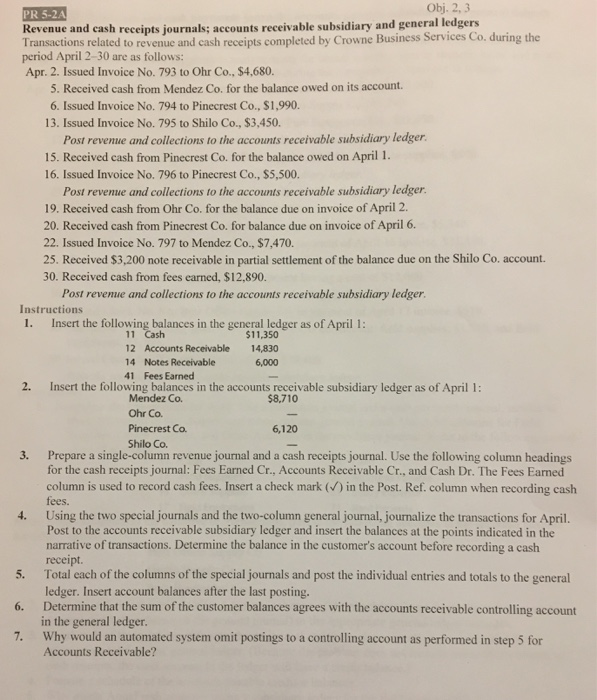

PR 5-2A Obj. 2, 3 Revenue and cash receipts journals: accounts receivable subsidiary and general ledgers Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period April 2-30 are as follows: Apr. 2. Issued Invoice No. 793 to Ohr Co., $4,680. 5. Received cash from Mendez Co. for the balance owed on its account 6. Issued Invoice No. 794 to Pinecrest Co., $1,990. 13. Issued Invoice No. 795 to Shilo Co., $3,450. Post revenue and collections to the accounts receivable subsidiary ledger. 15. Received cash from Pinecrest Co. for the balance owed on April 1. 16. Issued Invoice No. 796 to Pinecrest Co., $5,500. Post revenue and collections to the accounts receivable subsidiary ledger. 19. Received cash from Ohr Co. for the balance due on invoice of April 2. 20. Received cash from Pinecrest Co. for balance due on invoice of April 6. 22. Issued Invoice No. 797 to Mendez Co., $7,470. 25. Received $3,200 note receivable in partial settlement of the balance due on the Shilo Co. account. 30. Received cash from fees earned, $12,890. Post revenue and collections to the accounts receivable subsidiary ledger. Instructions 1. Insert the following balances in the general ledger as of April 1: 11 Cash $11,350 12 Accounts Receivable 14,830 14 Notes Receivable 6,000 41 Fees Earned 2. Insert the following balances in the accounts receivable subsidiary ledger as of April 1: Mendez Co. $8.710 Ohr Co. Pinecrest Co. 6,120 Shilo Co. 3. Prepare a single-column revenue journal and a cash receipts journal. Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Eamed column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. Using the two special journals and the two-column general journal, journalize the transactions for April Post to the accounts receivable subsidiary ledger and insert the balances at the points indicated in the narrative of transactions, Determine the balance in the customer's account before recording a cash receipt. Total each of the columns of the special journals and post the individual entries and totals to the general ledger, Insert account balances after the last posting. 6. Determine that the sum of the customer balances agrees with the accounts receivable controlling account in the general ledger 7. Why would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable