Question

Pr. 11-16-146 Basic and diluted EPS. Assume that the following data relative to Kane Company for 2013 is available: Net Income $2,100,000 Transactions in Common

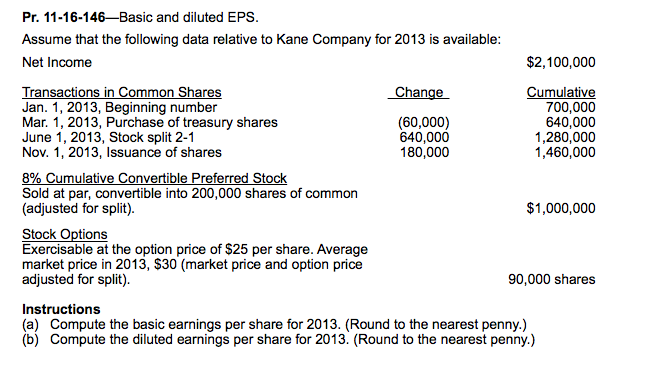

Pr. 11-16-146Basic and diluted EPS.

Assume that the following data relative to Kane Company for 2013 is available:

Net Income $2,100,000

Transactions in Common Shares Change Cumulative

Jan. 1, 2013, Beginning number 700,000

Mar. 1, 2013, Purchase of treasury shares (60,000) 640,000

June 1, 2013, Stock split 2-1 640,000 1,280,000

Nov. 1, 2013, Issuance of shares 180,000 1,460,000

8% Cumulative Convertible Preferred Stock

Sold at par, convertible into 200,000 shares of common

(adjusted for split). $1,000,000

Stock Options

Exercisable at the option price of $25 per share. Average

market price in 2013, $30 (market price and option price

adjusted for split). 90,000 shares

Instructions

(a) Compute the basic earnings per share for 2013. (Round to the nearest penny.)

(b) Compute the diluted earnings per share for 2013. (Round to the nearest penny.)

Pr. 11-16-146-Basic and diluted EPS. Assume that the following data relative to Kane Company for 2013 is available: $2,100,000 Net Income Change Transactions in Common Shares Cumulative Jan. 1, 2013, Beginning number 700,000 (60,000) 640,000 Mar. 1, 2013, Purchase of treasury shares 1,280,000 June 1, 2013, Stock split 2-1 640,000 180,000 1,460,000 Nov. 1, 2013, Issuance of shares 8% Cumulative Convertible Preferred Stock Sold at par, convertible into 200,000 shares of common $1,000,000 (adjusted for split Stock Options Exercisable at the option price of $25 per share. Average market price in 2013, $30 (market price and option price adjusted for split) 90,000 shares Instructions (a) Compute the basic earnings per share for 2013. (Round to the nearest penny.) (b) Compute the diluted earnings per share for 2013. (Round to the nearest penny.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started