Question

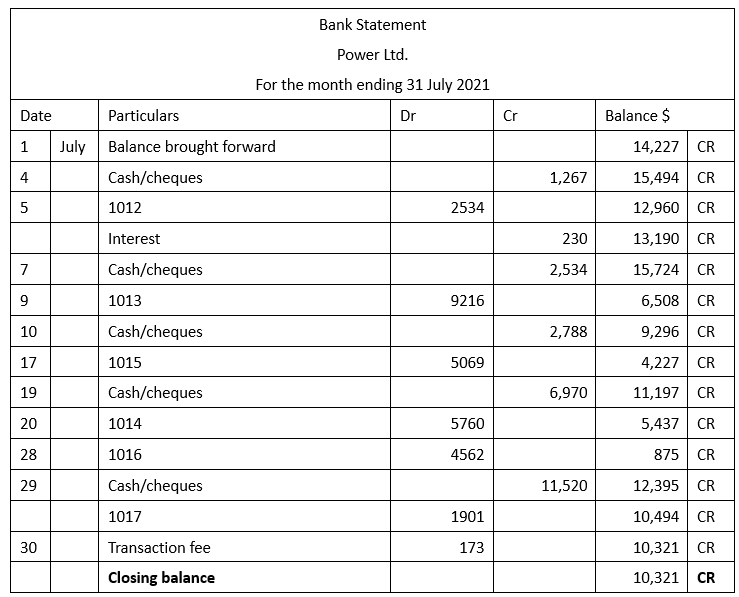

Power Ltd. received its bank statement for the month ended 31 July 2021. It shows a credit balance of $10,321, while the firms cash at

Power Ltd. received its bank statement for the month ended 31 July 2021. It shows a credit balance of $10,321, while the firms cash at bank ledger shows a different balance from its bank statement. It has a debit balance of $3,014 at the end of the month. At the beginning of July, its cash at bank ledger had a debit balance of $14,227.

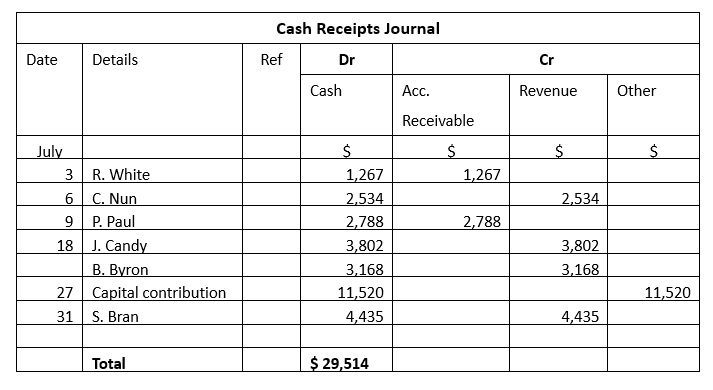

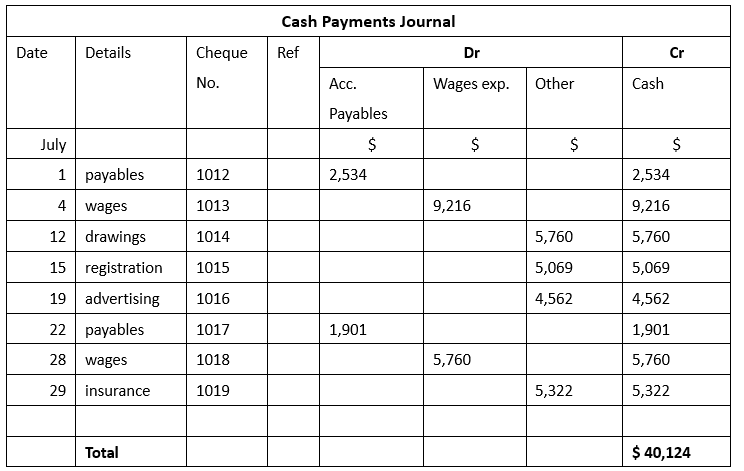

The businesss cash receipts and cash payments journals and the Bank Statement for the month are provided below:

Required

a. Update the cash receipts and cash payments journals by entering the necessary adjustments and total the cash receipts and payments in the journals for the month.

b. Post the total cash receipts and cash payments to the Cash at Bank ledger account and balance the account (using the running balance format for the ledger account).

c. Prepare a bank reconciliation statement for the month ended 31 July 2021.

d. What is the amount of cash that should be reported on the balance sheet prepared as at 31 July 2021, and what is the beginning cash balance that will be shown on the next months bank statement?

Cash Receipts Journal Ref Dr Date Details Cr Cash Acc. Revenue Other Receivable S $ $ 1,267 2,534 2,788 July 3 R. White 6 C. Nun 9 P. Paul 18 J. Candy B. Byron 27 Capital contribution 31 S. Bran $ 1,267 2,534 2,788 3,802 3,168 11,520 4,435 3,802 3,168 11,520 4,435 Total $ 29,514 Date Details Cheque Cr No. Cash Payments Journal Ref Dr Acc. Wages exp. Payables $ $ Other Cash $ $ July 1 payables 1012 2,534 2,534 4 1013 9,216 9,216 wages drawings 12 1014 5,760 5,760 15 1015 5,069 5,069 19 registration advertising payables 1016 4,562 4,562 22 1017 1,901 1,901 28 1018 5,760 5,760 wages insurance 29 1019 5,322 5,322 Total $ 40,124 Bank Statement Power Ltd. For the month ending 31 July 2021 Date Particulars Dr Cr Balance $ 1 14,227 CR 4 July Balance brought forward Cash/cheques 1012 1,267 15,494 CR 5 2534 12,960 CR Interest 230 13,190 CR 7 Cash/cheques 2,534 15,724 CR 9 9 1013 9216 6,508 CR 10 Cash/cheques 2,788 9,296 CR 17 1015 5069 4,227 CR 19 Cash/cheques 6,970 11,197 CR 20 1014 5760 5,437 CR 28 1016 4562 875 CR 29 Cash/cheques 11,520 12,395 CR 1017 1901 10,494 CR 30 Transaction fee 173 10,321 CR Closing balance 10,321 CRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started