PPLePl

PPLePl

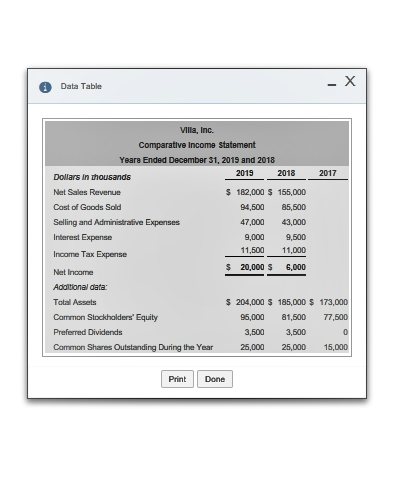

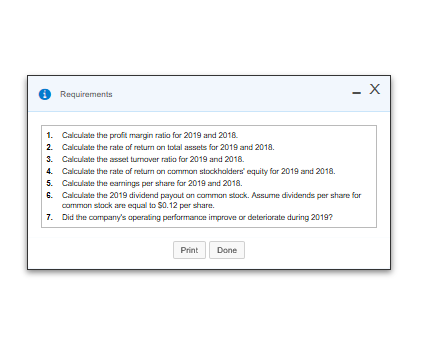

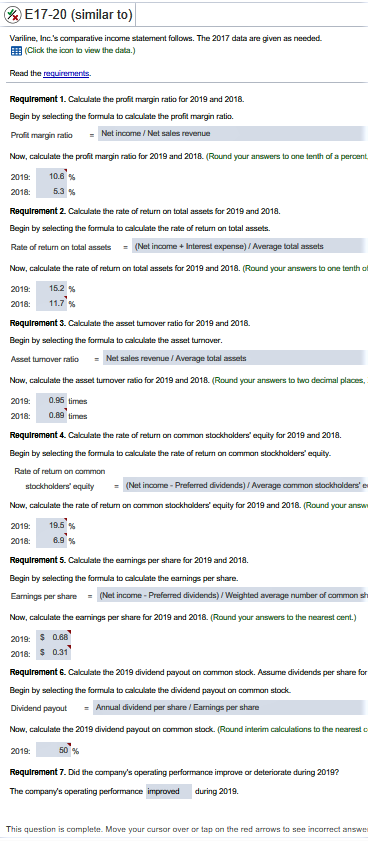

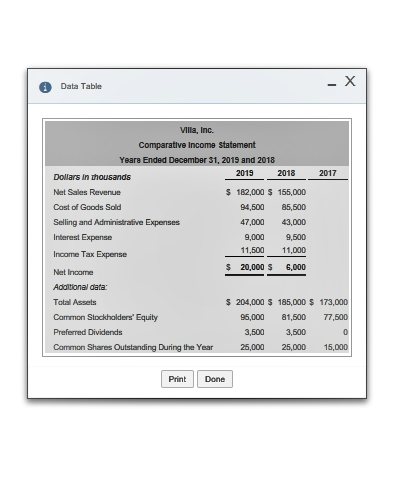

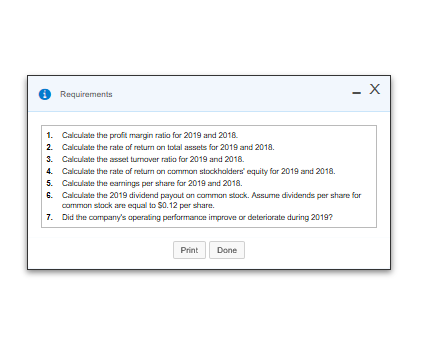

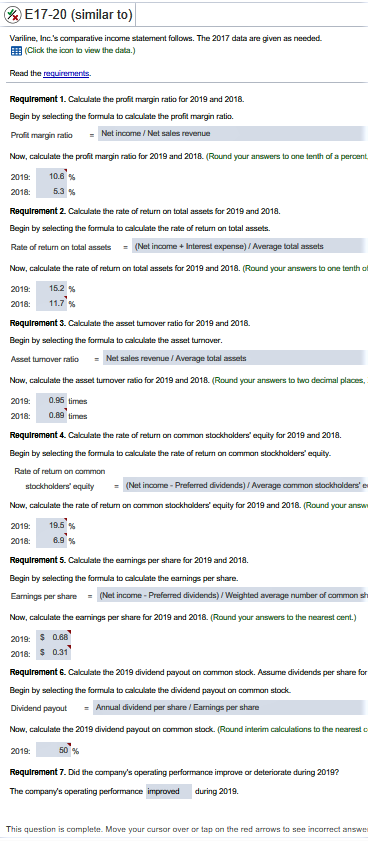

E17-20 (similar to) Variline, Inc.'s comparative income statement follows. The 2017 data are given as needed (Click the ican to view the data.) Read the requirements Requlrement 1. Calculate the profit margin ratio for 2019 and 2018. Begin by selecting the formula to calculate the profit margin ratio Profit margin ratio Now, calculate the profit margin ratio for 2019 and 2018 (Round your anewers to ane tenth of a percent 2019: 10.6 % 2018: Requirement 2. Caculate the rate of returm on total assets for 2019 and 2018. Begin by selecting the formula to calculate the rate of return on total assets Rate of return on total assets(Net income +Interest expense) / Average total assets Now, calculate the rate of return on total assets far 2019 and 2018. (Round your answers to one tenth at 2019:15.2 2018: 11.7 % Requirement 3. Calculate the asset tumaver ratio for 2019 and 2018. Begin by selecting the formula to calculate the asset tumover Asset tunaver ratioNet sales revenue Average total assets Now, calculate the asset turnover ratio for 2019 and 2018 (Round your anewers to two decimal places 2019: 0.95 2018: 0.89 times Requirement 4. Calculate the rate of return on common stockholders' equity for 2019 and 2018. Begin by selecting the formula to calculate the rate of returm on common stockholders' equity. Net income/Net sales revenue 3 % Rate of retum on common stockholders equity (Net income-Preferred dividends) Average common stockholders'e Now, calculate the rate of return on cammon stockholders equity for 2019 ard 2018. (Round your answ 2019: 19.5 % 2018: Requirement 5. Calculate the eamings per share for 2019 and 2018. Begin by selecting the formula to calculate the earnings per share. Eamings per share(Net income-Preferred dividends) /Weighted average number of common s Now, calculate the eamings per share for 2019 and 2018. (Round your answers to the nearest cent.) 2019: 0.68 2018: $ 0.31 Requirement &. Calculate the 2019 dividend payout an cammon stack. Assume dividends per share for Begin by selecting the formula to calculate the dividend payout on common stock Dividend payoutAnnual dividend per share/Earnings per share Now, calculate the 2019 dividend payout an common stock. Round interim calculations to the nearest c 2019: 6.9 % 50% Requirement 7. Did the company's aperating performance imprave ar deteriorate during 20192 The company's operating performance improved during 2019. This question is complete. Move your cursor over or tap on the red arrows to see incorrect answe Data Table Villa, Inc. Comparative Income statement Yeara Ended December 31, 2015 and 2018 2018 Dollars In thousands Net Sales Revenue Cast of Goods Sold Selling and Administrative Expenses Interest Expense Income Tax Expense Net Incane Adaltionel data Total Assets Common Stockholders Equity Preferred Dividends Common Shares s 182,000 $s 155,000 94,500 85,500 47,000 43,000 9,000 9,500 11,500 11,000 $ 20,000 6,000 S 204,000 $ 185,000 $ 173,000 95,000 81,500 77,500 3,500 25,000 25,000 15,000 3,500 During the Year Print Done Requirements 2. Calculate the rate of reburn on total assets for 2019 and 2018. Cacuate the asset turnaver ratio far 2019 and 2018 4 Calcuate the rate of returm on common stockholders' equity far 2019 and 2018. 5. Calcuate the earnings per share far 2019 and 2018. G. Calcuate the 2019 dividend payaut an common stack. Assume dividends per share far common stack are equal to $0.12 per share Did the company's aperating performance imprave or deteriorate during 2019? Print Done

PPLePl

PPLePl