Pr. 16-17-131 Available-for-sale equity securities. During the course of your examination of the financial statements of Doppler Corporation for the year ended December 31, 2013,

Pr. 16-17-131Available-for-sale equity securities.

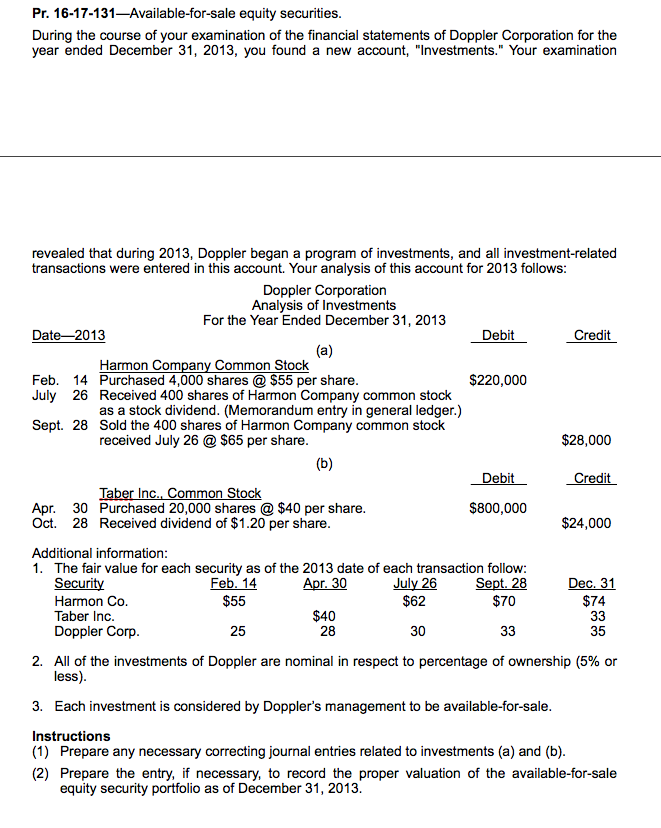

During the course of your examination of the financial statements of Doppler Corporation for the year ended December 31, 2013, you found a new account, "Investments." Your examination revealed that during 2013, Doppler began a program of investments, and all investment-related transactions were entered in this account. Your analysis of this account for 2013 follows:

Doppler Corporation

Analysis of Investments

For the Year Ended December 31, 2013

Date2013 Debit Credit

(a)

Harmon Company Common Stock

Feb. 14 Purchased 4,000 shares @ $55 per share. $220,000

July 26 Received 400 shares of Harmon Company common stock

as a stock dividend. (Memorandum entry in general ledger.)

Sept. 28 Sold the 400 shares of Harmon Company common stock

received July 26 @ $65 per share. $28,000

(b)

Debit Credit

Taber Inc., Common Stock

Apr. 30 Purchased 20,000 shares @ $40 per share. $800,000

Oct. 28 Received dividend of $1.20 per share. $24,000

Additional information:

1. The fair value for each security as of the 2013 date of each transaction follow:

Security Feb. 14 Apr. 30 July 26 Sept. 28 Dec. 31

Harmon Co. $55 $62 $70 $74

Taber Inc. $40 33

Doppler Corp. 25 28 30 33 35

2. All of the investments of Doppler are nominal in respect to percentage of ownership (5% or less).

3. Each investment is considered by Dopplers management to be available-for-sale.

Instructions

(1) Prepare any necessary correcting journal entries related to investments (a) and (b).

(2) Prepare the entry, if necessary, to record the proper valuation of the available-for-sale equity security portfolio as of December 31, 2013.

Pr. 16-17-131 Available-for-sale equity securities. During the course of your examination of the financial statements of Doppler Corporation for the year ended December 31, 2013, you found a new account, "Investments." Your examination revealed that during 2013, Doppler began a program of investments, and all investment-related transactions were entered in this account. Your analysis of this account for 2013 follows Doppler Corporation Analysis of investments For the Year Ended December 31, 2013 Date 2013 Debit Credit (a) Harmon Company Common Stock $220,000 Feb. 14 Purchased 4,000 shares $55 per share July 26 Received 400 shares of Harmon Company common stock as a stock dividend. (Memorandum entry in general ledger.) Sept. 28 sold the 400 shares of Harmon Company common stock received July 26 $65 per share $28,000 (b) Debit Credit Tab nc. Common Stock $800,000 Apr. 30 Purchased 20,000 shares $40 per share. $24,000 Oct. 28 Received dividend of $1.20 per share Additional information: 1. The fair value for each security as of the 2013 date of each transaction follow: Security Feb. 14 r, 30 July 26 Sept. 28 Dec. 31 $55 $62 $70 $74 Harmon Co Taber Inc $40 33 Doppler Corp. 28 30 33 35 2. All of the investments of Doppler are nominal in respect to percentage of ownership (5% or less 3. Each investment is considered by Doppler's management to be available-for-sale. Instructions (1) Prepare any necessary correcting journal entries related to investments (a) and (b) (2) Prepare the entry, if necessary, to record the proper valuation of the available-for-sale equity security portfolio as of December 31, 2013Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started