Question

PPE and intangible assets A, Determine the acquisition cost of each asset. B, Determine the 2016 depreciation/amortization for each asset. Round the amounts to the

PPE and intangible assets

A, Determine the acquisition cost of each asset.

B, Determine the 2016 depreciation/amortization for each asset. Round the amounts to the nearest dollar; compute the depreciation per unit on machinery to 4 decimal places. Assume partial-year depreciation is based on the number of months in use. The machinery produced 109,000 units after Redbud acquired it in 2016.

C, Determine the amount reported on the 2016 balance sheet for each asset.

D, Determine the 2017 depreciation/amortization for each asset. Round the amounts to the nearest dollar. The machinery produced 150,000 units in 2017.

E, On June 30, 2018, the equipment was sold for $290,000. Record the journal entries for:

(1) depreciation on the equipment from January 1, 2018 to June 30, 2018 and

(2) the sale of the equipment.

F, Which of the following components of cost allocation affected the amount of the gain/loss Redbud recorded on the sale of the equipment in requirement 5?

a. The depreciation method.

b. The estimated useful life.

c. Neither a or b.

d. Both a and b.

G, At the beginning of 2018, Redbud discovered that the building contains asbestos. To ensure the safety of employees, Redbud eliminated access to areas where asbestos was discovered. In addition, Redbud made plans to demolish the building at the beginning of 2021 (in 3 years).

Determine the 2018 depreciation on the building if Redbud accounted for this discovery as a change in the estimated useful life of the building. When finding the book value at the beginning of 2018, remember that the building was used for a partial period in 2016.

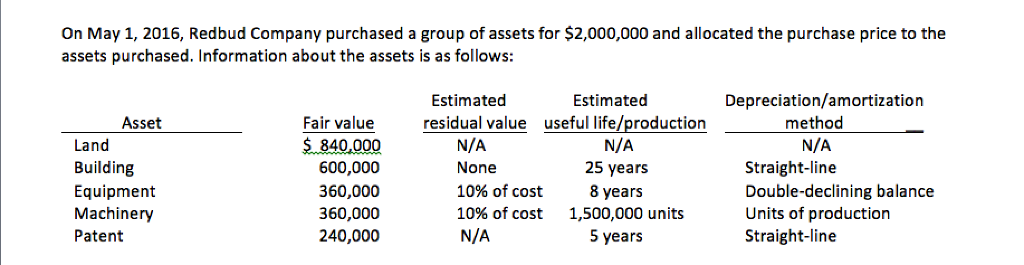

on May 1, 2016, Redbud Company purchased a group of assets for $2,000,000 and allocated the purchase price to the assets purchased. Information about the assets is as follows: Depreciation/amortization Estimated Estimated Fair value residual value useful life/production Asset method Land N/A N/A N/A 840,000 Building 25 years Straight-line 600,000 None 10% of cost 8 years Double-declining balance Equipment 360.000 10% of cost 1,500,000 units Units of production Machinery 360.000 N/A Patent 240,000 Straight-line 5 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started