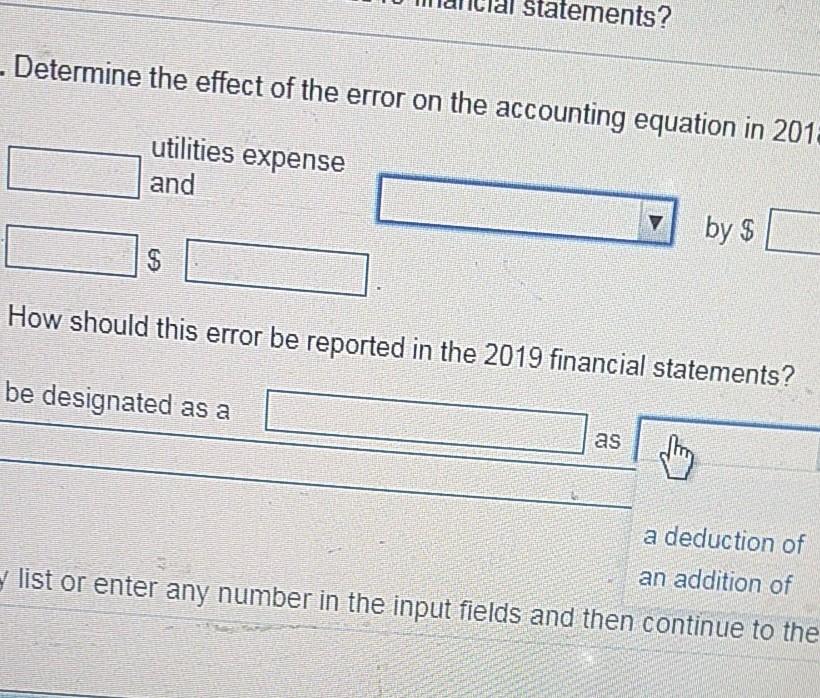

Powell Corporation discovered in 2019 that it had incorrectly recorded in 2018 a cash payment of $45,000 for utilities expense. The correct amount of the utilities expense was $40,000. Requirements 1. Determine the effect of the error on the accounting equation in 2018. 2. How should this error be reported in the 2019 financial statements? Requirement 1. Determine the effect of the error on the accounting equation in 2018. utilities expense In 2018, total stockholders' In 2018, the error and by $ equity would be S overstated net income Requirement 2. How should this error be repori overstated total liabilities ints? understated net income The error would be designated as a understated total liabilities $ in 2019 Inls lest: 45 pts pos Powell Corporation discovered in 2019 that it had incorrectly recorded in 2018 a cash payment of $45,000 for utilities expense. The correct amount of the utilities expense was $40,000. Requirements 1. Determine the effect of the error on the accounting equation in 2018. 2. How should this error be reported in the 2019 financial statements? Requirement 1. Determine the effect of the error on the accounting equation in 2018 utilities expense In 2018, the error equity would be. and In 2018, total stockholders' V by $ $ Requirement 2. How should this error be reported in the 2019 financial statements? The error would be designated as a as S in 2019 A. mine the effect of the error on the accounting equation in 2018. 2. How should this error be reported in the 2019 financial statements? Requirement 1. Determine the effect of the error on the accounting equation in 2018. utilities expense In 2018, the error equity would be and by $ In 2018, toi stockholders $ Requirement 2. How should this error be reported in the 2019 financial statements? The error would be designated as a hing vas $ memorandum entry prior period adjustment Choose from any list or enter any number in the input fields and then continue to the next question. SCTVCURT Statements? -Determine the effect of the error on the accounting equation in 2018 utilities expense and by $ $ How should this error be reported in the 2019 financial statements? be designated as a as a deduction of an addition of y list or enter any number in the input fields and then continue to the covered in 2019 that it had incorrectly recorded in 2018 a cash payment of utilities expense. The correct amount of the utilities expense was $40,000. Requirements 1. Determine the effect of the error on the accounting equation in 2018. 2. How should this error be reported in the 2019 financial statements? Requirement 1. Determine the effect of the error on the accounting equation in 2018. In 2018, the oor utilities expense and huc In 2018, to stockholders to the beginning balance in the retained earnings account on the Retained Earnings Statement to the ending balance in the retained earnings account on the Retained Earnings Statement to the net income account on the Income Statement to the Paid-in Capital account on the Retained Earnings Statement Choose from any list or enter any number in the input helds and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started