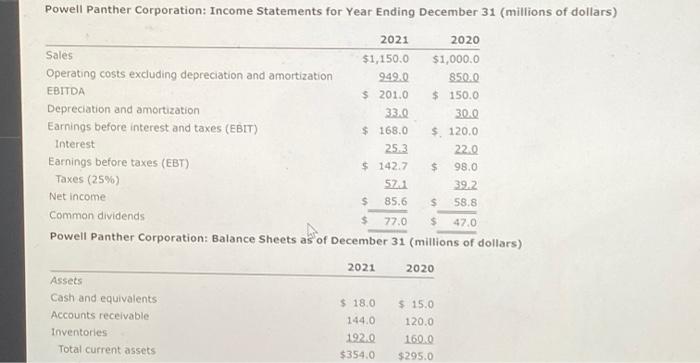

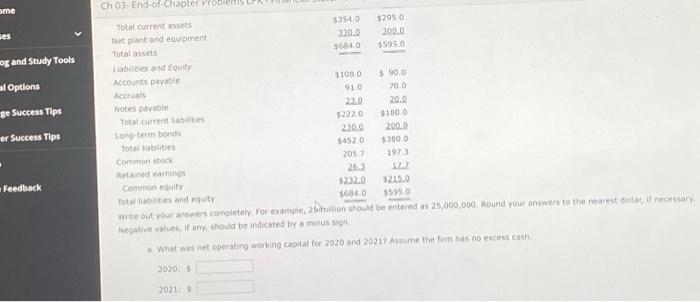

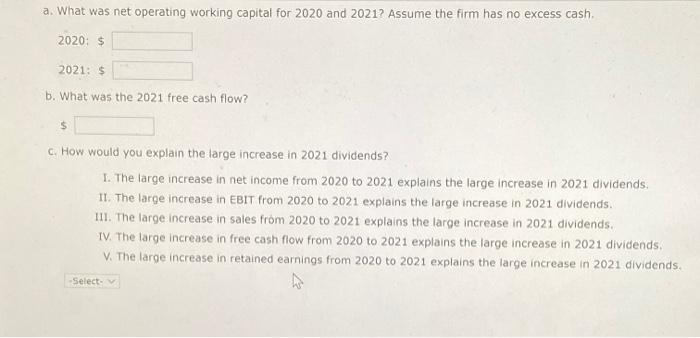

Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) 2021 2020 Sales $1,150.0 $1,000.0 Operating costs excluding depreciation and amortization 94940 850.0 EBITDA $201.0 $ 150.0 Depreciation and amortization 33.0 3040 Earnings before interest and taxes (EBIT) $168.0 $ 120.0 Interest 253 220 Earnings before taxes (EBT) $ 142.7 $ 98.0 Taxes (25%) 521 39.2 Net income 85.6 $ 58.8 Common dividends 77.0 $ 47.0 Powell Panther Corporation: Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cash and equivalents Accounts receivable Inventories Total current assets $ 18,0 144.0 1920 $354.0 $ 15.0 120.0 160.0 $295.0 ome ses og and Study Tools l Options ge Success Tips Ch 03. End-of-Chapter Problems LN Total current assets S3540 $2950 Net plant and equipment 3200 300.0 Total assets 56040 $595.0 Cables and Equity Accounts payable 3105.0 $90.0 Accruals 910 700 Notes pavable 2220 Total current abilities 52220 3180.0 Long-term bonds 2002 Total abilities 54520 3000 Common stock 205.7 1973 Retained earnings 20 VA Common equity $232.0 $215.0 Totals and equity $6040 5595.0 write out your answers completely. For example, hmmon should be entered as 25,000,000 Round your answers to the nearest dla necessary Negative values, if any should be indicated by a mission What was net operating working capital for 2020 and 20217 Assume the imas no excess cash er Success Tips Feedback 2020 20215 a. What was net operating working capital for 2020 and 2021? Assume the firm has no excess cash 2020: $ 2021: $ b. What was the 2021 free cash flow? $ C. How would you explain the large increase in 2021 dividends? I. The large increase in net income from 2020 to 2021 explains the large increase in 2021 dividends 11. The large increase in EBIT from 2020 to 2021 explains the large increase in 2021 dividends. III. The large increase in sales from 2020 to 2021 explains the large increase in 2021 dividends. IV. The large increase in free cash flow from 2020 to 2021 explains the large increase in 2021 dividends. V. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends. Select