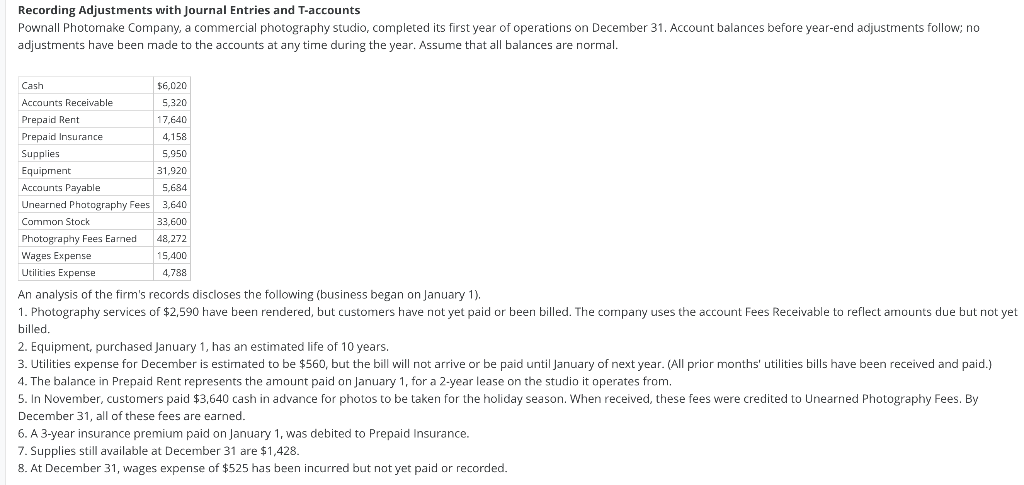

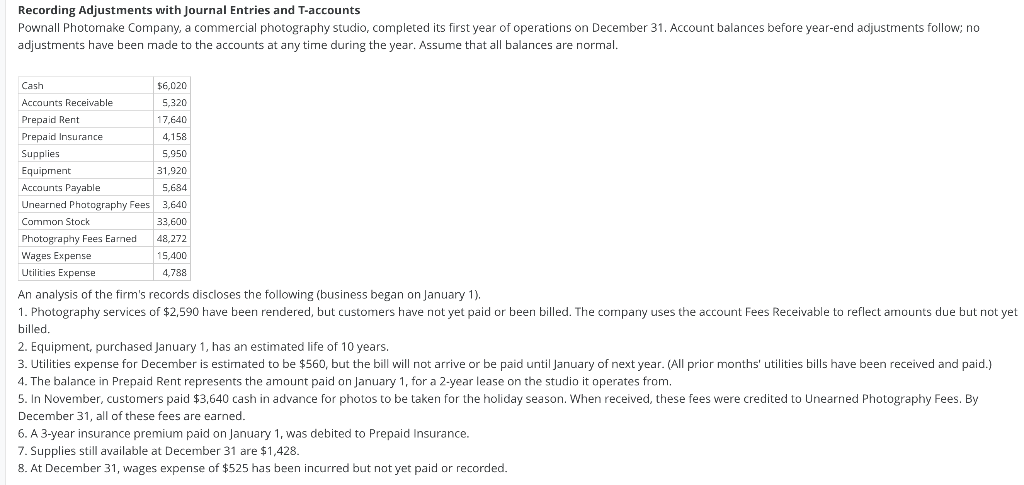

Pownall Photomake Company, a commercial photography studio, completed its first year of operations on December 31. Account balances before year-end adjustments follow; no adjustments have been made to the accounts at any time during the year. Assume that all balances are normal.

Anything typed in the blue rectangles are my answers, but I think they need correcting.

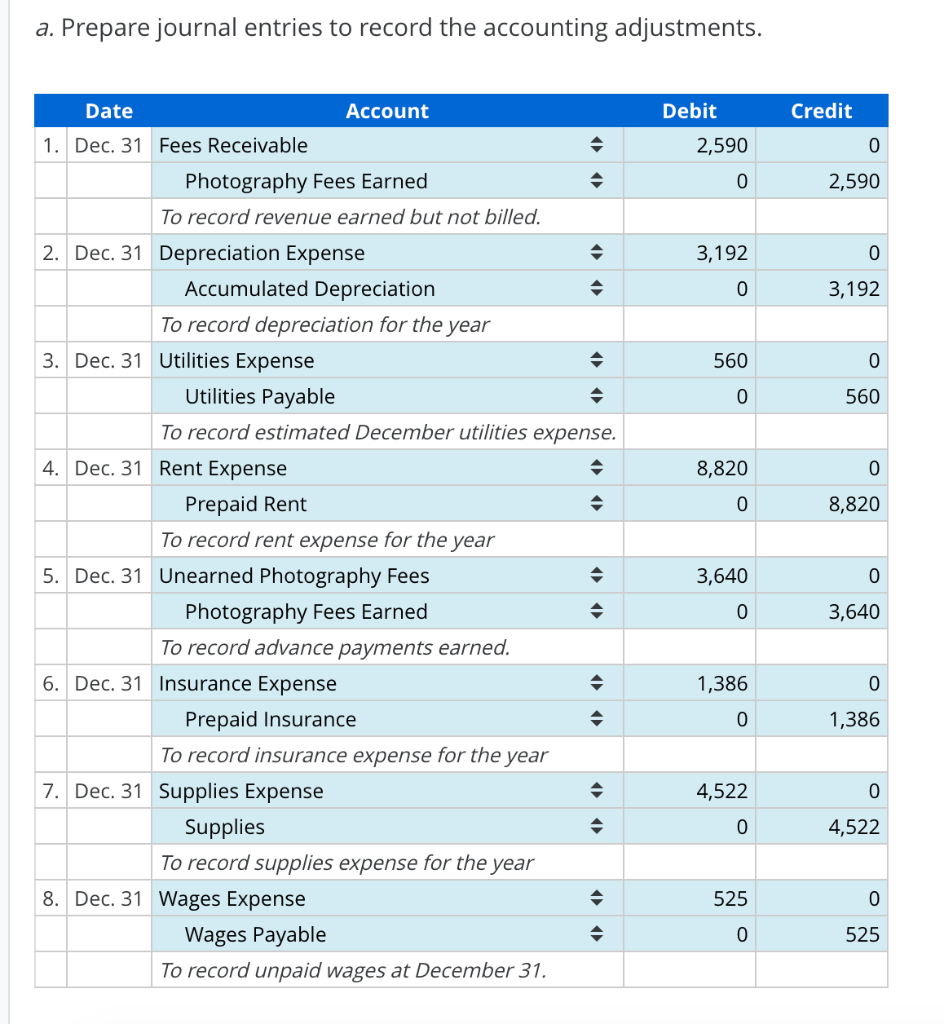

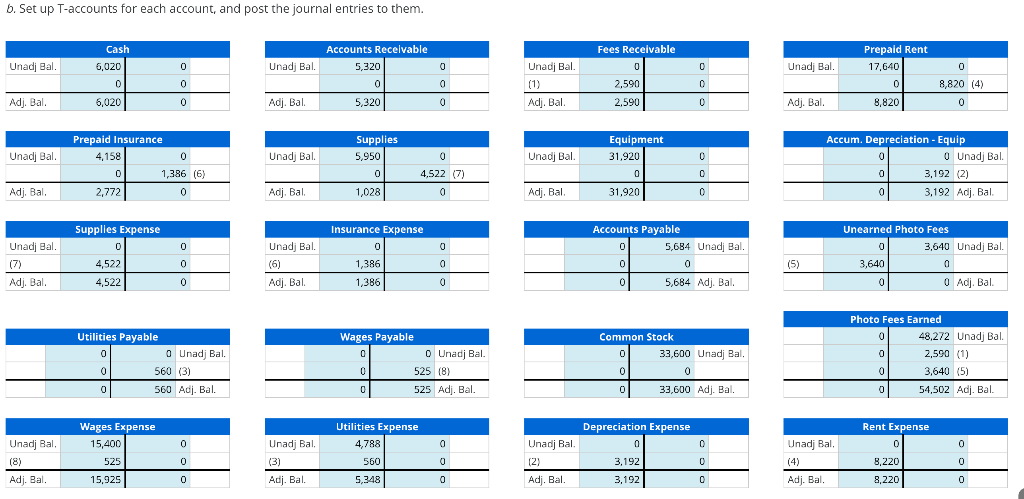

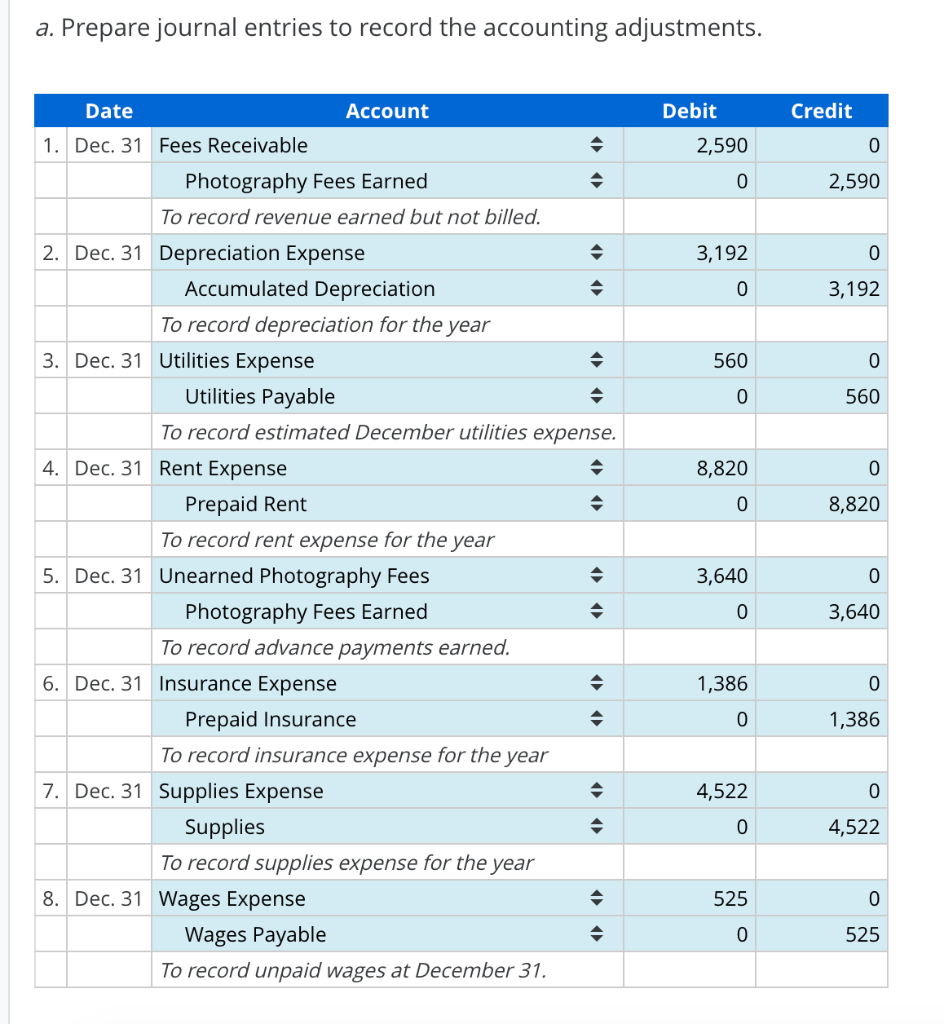

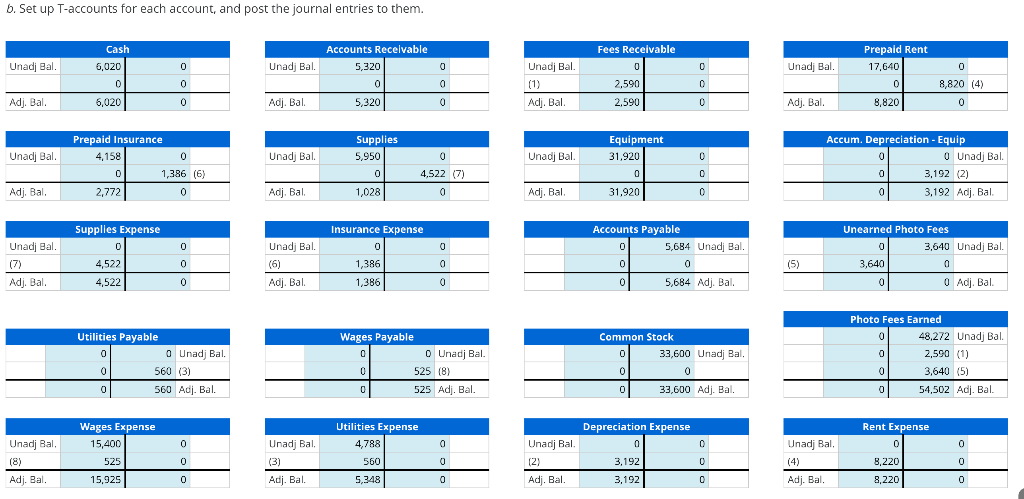

Recording Adjustments with Journal Entries and T-accounts Pownall Photomake Company, a commercial photography studio, completed its first year of operations on December 31. Account balances before year-end adjustments follow; no adjustments have been made to the accounts at any time during the year. Assume that all balances are normal. Cash Accounts Receivable Prepaid Rent Prepaid Insurance Supplies Equipment Accounts Payable Unearned Photography Feest Common Stock Photography Fees Earned Wages Expense Utilities Expense $6,020 5.320 17,640 4,158 5,950 31,920 5,684 3,640 33,600 48,272 15,400 4,788 An analysis of the firm's records discloses the following (business began on January 1). 1. Photography services of $2,590 have been rendered, but customers have not yet paid or been billed. The company uses the account Fees Receivable to reflect amounts due but not yet billed. 2. Equipment, purchased January 1, has an estimated life of 10 years. 3. Utilities expense for December is estimated to be $560, but the bill will not arrive or be paid until January of next year. (All prior months' utilities bills have been received and paid.) 4. The balance in Prepaid Rent represents the amount paid on January 1, for a 2-year lease on the studio it operates from. 5. In November, customers paid $3,640 cash in advance for photos to be taken for the holiday season. When received, these fees were credited to Unearned Photography Fees. By December 31, all of these fees are earned. 6. A 3-year insurance premium paid on January 1, was debited to Prepaid Insurance. 7. Supplies still available at December 31 are $1,428. 8. At December 31, wages expense of $525 has been incurred but not yet paid or recorded. a. Prepare journal entries to record the accounting adjustments. Date 1. Dec. 31 Fees Receivable Photography Fees Earned Account To record revenue earned but not billed. 2. Dec. 31 Depreciation Expense Accumulated Depreciation To record depreciation for the year 4. Dec. 31 Rent Expense 3. Dec. 31 Utilities Expense Utilities Payable To record estimated December utilities expense. Prepaid Rent To record rent expense for the year 5. Dec. 31 Unearned Photography Fees Photography Fees Earned To record advance payments earned. 6. Dec. 31 Insurance Expense Prepaid Insurance To record insurance expense for the year 7. Dec. 31 Supplies Expense Supplies To record supplies expense for the year 8. Dec. 31 Wages Expense Wages Payable To record unpaid wages at December 31. Debit 2,590 0 3,192 0 560 0 8,820 0 3,640 0 1,386 0 4,522 0 525 0 Credit 0 2,590 0 3,192 0 560 0 8,820 0 3,640 0 1,386 0 4,522 0 525 b. Set up T-accounts for each account, and post the journal entries to them. Unadj Bal. Adj. Bal Unadj Bal Adj. Bal. Unadj Bal. (7) Adj. Bal. Unadj Bal. (8) Adj. Bal. Cash 6,020 0 6,020 Prepaid Insurance 4,158 0 2,772 Supplies Expense 0 4,522 4,522 Utilities Payable 0 0 0 0 0 0 Wages Expense 15,400 525 15,925 0 1,386 (6) 0 0 0 0 0 Unadj Bal. 560 (3) 560 Adj. Bal. 0 0 0 Unadj Bal. Adj. Bal. Unadj Bal. Adj. Bal. Unadj Bal. (6) Adj. Bal. Unadij Bal. (3) Adj. Bal Accounts Receivable 5,320 0 5,320 Supplies 5,950 0 1,028 Insurance Expense 0 1,386 1,386 Wages Payable 0 0 0 0 0 0 0 4,522 (7) 0 Utilities Expense 4,788 560 5,348 0 0 0 0 Unadj Bal. 525 (8) 525 Adj. Bal. 0 0 0 Unadj Bal. (1) Adj. Bal. Unadj Bal. Adj. Bal. Unadj Bal. (2) Adj. Bal. Fees Receivable 0 2,590 2,590 Equipment 31,920 0 31,920 Accounts Payable 0 0 0 Common Stock 0 0 0 0 0 3,192 3,192 0 0 0 5,684 Unadj Bal. 0 5,684 Adj. Bal. Depreciation Expense 0 0 0 33,600 Unadj Bal. 0 33,600 Adj. Bal. 0 0 0 Unadj Bal. Adj. Bal. (5) Prepaid Rent 17,640 0 8,820 Unadj Bal, (4) Adj. Bal. Accum. Depreciation - Equip 0 0 0 0 8,820 (4) 0 0 3,640 0 3,192 (2) 3,192 Adj. Bal. Unearned Photo Fees 0 Unadj Bal. 3,640 Unadj Bal. 0 0 Adj. Bal. Photo Fees Earned 0 0 0 0 Rent Expense 0 8,220 8,220 48,272 Unadj Bal. 2,590 (1) 3,640 (5) 54,502 Adj. Bal. 0 0 0